Federal Reserve rate cuts have become a focal point for cryptocurrency investors seeking to understand market dynamics, yet the relationship between monetary policy and digital asset performance reveals a complexity that defies simple narratives.

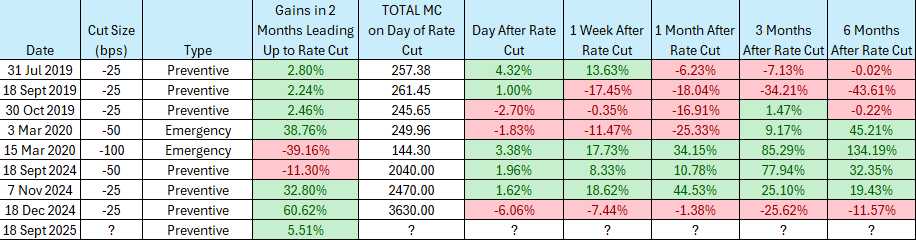

An examination of eight rate cut cycles and their impact on cryptocurrency markets unveils a nuanced picture where context, timing, and broader economic conditions matter as much as the policy decisions themselves.

Understanding the Anticipatory Effect

The period leading up to Federal Reserve rate cuts demonstrates a consistent pattern of positive market sentiment.

In the two months preceding rate announcements, cryptocurrency markets showed gains in six out of eight instances, averaging a 10.52% increase.

This anticipatory rally reached its zenith before the December 2024 rate cut, with markets surging 60.52%, though this exceptional performance was amplified by the cumulative effects of earlier cuts in...

Deeper Insights Ahead

Federal Reserve rate cuts have become a focal point for cryptocurrency investors seeking to understand market dynamics, yet the relationship between monetary policy and digital asset performance reveals a complexity that defies simple narratives.

An examination of eight rate cut cycles and their impact on cryptocurrency markets unveils a nuanced picture where context, timing, and broader economic conditions matter as much as the policy decisions themselves.

Understanding the Anticipatory Effect

The period leading up to Federal Reserve rate cuts demonstrates a consistent pattern of positive market sentiment.

In the two months preceding rate announcements, cryptocurrency markets showed gains in six out of eight instances, averaging a 10.52% increase.

This anticipatory rally reached its zenith before the December 2024 rate cut, with markets surging 60.52%, though this exceptional performance was amplified by the cumulative effects of earlier cuts in September and November 2024.

The March 2020 cut presents an instructive counterexample, with markets declining 39.16% in the anticipatory period due to the COVID-19 pandemic’s unprecedented disruption.

Excluding this anomaly, the average anticipatory gain rises to 18.34%, suggesting that under normal market conditions, cryptocurrencies tend to benefit from the expectation of accommodative monetary policy.

The Reality of Immediate Market Reactions

The immediate aftermath of rate cut announcements presents a more complex picture than conventional wisdom might suggest.

