Table of Contents

The State of Liquidity Report, published quarterly, offers valuable insights on the past quarter’s market listings and liquidity landscape. It covers overall market trading trends, volumes and volatility, token listing and delisting activity, and insights on notable listings during this period. This report may be useful for projects that are looking to launch their own token in the near future, projects that are already listed, as well as investors and other market participants.

All the data used in this report is collected from publicly available sources.

Executive Summary

The actual approval of the Bitcoin Spot ETF on 10th of January marked the start of a new potential bull market, coinciding with the first peak in trading volumes for the year (Figure 1) while gradually...

Deeper Insights Ahead

Table of Contents

The State of Liquidity Report, published quarterly, offers valuable insights on the past quarter’s market listings and liquidity landscape. It covers overall market trading trends, volumes and volatility, token listing and delisting activity, and insights on notable listings during this period. This report may be useful for projects that are looking to launch their own token in the near future, projects that are already listed, as well as investors and other market participants.

All the data used in this report is collected from publicly available sources.

Executive Summary

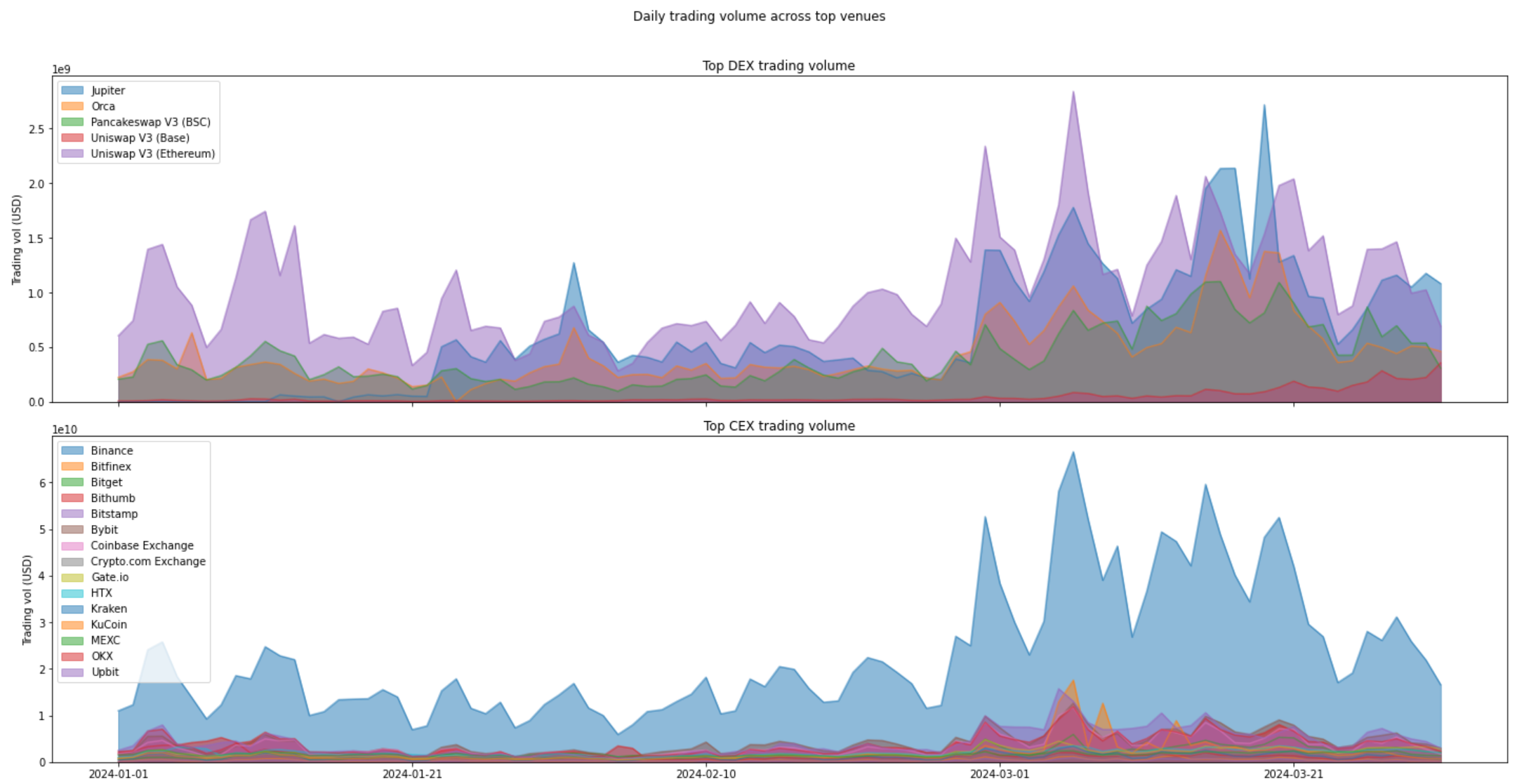

The actual approval of the Bitcoin Spot ETF on 10th of January marked the start of a new potential bull market, coinciding with the first peak in trading volumes for the year (Figure 1) while gradually increasing throughout Q1. General market sentiment has turned positive for both retail and institutional as Bitcoin ETF inflows kept chugging along throughout the weeks after approval, signalling healthy investor appetite for the fresh narrative of an alternative asset class. Overall volumes and liquidity also improved compared to past quarters of Q4 2023 and Q3 2023. After last quarter renewed interest in TGE’s, we’ve now seen increases in the number of listings across the board.

