In Part I of Evaluating L2 Solutions, we explored the urgent need for Layer 2 solutions on Ethereum, highlighting the critical differences between Optimistic and ZK Rollups.

Part II delves into the intricacies of Optimistic Rollups (ORUs), shedding light on their role in Ethereum’s scalability quest. Unpack the nuances of leading Optimistic Rollup chains like Arbitrum, OP Mainnet, and Base. Dive into the technical prowess and potential of ORU technologies such as OP Stack and Arbitrum Orbit, and how they shape the future of Ethereum’s Layer 2 solutions.

Part I: ETH Needs L2’s: Why Ethereum’s success as the most popular Layer 1 is also its biggest problem, and how to solve it

Part II: The Bright Future of Optimistic Rollups: The dominant L2 rollup solution has several competitors – which one will be the winner?

Part III: ZK Rollups: Gain some knowledge about Zero-Knowledge Rollups, which Vitalik believes will be the ultimate solution to scaling

Table of Contents

The Bright Future of Optimistic Rollups

Both Arbitrum and OP Mainnet weathered the crypto winter of 2022 with steady growth throughout the tumult. Base also fared very well, capturing a respectable 4.44% of L2 market share in just 4 months since its inception on 9th August this year. Optimistic Rollups (ORUs) have prevailed at the top of TVL rankings – while Zero Knowledge Rollups (ZKRUs) are dominating the rest of the market share.