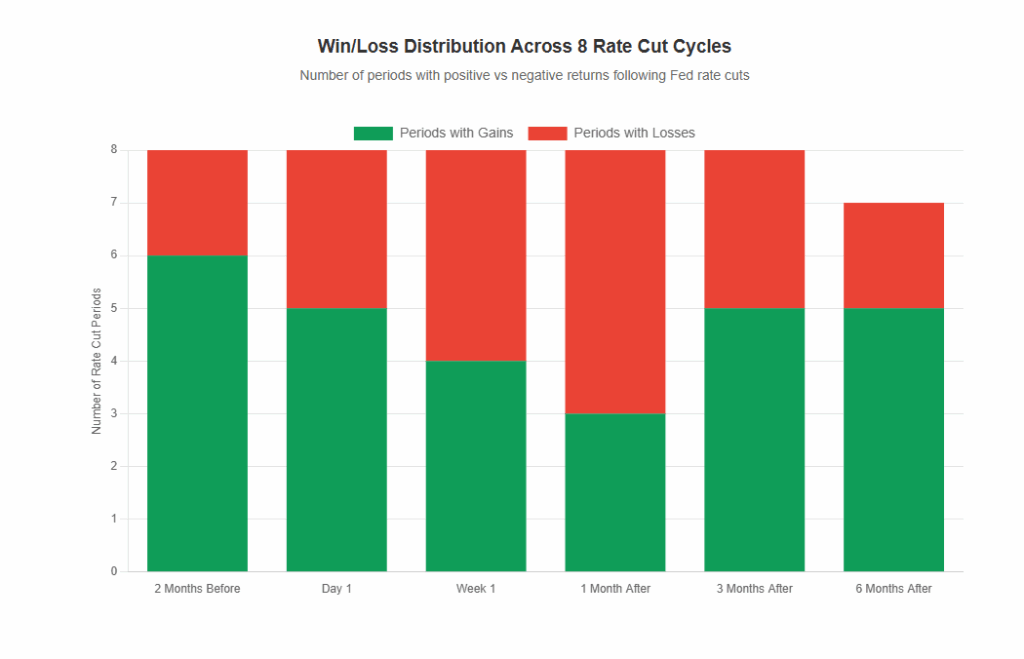

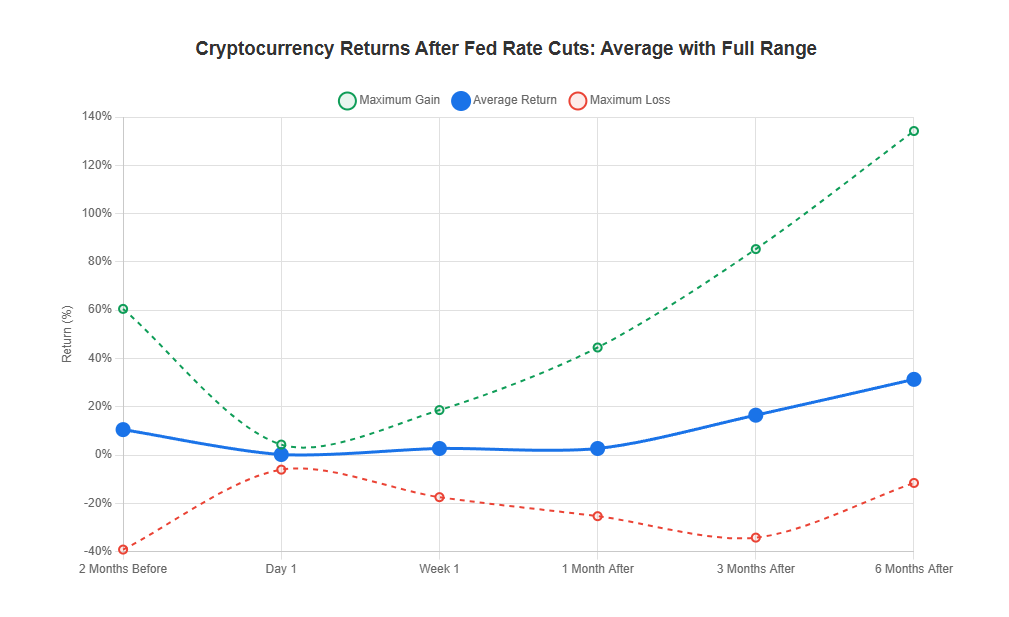

While five out of eight cuts resulted in first-day gains, the average increase was a modest 0.21%, with outcomes ranging from a 4.32% gain to a 6.06% decline.

Extending the timeframe to one week post-announcement provides little additional clarity. Only four out of eight periods showed gains, though the average return improved to 2.70%, with results spanning from an 18.62% gain to a 17.45% loss.

This data partially validates the “buy the rumor, sell the news” phenomenon, where markets often show mixed immediate reactions despite prior anticipation, with high expectations frequently leading to disappointment.

The Emergence of Longer-Term Benefits

The true impact of Federal Reserve rate cuts on cryptocurrency markets becomes more apparent over extended timeframes.

One month after rate cuts, only three out of eight periods (37.5%) showed gains, with an average return of 2.70% and outcomes ranging from a 44.53% gain to a 25.33% loss. This relatively bearish tilt in the first month underscores the unpredictable nature of the crypto market’s immediate response to monetary easing.

The three-month mark represents a turning point in market performance. Five out of eight periods (62.5%) demonstrated gains, with the average return climbing to 16.50% despite outcomes still varying dramatically from an 85.29% gain to a 34.21% loss.

This suggests that while the crypto market tends to find its footing over a quarter, the path remains highly dependent on the broader macro context surrounding each specific easing cycle.