Not only did Bitcoin reach its highest ever at $73,780.07, the Bitcoin ecosystem has been gaining popularity with the introduction of Ordinals and L2s such as Stacks. Continued memecoin mania towards the end of the quarter also kept DEX volumes high – with multiple memecoins on Base and Solana surging to 9-figure market caps and beyond within days of launch.

1. Overall crypto market

a. Centralised / Decentralised Trading Activity

Figure 1: Top 15 CEXs and Top 5 DEXs from CoinMarketCap Ranking.

| Q1 2024 | Q4 2023 | Q3 2023 | Q2 2023 | Q1 2023 | |

|---|---|---|---|---|---|

| CEX trading volume | $4.7t | $2.2t | $1.2t | $1.4t | $2.5t |

| DEX trading volume | $234b | $111b | $57b | $93b | $137b |

Figure 2: This aggregated trading volume from Top 15 CEXs and Top 5 DEXs from CoinMarketCap, not total volume overall, and is meant to be context for Figure 1.

Trading volumes more than doubled in Q1 2024 from the previous quarter, clearly signalling the return of both offchain and onchain market participants. DEX volumes picked up and remained consistent throughout the period, with greater spikes than CEX volumes on some days from fuelled by the surge in onchain memecoin speculation. Notably, volumes on Solana through Jupiter and Uniswap on Base remained consistently high, even on days where CEX volumes fell – hinting at a potential disconnect in sentiment between CEX and DEX trading pairs.

- The Ethereum Dencun upgrade introduced “blobs” on March 13, making L2s a lot cheaper to transact on – contributing to increased volumes on L2s such as Base.

- Binance remains as the dominant CEX but appears to be ceding market share. However, volumes appear to be moving onchain instead of to other exchanges, improving decentralisation of trading volume.

- With the recent introduction of the Coinbase Smart Wallet to onboard current Coinbase CEX users, Base as their first onchain stop will be expected to do well. Solana will also remain favoured for retail as gas fees and transaction speed going forward.

b. Token Listing and Delisting Activity

Figure 3: Frequent Listers (101 or more listings per quarter)*

Figure 4: Active Listers (11-100 listings per quarter)*

Figure 5: Exclusive Listers (0-10 listings per quarter)*

*CoinMarketCap Top 15 by trust score (excluding Binance Turkey). Data on previous listings are pulled from various data feeds and cross checked against exchange announcement pages, their spot trading platforms, and X. Leveraged tokens, rebrands and migrations are excluded.