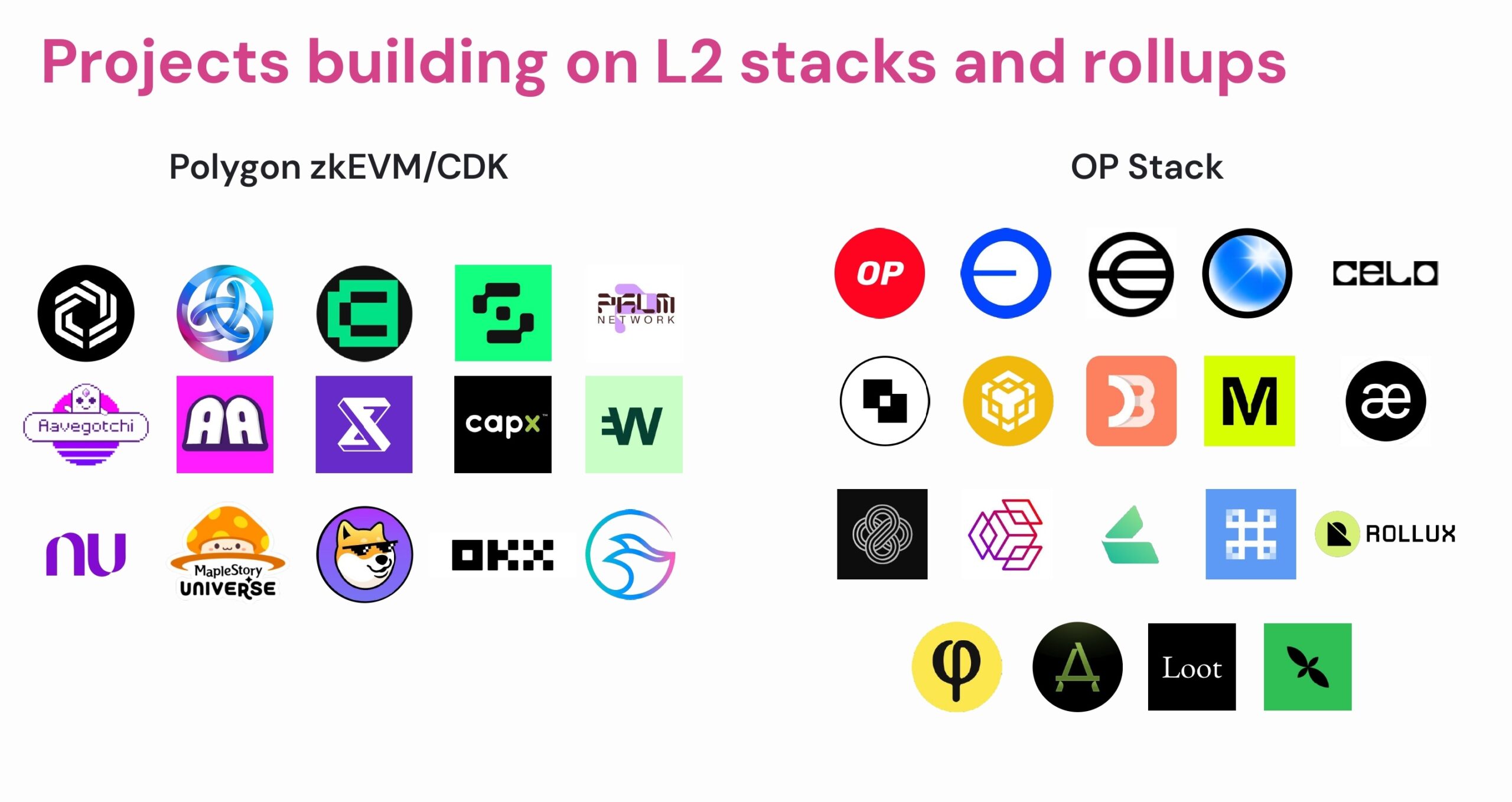

ORUs face strong competition. A significant number of upcoming L2 projects will all be built on Polygon’s ZK stack using their Chain Development Kit, with several of them being prior L1 solutions that have migrated to become an Ethereum L2 such as Canto, Immutable and Astar – cementing rollups as the most prevalent solution to Ethereum scaling.

| Polygon zkEVM/CDK | OP Stack |

| 1. Immutable zkEVM 2. Astar zkEVM 3. Canto 4. Safe (Gnosis Safe) 5. Palm Network 6. Aavegotchi 7. IDEX 8. CapX 9. Wirex 10. Nubank 11. Nexon (Maplestory Universe) 12. Dogechain 13. OKX 14. Manta Pacific | 1. OP Mainnet 2. Base 3. Worldcoin 4. opBNB 5. Celo 6. Zora 7. PGN 8. Debank Chain 9. Mode 10. Aevo 11. Kinto 13. Lyra 14. Lattice (Redstone) 16. Pika 18. Loot 19. Mint |

Figure 1: Comparison of projects building on Polygon vs OP Stack – Source 1 and Source 2

ORU technology stacks aren’t only resting on their laurels either. Besides the main dominant stacks of OP Stack and Arbitrum Orbit with plenty of innovation on their roadmaps, various others are being developed, such as Fuel Network which seeks to integrate the best of both ZK and Optimistic technology using their hybrid prover. Arbitrum Orbit’s L3 and OP’s Superchain visions are also blazing the trail for interoperability – as their technologies aim to integrate other future chains built on their stacks for unified compatibility.

We expect the future of rollups will likely be a potential hybrid combining the best of each solution – the ease of development of ORUs to encourage on-chain activity, and the efficiency, security and finality of ZKRUs. There will also be a need to reconcile the numerous competitors in some way; interoperability protocols and layer 2 aggregators may be projects to look out for in the future.

Why are Optimistic Rollups winning?

ZK Rollups have been praised for their security, privacy and speed. But why are the top 3 L2 contenders all Optimistic? Users have voted with their money, and ORUs are the clear winner – for now. Here’s a few reasons that may explain this:

Lower on-chain costs

Users priced out of Ethereum with lower capital but still want to participate on-chain will gravitate towards chains that cost much lesser to transact on while still offering the most opportunities.

The current top 5 chains with the greatest TVL (besides Ethereum) are Tron, BSC, Arbitrum, Solana and Avalanche – which are all known for having lower transaction costs and more dapps. Furthermore, on-chain gas costs are higher for ZK compared to ORUs. On L2Fees, the current gas costs for a swap on Polygon zkEVM ($2.22) and StarkNet ($0.95) are far higher than OP Mainnet ($0.19) and Arbitrum (0.33).

For users in less developed countries where on-chain gas for a transaction would cost the same as a meal or a drink, the security of their chain would be the least of their concerns.

First Mover Advantage

Optimistic Rollups have been around for much longer compared to ZK Rollups. OP Mainnet was launched in January 2021 while Arbitrum went live in August 2021. In comparison, Polygon’s zKEVM and zkSync Era were only launched in 27th and 24th March 2023 respectively, effectively giving Optimistic Rollups a 2-year lead in terms of development of dApps.

However, Base was only launched in August 2023 – but has already taken the third place with the help of Coinbase backing, speculation of memecoins such as Bald and Toshi, and highly successful dApps such as friendtech that have helped to skyrocket activity.

Future chains could consider overcoming the problem of cold start with a similar playbook; enabling speculation and attracting liquidity is an excellent way to capture mainstream attention.