Six months after rate cuts, the benefits become most pronounced. Excluding the September 2019 data point, where the six-month mark coincided with the COVID-19 crash, five out of seven periods showed gains, averaging 31.34% with a range from 134.19% gain to an 11.57% loss.

The Mechanics of Monetary Policy Impact

The relationship between rate cuts and cryptocurrency performance operates through several interconnected mechanisms.

When the Federal Reserve lowers interest rates, the financial ecosystem experiences a surge in liquidity as capital flows more freely and portfolios seek diversification.

This creates particularly fertile conditions for alternative assets like cryptocurrencies to attract investment.

Today’s market offers a striking example of potential capital reallocation. Global investors now hold a record $7.4 trillion in money market funds. If falling rates push yields lower, shifting even 10% of that capital into alternative assets would release hundreds of billions of dollars into the market.

Additionally, as rates fall, the opportunity cost of holding non-yielding assets (like crypto) diminishes, making it a more viable alternative within diversified portfolios.

The September 2025 Decision: A Case Study in Complexity

As we approach the September 17, 2025 FOMC meeting, the Federal Reserve faces an increasingly complex trilemma that illustrates why historical patterns may not repeat precisely.

- First, the asset price conundrum:

Risk assets have already priced in aggressive easing, with equities at elevated multiples and credit spreads compressed to cycle tights. Any dovish surprise could catalyze a melt-up that would ultimately threaten financial stability.

- Second, inflation persistence:

While headline inflation has moderated, core services ex-housing remains stubbornly elevated above target. With fiscal policy still expansionary and geopolitical risks to commodity prices lurking, the Fed cannot afford to ease aggressively based solely on employment concerns.

- Third, labor market nuance:

The unemployment uptick stems largely from labor force expansion rather than widespread layoffs. The quits rate and job openings data suggest normalization from unsustainably tight conditions rather than economic distress.

This trilemma has led to divergent views on forward policy.

For example, while Goldman Sachs economists forecast three 25-basis-point reductions in 2025 (September, October, and December), Caladan’s base case sees only one 25bp cut for 2025, likely in Q4, with a second cut contingent on material labor market deterioration or convincing evidence of inflation convergence to 2%.

The December 2024 Precedent: A Critical Case Study

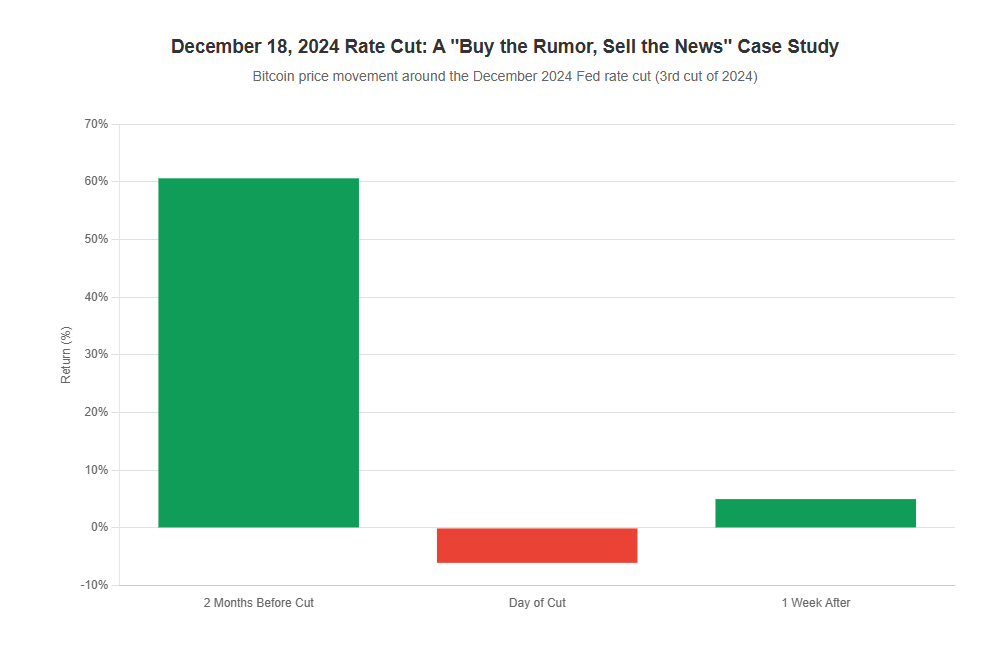

When analyzing potential post-cut reactions, the December 18, 2024 rate cut provides the most relevant recent precedent for a significant market decline.