The start of 2024 was a busy one for exchanges and listing projects. Compared to Q4 2023, Q1 2024 listing volume jumped by over 30% and over double that of Q3 2023. All exchanges either maintained or increased their listing volume, as projects sought to capitalise on the wave of returning retail attention and launch their tokens. Several high-profile airdrops also occurred throughout the quarter, injecting welcomed liquidity back into the space.

- Despite the rise in listing volume and activity across all exchanges, MEXC is still nearly fourfold that of their nearest competitors Bitget and Gate, which have similar listing volumes for the quarter – quite a feat for the exchange, doing over 6.5 listings every day on average throughout the quarter.

- Bitfinex moved into the Active Listers set with 13 listings this quarter, over threefold that of each of the previous two quarters.

- Several exchanges doubled (or nearly doubled) their volume in Q1 compared to Q4; Coinbase, Crypto.com, Bybit, Bitstamp, Bitfinex – a notable increase considering the number of exchanges that managed double their past quarter’s volumes.

- Despite Binance’s previous track record as being an exclusive lister, this is the second quarter in a row where they have had 10+ listings, coming to a high of 18 this past quarter. Perhaps this is a play to get new users in, as they continue to struggle with losing dominance, particularly as they abolished zero-fee trading for Bitcoin and several asset pairs on March 22.

- It is clear that there is a significant increase in listing activity and the number of high quality projects that are listing, indicating the emergence from the bear market.

- Feedback from the top exchanges is that there is so much demand around listing that many of even the most sought after tokens, with negotiated spots on the top exchanges, will have a wait of 6-9 months to go live.

c. State of Liquidity on Top 1000 Tokens (ranked by ADV)

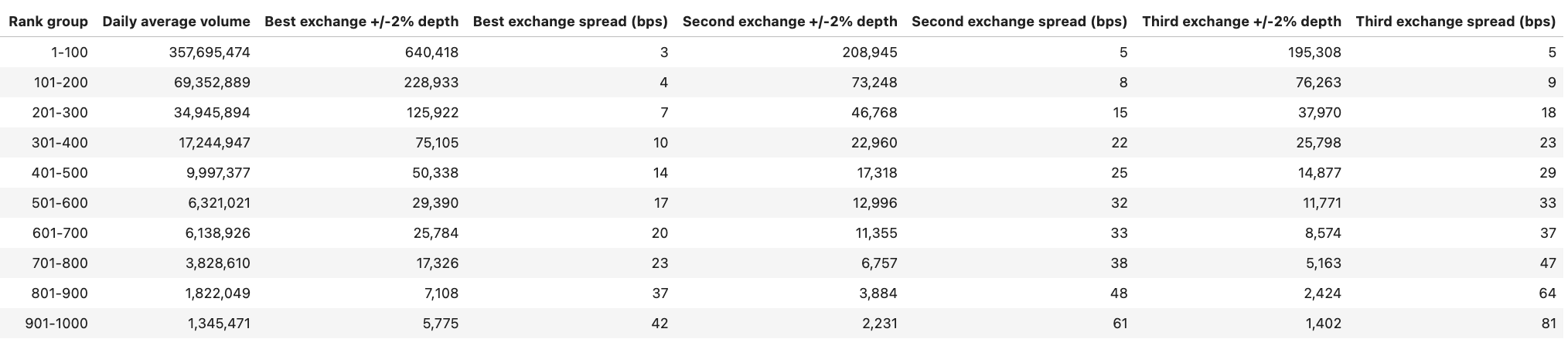

To provide an overview of the overall state of market liquidity, we survey the top 1000 tokens as listed on CoinMarketCap and detail liquidity metrics across their respective top 3 exchange venues.

Figure 6: Top 1000 tokens ranked by volume of top performing exchange

In comparison to our data in Q4 2023, numbers have improved significantly in all of the metrics here, indicating a much healthier state of market liquidity for the quarter.

