Dive into this comprehensive analysis of L2 solutions in the Ethereum blockchain. Learn about the successes and challenges of ZK vs Optimistic Rollup projects and compare top Optimistic Rollup contenders like Arbitrum, OP Mainnet and Base.

Part I: ETH Needs L2’s: Why Ethereum’s success as the most popular Layer 1 is also its biggest problem, and how to solve it

Part II: The Bright Future of Optimistic Rollups: The dominant L2 rollup solution has several competitors – which one will be the winner?

Part III: ZK Rollups: Gain some knowledge about Zero-Knowledge Rollups, which Vitalik believes will be the ultimate solution to scaling

Table of Contents

Suffering from Success

Ethereum is the most popular L1 smart-contract-enabled blockchain. The second-most popular blockchain with support for dApps is BNB Chain, but its popularity is dwarfed by Ethereum.

It’s this rapid growth that has caused Ethereum to grow congested as the prevalent L1 smart contract chain, pushing gas fees to astronomical heights during the 2021 bull market where average gas spiked as high as $196 (current average gas is about $4). Ethereum can also only handle ~27 transactions per second (TPS) compared to newer L1 chains such as Solana which was built for scalability and can handle 50,000 TPS.

Without scaling solutions to improve throughput and reduce load on the Ethereum mainnet, the average retail user would be priced out of participation, turning Ethereum into an exclusive playground for whales that can afford the gas fees.

There is thus an urgent need for scaling solutions to encourage mass adoption of Ethereum.

Several solutions have emerged, all seeking to address the popular narrative of the blockchain trilemma, which claims that any blockchain architecture can only achieve two out three properties of decentralisation, security and scalability. As Ethereum provides the main desired properties of decentralisation and security, solutions such as sharding, L2s, and sidechains address the remaining problem of scalability.

L1 or L2 solutions?

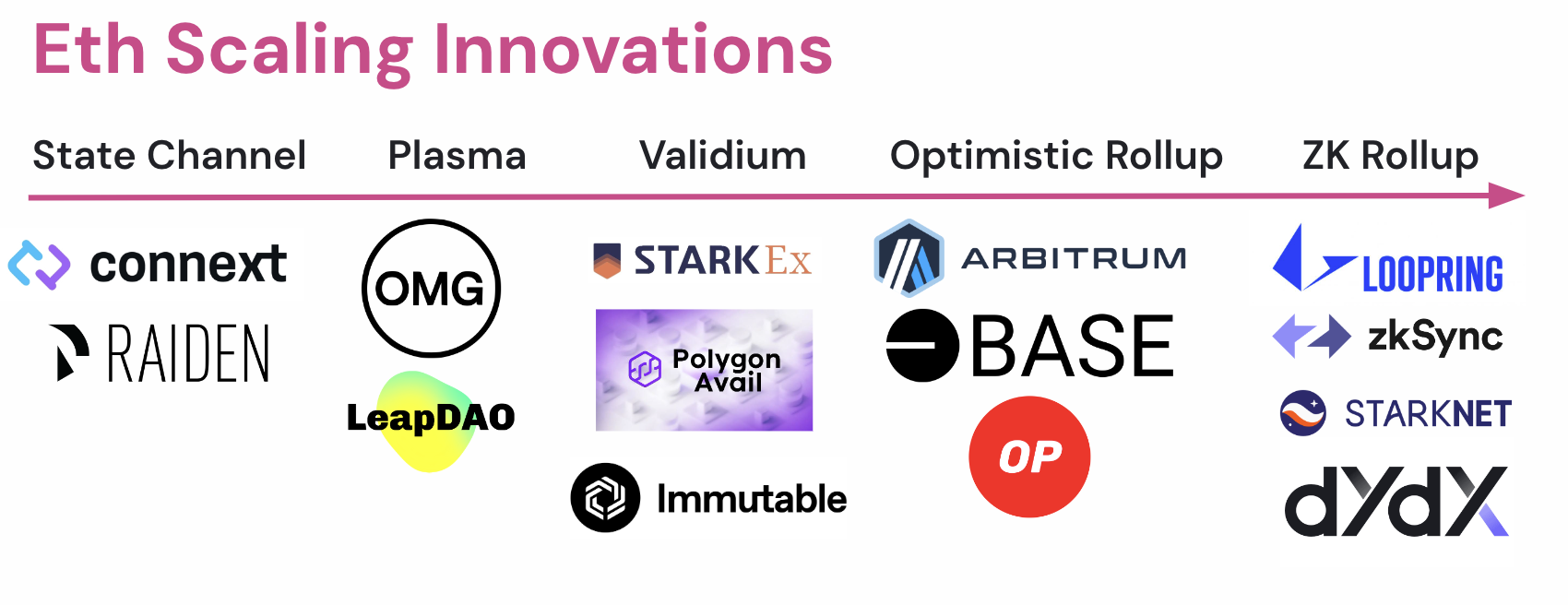

Figure 1: ETH Scaling Innovations

No lack of proposed scaling solutions exists for Ethereum, whether L1 (Sharding) or L2 (sidechains, plasma, state channels, etc.). Sharding was once the preferred scaling solution by the Ethereum community, but rollups have since become the most popular option for the following reasons:

- Sharding is complicated and risky to implement because it requires changing the underlying blockchain. To rely on sharding would take years.

- Channels are an application-specific L2 solution so they wouldn’t scale easily.

- Sidechains sacrifice the underlying Ethereum security. And the use of Bridges between Ethereum and sidechains has already resulted in several high-profile hacks.

Figure 2: ETH Types of Sidechains

Figure 3: Ranking of leading L2 projects by TVL and Market Share - Source

On the L2Beat scoreboard sorted by TVL (Total Value Locked in ETH converted to USD), Arbitrum, OP Mainnet (previously Optimism) and Base top the rankings, with $6.57B, $2.99B and $570M TVL respectively. All of these projects use Optimistic Rollups.