Network Effects

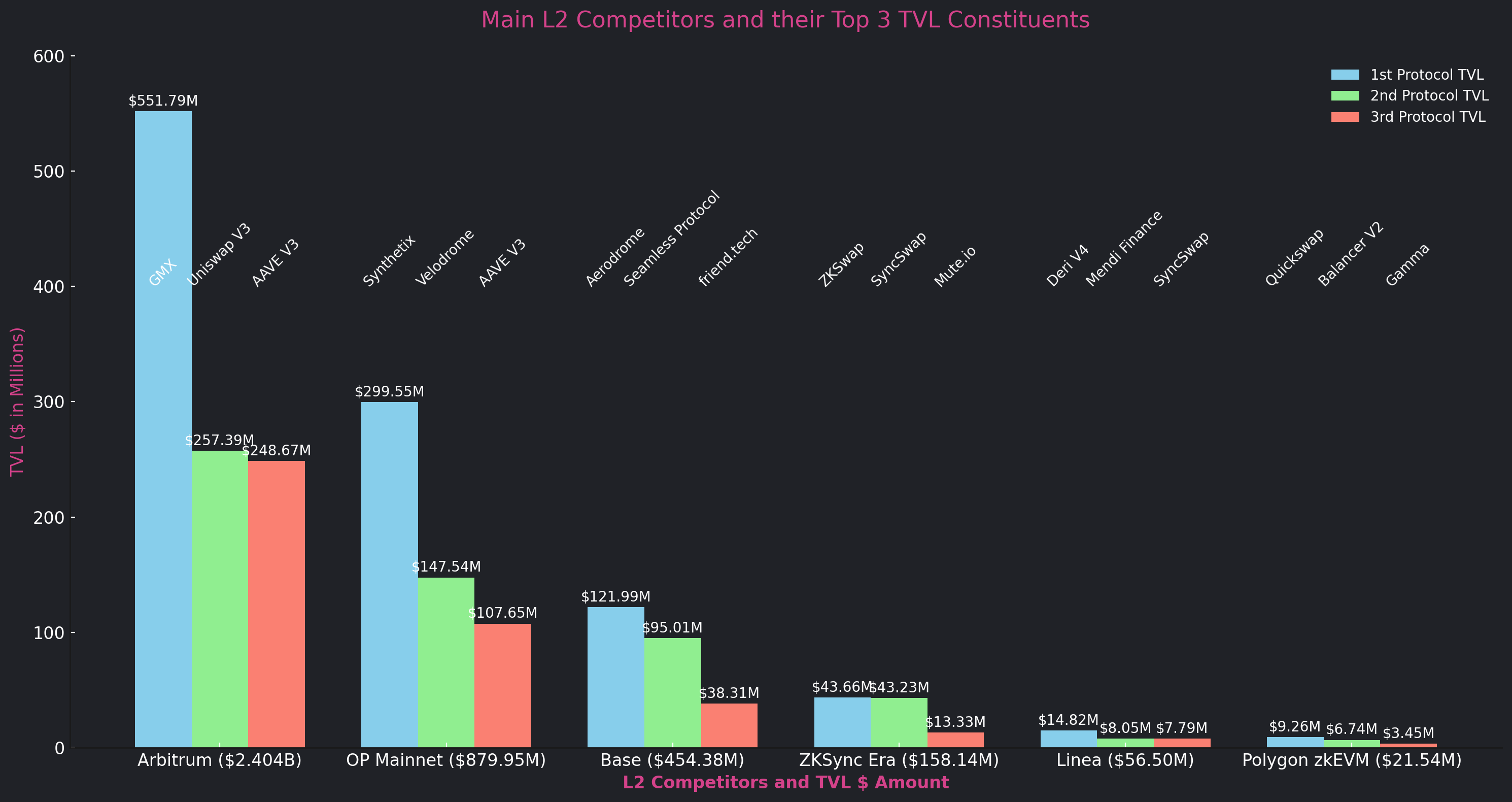

Popular dApps have helped retain a large amount of TVL on the top 3 chains, such as GMX + AAVE + Radiant on Arbitrum, Synthetix + Velodrome + AAVE on OP Mainnet, Velodrome + Friendtech + Seamless on Base.