- Average volume and market depth increased by half to twofold on various rank groups

- It appears that more orders have been placed – possibly due to the return of retail

- Spreads also have become tighter, with potentially more MM participation this quarter

- Liquidity has spread out more across the 101-1000 rank groups

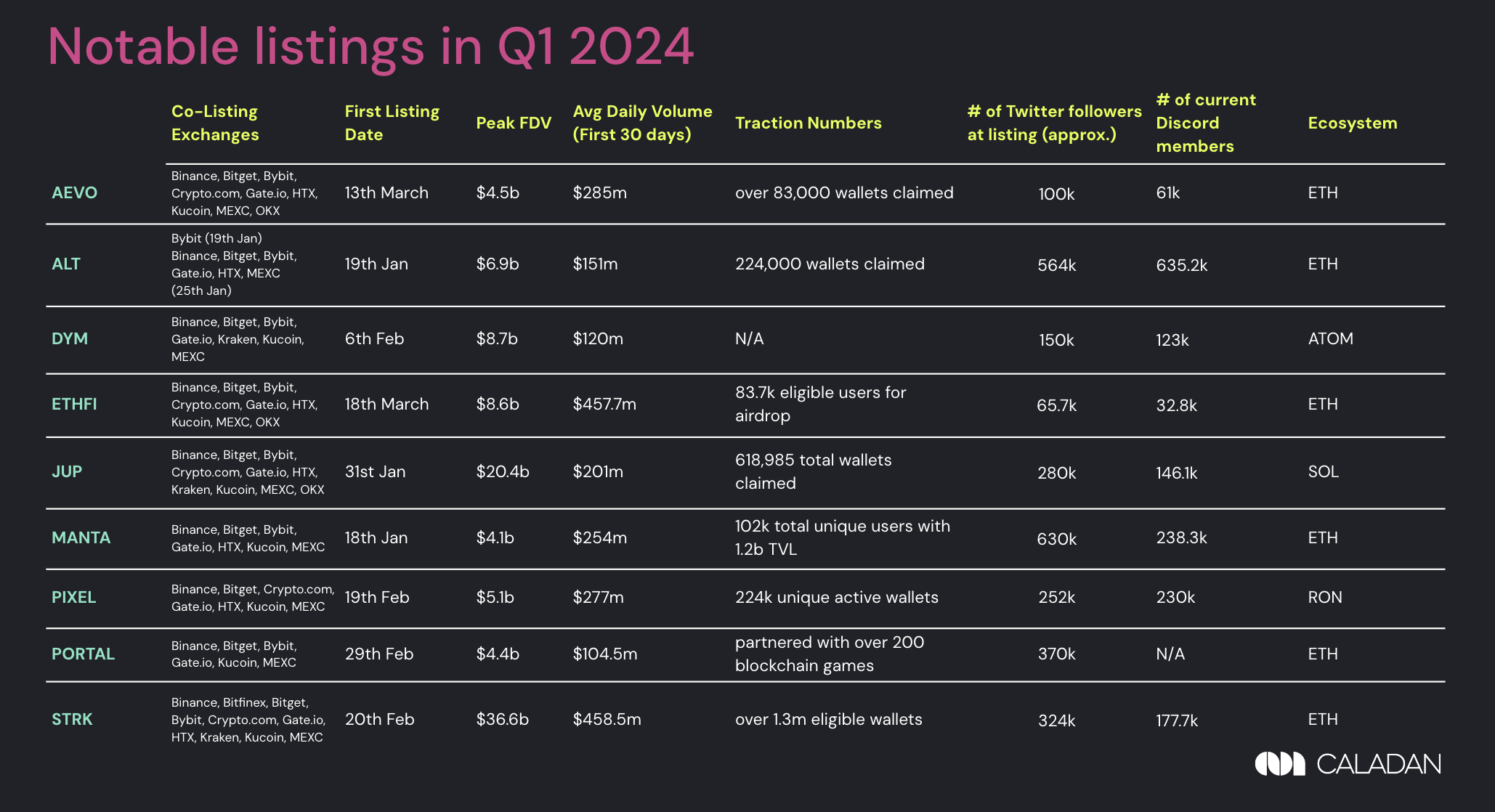

2. Insights on Q4 notable listings

Notable listings in Q4 2023

Figure 7: Comparison stats for Notable Listings in Q4

Listing activity picked up significantly in this quarter, buoyed by increased retail attention and rising bullish sentiment. To better filter for truly Notable Listings, we’ve tightened the criteria to coins that have launched and sustained >$300M Market Cap for over 24 hours post-listing.

- There was a higher number of significant listings this quarter, necessitating the narrowing of the Notable Listing definition to coins over $300m in Market Cap.

- Altlayer stood out as the only coin to debut on one exchange (Bybit) first, delaying their launch on other CEXes for a full 6 days from 19th Jan to 25th Jan.

- The majority of the this quarter’s notable listings are within the ETH ecosystem. As previously noted, the Dencun upgrade slashed transaction fees of L2’s, making them more popular than ever.

- MANTA and STRK have both been around a while, and have been steadily building out their developer ecosystem and waiting to TGE. AEVO is also a new perps/options dex that has been steadily gaining volume on their platform before listing

- DYM is the only Cosmos rollup, seeking to be the operational hub for RollApp development in the ecosystem. Furthermore, there is revived activity in the Cosmos ecosystem as well. A lot of prominent chains still continue to use their SDK to build out their tech stacks, such as Berachain.

- Unlike last quarter that had a significant number of top project listings, this quarter, Jupiter, one of the top DEXes, is the only one on Solana. Its peak FDV was second only to STRK. Solana continues to build momentum, despite news like the FTX estate selling off large amounts of locked tokens.

- Another popular narrative is liquid restaking, so ETHFI has performed quite well. ALT works with restaking chains but works on scaling both optimistic and zk rollup stacks, making it much more inclusive.

- PIXEL is the latest highly anticipated new game powered by Ronin Chain (from the Axie Infinity team), while PORTAL, also in the gaming sector, is more of a publisher.

- Due to the revised definition of Notable Listings, there were no coins that were previously traded on DEXes before their CEX listings for this round.