Figure 4: Newcomers Base, Mantle and Linea have taken from incumbents - Source

From July to October 2023, we observe an increase in TVL of +$1.79B and a decrease in top 10 coins’ market share of -1.95%. This indicates the following:

- Capture of market share by new entrants such as Base, Mantle and Linea

- Increase in total market size for top 10 coins, not just the “hot ball of money” shuffling around on-chain

- Progress in decentralisation as market share of top coins is slightly better distributed

Interestingly, 6 out of 10 projects on the October scoreboard are Zero Knowledge (ZK) Rollups, showing strong R&D traction. However, adoption has much room to grow — Arbitrum’s TVL is still over 14 times that of ZKSync, the leading ZK Rollup.

In a comparison of combined TVLs for each technology in the Top 10 leaderboard, Optimistic Rollups total $10.27B, dwarfing ZK Rollups’ $1.24B by a factor of eight. Granted, Optimistic Rollups have been around longer and have had longer to draw users.

There is hot debate about which rollup technology is technically the best between Optimistic and ZK, but it is worth noting that Vitalik Buterin and OP Labs’ Kelvin Fichter have discussed hybrid rollups, which combine both technologies. Kelvin has also published a post mooting the future of the Ethereum rollup as a hybrid of both approaches.

L2: What’s working, and what isn’t?

In contrast to other Layer 2 (L2) solutions, rollups maintain the security of the Ethereum Mainnet while reducing the transaction processing load.

ZK Rollups are faster than Optimistic Rollups when it comes to moving funds to and from the Ethereum blockchain. According to Vitalik Buterin, ZK Rollups will likely become the main L2 solution for Ethereum in the next 10 years.

However, currently, ZK Rollups are more computationally intensive, leading to gas fees that are more than ten times higher compared to Optimistic Rollups. Optimistic Rollups have a gas fee of approximately 40,000 GWEI per batch, while ZK Rollups have a gas fee of around 500,000 GWEI.

Sharding, which was Ethereum’s original native solution for scalability, took a backseat to L2 scaling solutions due to the sudden growth of rollups.

Both Optimistic and ZK Rollup solutions have continued to attract investor attention during both bullish and bearish periods. In March 2022, OP Mainnet (previously Optimism) raised $150 million in its Series B round, valuing the solution at $1.65 billion. Arbitrum reached unicorn status in August 2021 after raising $120 million.

Even during bearish periods, rollups, particularly ZK Rollups, continue to draw interest from investors. Matter Labs, the team behind zkSync, raised $200 million in November 2022. Scroll, another ZK solution, achieved a valuation of $1.8 billion in March 2023 after raising $50 million. There is still a strong appetite and confidence in robust infrastructure, with rollups being seen as a key contributor to the future of the industry.

The Two Fastest Horses: Optimistic and ZK Rollups

Several differences between Optimistic and ZK Rollups are in EVM compatibility, security, and speed.

EVM-Compatibility

In general, ZK Rollups are far more challenging to build than Optimistic Rollups because of their complexity. The technology also isn’t inherently EVM-compatible, which has posed additional friction to developer adoption. Although simple computations such as token transfers are easily proven on a ZK Rollup chain, proving general-purpose EVM computations is far more challenging. Developers can’t simply port their existing smart contracts to a ZK solution but must instead rewrite working code to make it work on a ZK chain.

But this is changing. zkSync and Polygon have both announced plans to introduce a zkEVM, which recreates EVM compatibility and allows the execution of smart contracts. Polygon’s zkEVM is currently in Beta. This would allow developers to move existing code into the ZK Rollup ecosystem without modifying the code, and could be the game-changer that ZK Rollups are looking for.

Security

ZK Rollups and Optimistic Rollups take different approaches to ensuring the validity of off-chain computations. ZK Rollups generate zk-SNARK proofs to cryptographically prove the correctness of every transaction in each batch. This provides a strong security guarantee that invalid state transitions cannot occur without being detected. Optimistic Rollups instead rely on fraud proofs – unless challenges are submitted to prove a transaction is invalid, all transactions are assumed to be valid.

Optimistic Rollups are arguably less secure, as invalid state transitions can go undetected if no fraud proofs are submitted in time. However, generating zk-SNARK proofs has a higher computational overhead, generally requiring expensive hardware and incurring greater costs. Overall, ZK Rollups offer stronger theoretical security assurances through validity proofs, while Optimistic Rollups trade off some security for lower costs.

Speed

When it comes to transaction speed, Optimistic Rollups process transactions faster by submitting them in bulk to layer 1 without generating validity proofs. On the other hand, ZK Rollups require computational work to generate zk-SNARK proofs for each transaction batch before publishing them. This difference in approach allows Optimistic Rollups to be faster in publishing transactions, while ZK Rollups have faster withdrawal times back to layer 1 because their validity is already proven, eliminating the need for a challenge period of up to one week in case of disputes.

Conclusion

In assessing L2 solutions for the Ethereum blockchain, the main runners are Optimistic Rollups and ZK Rollups. Ultimately, there is no single best solution, and true user adoption will determine the success of each approach. We expect that users will vote through actual use of the most suitable option, and liquidity will eventually gravitate towards the solution that best meets the needs of end-users in terms of user experience and functionality.

Disclosure: AlphaLab Capital Group holds a long position in $ARB.

Figure 1: ETH Scaling Innovations

Figure 1: ETH Scaling Innovations

Figure 3:

Figure 3:  Figure 4: Newcomers Base, Mantle and Linea have taken from incumbents -

Figure 4: Newcomers Base, Mantle and Linea have taken from incumbents -