However, this event had unique characteristics that may not apply to September 2025:

- The total crypto market cap had surged 60.62% in the two months preceding the cut, creating extreme overbought conditions

- It was the third rate cut in a series of quick cuts within 2024, potentially exhausting the positive momentum

- The immediate reaction was a 6.06% decline on the announcement day, demonstrating how excessive anticipation can undermine accommodation benefits

- The subsequent response showed more muted gains of 5-10% as markets had reached peak valuations

In contrast, the September 2025 setup differs markedly. Markets are down from mid-August highs rather than at extreme highs, and this would be the first cut of the year rather than the third.

Therefore, while we can likely rule out an outsized retracement post-FOMC (barring other catalysts), the historical data suggests neither a definitive run-up nor immunity from a smaller correction (which seems to be happening now as the markets are ostensibly front-running the sell-the-news thesis).

The Russell 2000 Connection: Understanding Crypto’s Amplified Response

A critical lens for understanding cryptocurrency’s response to Federal Reserve policy emerges through its relationship with small-cap equities.

Analysis of the Russell 2000 and cryptocurrency market correlation from January 2020 through September 2025 reveals an exceptionally strong relationship with a correlation coefficient of 0.8342 and perfect directional alignment (100%) across all six years.

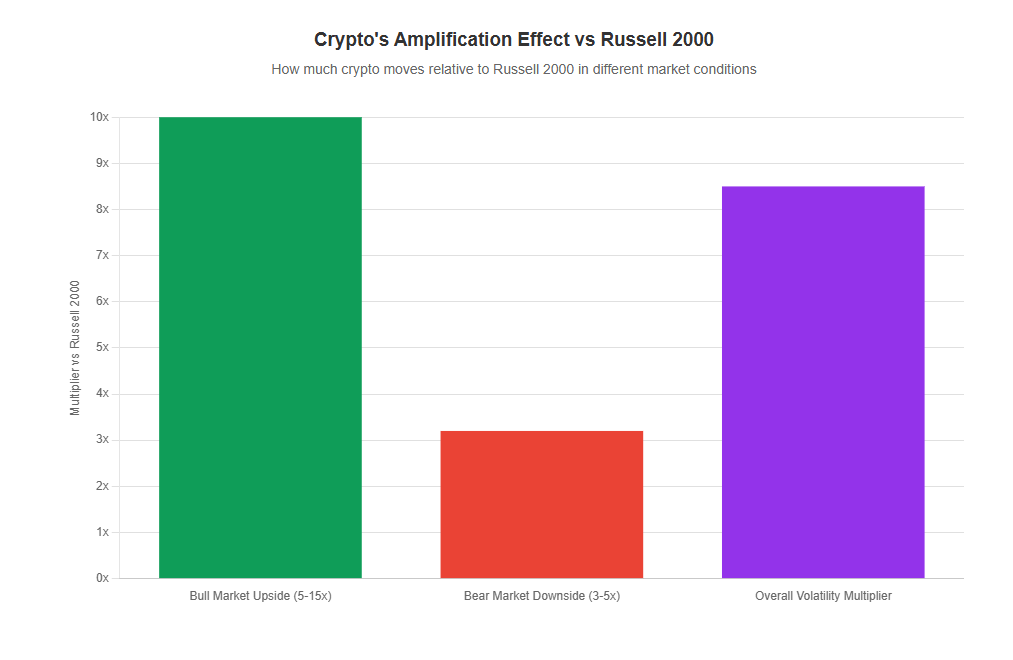

This high correlation demonstrates that cryptocurrency behaves as a mainstream risk asset moving in lockstep with small-cap equity markets, effectively acting as a highly leveraged Russell 2000 position with an 8.5x volatility multiplier.