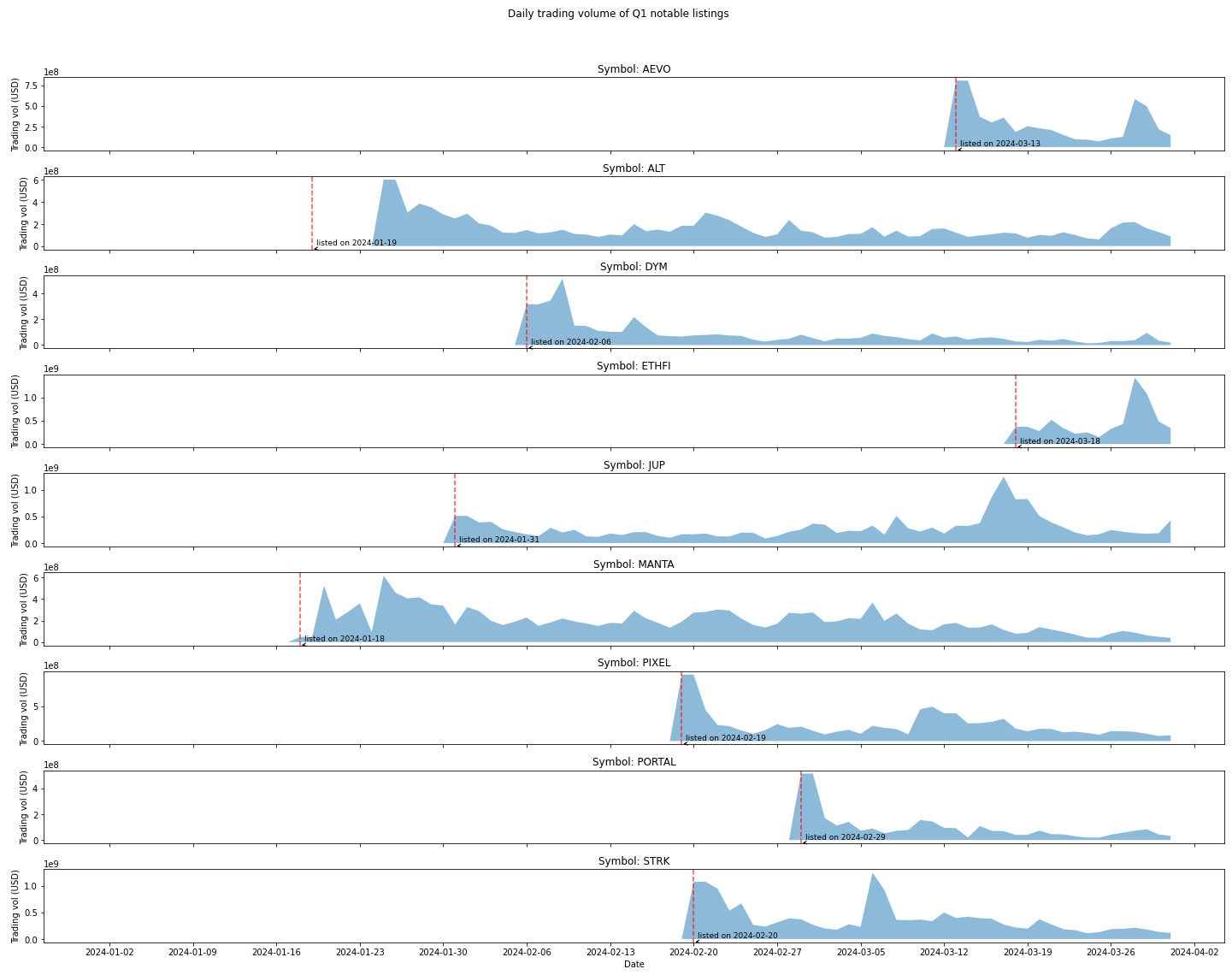

a. Volume performance

Figure 8: Daily Trading Volume of Q1 Notable Listings

- ETHFI, JUP, MANTA, and STRK all had delayed peaks, while the others pumped at listing and then fell, per the usual trend.

- AEVO and ETHFI both had a significant spike during March 26th compared to other tokens’ performance on that date.

b. Price Movement

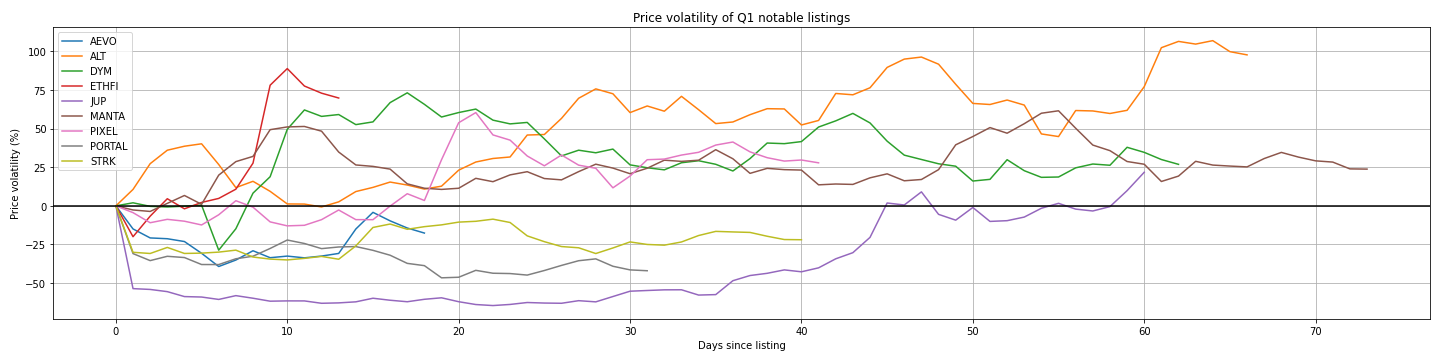

Figure 9: Price volatility of Q1 notable listings

The chart here shows the volatility of token performance against its initial listing price.