In comparison, dApps on ZK based competitors such as zkSync Era and Polygon zkEVM have yet to attract widespread usage on their derivatives and lending protocols. Most of the dApps on ZK L2s are nowhere near $50M TVL, while GMX on Arbitrum boasts a healthy $550M TVL, multiples ahead of the rest. The graphic below illustrates the vast difference in TVL.

| Chain | Arbitrum | OP Mainnet | Base | ZKSync Era | Linea | Polygon zkEVM |

|---|---|---|---|---|---|---|

| TVL ($) | 2.404B | 879.95M | 454.38M | 158.14M | 56.5M | 21.54M |

| #1 Protocol ($TVL) | GMX (551.79M) | Synthetix (299.55M) | Aerodrome (121.99M) | ZKSwap (43.66M) | Deri V4 (14.82M) | Quickswap (9.26M) |

| #2 Protocol ($TVL) | Uniswap V3 (257.39M) | Velodrome (147.54M) | Seamless Protocol (95.01M) | SyncSwap (43.23M) | Mendi Finance (8.05M) | Balancer V2 (6.74M) |

| #3 Protocol ($TVL) | AAVE V3 ($248.67M) | AAVE V3 (107.65M) | friend.tech (38.31M) | Mute.io (13.33M) | SyncSwap (7.79M) | Gamma (3.45M) |

Figure 2: Main L2 Competitors and their Top 3 TVL Constituents – Source

As ZK chains are out of the narrative for now, we look forward to seeing how ZKRUs will catch up with ORUs in terms of TVL.

Current Opportunities

Both Arbitrum and OP Mainnet/OP Stack show signs that they’ll continue to grow steadily in the upcoming years.

Buterin’s view is that ZK Rollups will eventually win out in all uses cases, with optimistic rollups winning in the short-term in “simple payments, exchange and other application-specific use cases.” But nothing in the existing ZK solutions hints that ZK can lower its gas fees as far down as optimistic rollups.

We imagine that Optimistic rollups will continue to dominate as a solution for users who want low fees above all else, even if they have to wait a week for withdrawals, as bridging solutions enable far more convenience while still enjoying the best of Optimistic rollups.

Ultimately these technologies are not necessarily comparable, and there is no need to compare. It’s all about true user adoption, rather than marginal efficiency that the ZK’s will have in comparison to Optimistic rollups. For example, Solana has much higher TPS than any of the EVM chains, and recent narratives around airdrops, efficient fees and memecoin speculation have helped push liquidity and activity to highs unseen since 2021 (or even more, as NFT and DEX 24h trading volume on Solana recently flipped Ethereum).

Quick comparison of Arbitrum vs OP Mainnet

In a step towards decentralisation, Arbitrum recently became the first L2 solution to announce a self-executing DAO governance. Self-governance means that DAO decisions will be immediately implemented on-chain without having to involve an intermediary. The company also launched Arbitrum Orbit, a solution for developers deploy build permissionless L3 chains using Arbitrum technology, a similar offering to OP Mainnet’s OP Stack. As both Arbitrum and OP Mainnet’s technologies serve different markets, there is no direct competition – but whether they’ll both succeed in the long-term may be another question.

Arbitrum Stylus lets developers deploy EVM-compatible smart contracts in C, C++, Move and Rust, in addition to Solidity, which empowers experienced web2 engineers with the ability to transit seamlessly into web3. Arbitrum estimates there are roughly 3 million Rust developers and 12 million C developers, compared to 20k Solidity developers. This allows more dApps and ideas to be built on Arbitrum with Stylus, leading to greater user activity. Combined with specific-focus L3 appchains building on Arbitrum Orbit, the right product-market fit such as gaming or trading can help propel Arbitrum ahead of the competition.

On the other hand, OP Stack appears to be encouraging a “mix and match” approach to creating new solutions. Doing this has resulted in some interesting on-chain games, but whether it brings long-term value to the chain remains to be seen. OP Mainnet also has a strong contender with their Superchain. With Base quickly taking TVL share and multiple other chains built on the stack such as opBNB, Debank, Metis, Celo, Worldcoin, Lyra and many more, every L2 that joins the OP Superchain (and their future success) helps strengthen the narrative of the OP alliance as the definitive ORU stack.

Looking forward

Optimistic rollups have high first mover advantage, no obvious security risks, and currently, high adoption, so we strongly believe that they will continue to do well in short to medium term – especially with catalysts such as the upcoming EIP-4844. There is a level of comfort that users have with optimistic rollups, and will need a compelling reason to move over. It will take no small effort to overcome this headstart for ZK L2’s.

In assessing the long-term investment potential of Layer 2 solutions, we recognize Arbitrum’s current lead in total value locked (TVL) and its notable efficiency in attracting and onboarding serious developers. Arbitrum’s developer-friendly environment gives it an edge, but OP Mainnet’s progress and potential should not be underestimated. Both platforms showcase strong interoperability capabilities and are vying to expand their user bases and ecosystems.

While we lean towards Arbitrum’s prospects based on its current trajectory and developer engagement, which correlates with network growth, innovation, and stability, we acknowledge the fluidity of the sector and maintain a close watch on both projects, as well as other emerging ORU innovations.

Disclosure: AlphaLab Capital Group holds a long position in ARB.