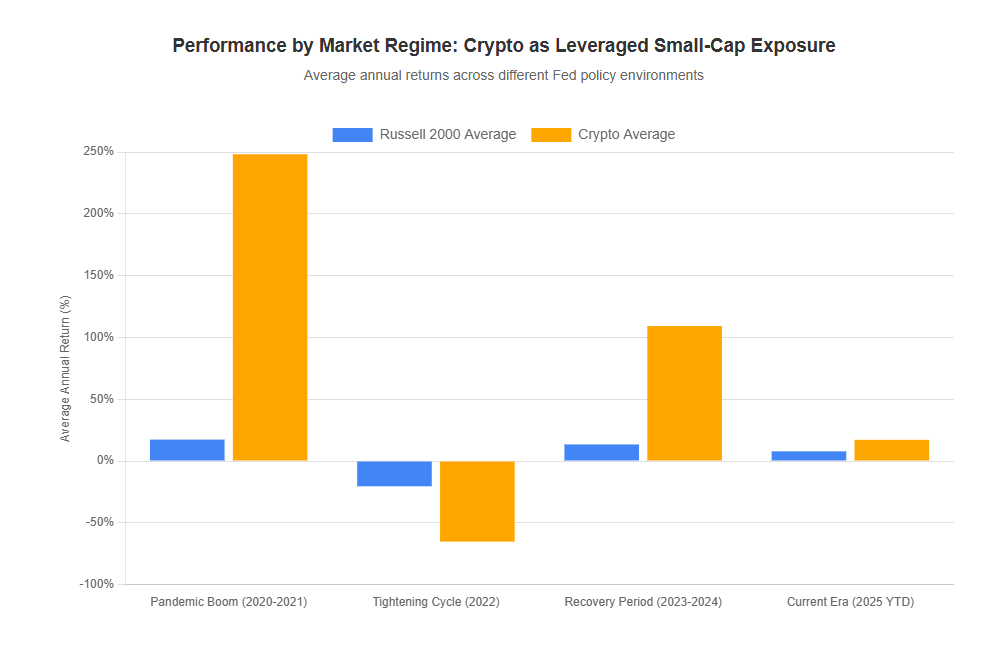

The relationship manifests consistently across different market environments:

- During the pandemic boom (2020-2021), Russell averaged 17.29% annually while crypto averaged 248.20% annually, both driven by ultra-low rates, quantitative easing, and stimulus spending.

- The tightening cycle (2022) saw perfect negative alignment with Russell declining 20.48% and crypto plummeting 65.22%, demonstrating a 3.2x downside multiplier.

- The recovery period (2023-2024) maintained positive correlation with Russell averaging 13.40% annually and crypto averaging 109.19% annually, both rallying on Fed dovishness expectations and ETF flows.

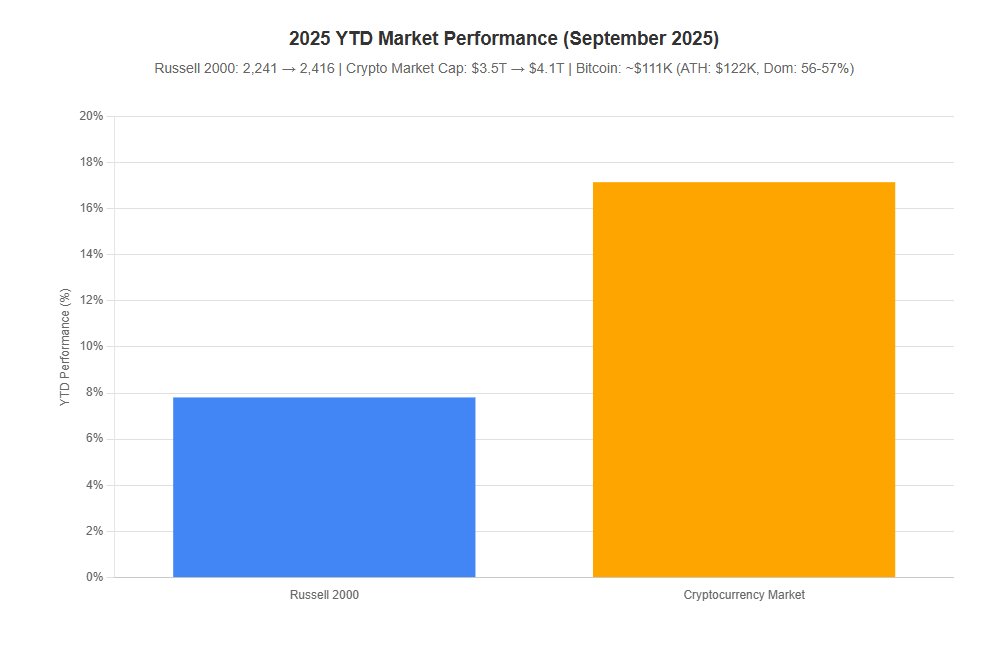

- In 2025 YTD, alignment continues with Russell up 7.81% (from 2,241 to 2,416) and crypto up 17.14% ($3.5T to $4.1T market cap), with Bitcoin trading around $111K after reaching highs near $122K and maintaining 56-57% dominance.