- Q1 saw a mix in terms of price action for the list of notable tokens, with some underperformers and some overperformers.

- JUP dropped significantly below listing price partly due to uncertainties around the protocol at launch time – reaching nearly 70% down from listing price, until it started to rally over a month after they listed.

- ALT performed very well, consistently growing since launch, while DYM, ETHFI and PIXEL did similarly well.

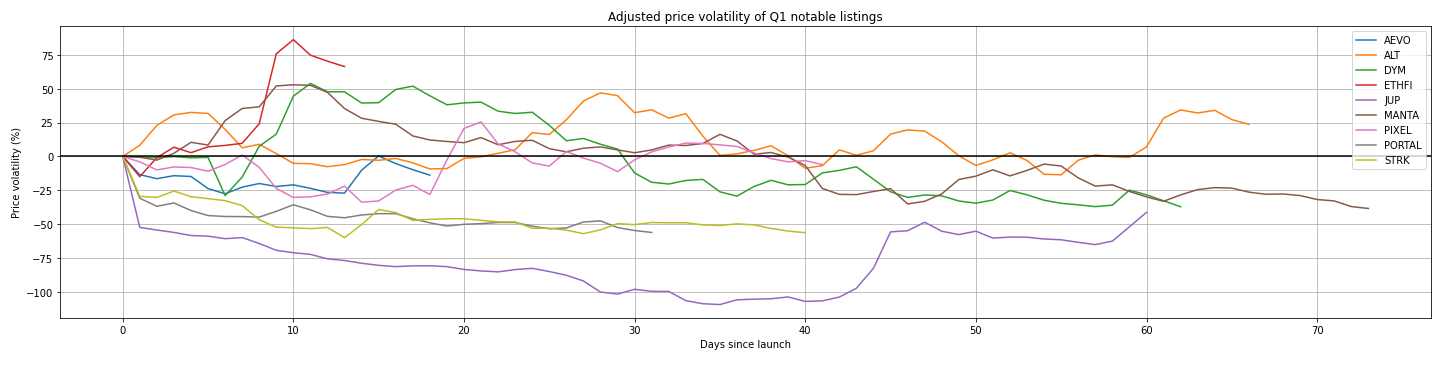

Figure 10: Index-adjusted price volatility of Q1 Notable Listings

- Adjusting for overall crypto market price performance (benchmarked against Coindesk Crypto Index), the general story above remains the same with the same underperformers and overperformers.

Conclusion

Q1 of 2024 was a good quarter for the bulls as the Bitcoin Spot ETF approval (among other catalysts) warmed up investor appetite for cryptocurrencies. As predicted in our previous quarter’s SOLR, we saw several more airdrops this quarter that helped to bring liquidity back to the market as project launches sought to ride on the renewed wave of retail attention.

More upcoming airdrops have been scheduled and confirmed for Q2, such as major protocols on Solana like Parcl, Tensor, Drift and Kamino, Restaking protocols, zkSync, LayerZero, Blast and Hyperliquid among others. For those who have stayed and continued to support projects that were building throughout the bear market, the upcoming airdrops will be something to look forward to.

Upcoming events that may affect the market are the Bitcoin Halving and the approval of the Ethereum Spot ETF, building on the momentum of the Bitcoin Spot ETF. Volumes have finally returned to the market – but future market direction will be affected by continual spot BTC ETF inflows and macro interest rate conditions.

Speak with us about market making and listings – services@caladan.xyz