Risk Factors and Market Dynamics

A critical complication in the current environment is the divergence between short-term and long-term interest rates. While the Fed lowered short-term rates in late 2024, longer-term rates have been generally rising, potentially complicating the traditional rate cut playbook.

For the immediate September 17 decision, while a 25bp cut appears largely priced in (I would argue that the markets have also priced in a more aggressive approach to the cuts), the market’s perception of Powell’s accompanying statement will be crucial.

Given the historical volatility patterns and current market positioning, it’s impossible to be strongly convicted in either direction post-FOMC.

Risk-Return Dynamics and Market Behavior

The Russell-crypto relationship reveals striking patterns in risk and return. Russell 2000 shows an average return of 8.12% per year with 13.72% volatility, while crypto delivers 111.12% average returns with 116.69% volatility.

Despite this extreme volatility ratio, crypto maintains superior risk-adjusted performance with a Sharpe ratio of 0.95 versus Russell’s 0.59, delivering a crypto premium of 103 percentage points.

Market cycle behavior follows predictable patterns through this lens. In bull markets, crypto outperforms by 5-15x in magnitude (averaging 10x), driven by liquidity, institutional flows, and technology narratives.

In bear markets, crypto declines 3-5x more than Russell, with correlation strengthening during crisis periods. During recovery phases, crypto typically rebounds faster and stronger, benefiting from accommodation expectations and sustained ETF demand.

Strategic Implications for Investors

The sustained 0.83 correlation with no signs of decoupling through 2025 has profound implications for portfolio construction and risk management.

For investors, this means crypto provides minimal diversification benefit for small-cap portfolios, instead functioning as amplified exposure to the same macro drivers (Fed policy, liquidity conditions, and economic growth expectations).

The correlation is expected to remain in the 0.7-0.9 range, maintained by ETF adoption creating direct institutional linkage, overlapping risk-seeking investor demographics, and continued sensitivity to monetary policy.

Potential moderating factors include crypto-specific regulatory developments, independent blockchain innovation cycles, and varying regional adoption patterns.

For practical application, investors should treat Russell 2000 and crypto as correlated positions rather than independent exposures, model both assets declining together in risk-off scenarios, and account for potential simultaneous liquidity stress.

The data confirms that monitoring Russell 2000 movements provides valuable signals for cryptocurrency direction, particularly around rate cut events.

A Dual-Indicator Framework for Navigating Rate Cut Impacts

The data presents a clear verdict: Federal Reserve rate cuts do not guarantee immediate cryptocurrency gains. With only 37.5% of cuts producing positive returns within one month, the popular narrative of instant gratification proves false.

Instead, the real opportunity emerges over time (three months [62.5% success rate] to six months [71.4% success rate]) as sustained accommodative policy conditions allow liquidity to flow into risk assets.

The Russell 2000 correlation adds a crucial dimension to this analysis.

With cryptocurrency functioning as an 8.5x leveraged version of small-cap equities, investors gain a powerful predictive framework: monitor both Fed policy decisions and Russell 2000 price action as complementary signals.

When small-caps rally post-cut, crypto typically amplifies those gains by 5-15x. When small-caps struggle, crypto’s losses often triple Russell’s decline.

For the September 17, 2025 decision, this dual-indicator approach suggests measured expectations.

Without the excessive 60% pre-cut rally seen in December 2024, a dramatic sell-off appears unlikely. Yet with markets already pricing in accommodation and the Fed constrained by its trilemma, a significant rally is equally improbable.

The highest probability outcome lies in continued volatility within a range, with the true directional move emerging 1-3 months post-cut as the market digests both the policy reality and its implementation effects.

The message for investors is clear: patience pays more than speculation when it comes to rate cuts and crypto.

Those seeking to capitalize on Fed accommodation should prepare for a marathon, not a sprint, with position sizing that accounts for crypto’s extreme volatility and correlation with traditional risk assets. In this environment, Russell 2000 movements may prove as valuable a signal as Powell’s words themselves.