Everyone asks “wen listing”, but nobody asks how listing.

In Part II of our three-part Road to Token Listing Success series, we tell you all you need to know about listings – DEXs and CEXs, which should come first, and how to choose your CEX.

Part I: Strategic Sequencing: The importance of sequencing and how your product goals will determine ordering of Mainnet, Listing, and other announcements

Part II: Listing and Launch: How exchanges choose projects, types of exchanges, CEX vs DEX and which should come first, and what considerations you should have for your token launch.

Part III: Mainnet and Post-Launch: Mainnet and sustaining your project’s momentum after launch

Part II: Listing 101

Undoubtedly, where you get listed makes a huge difference on the performance of your token.

Different exchanges have varying levels of market exposure and user bases. Listing your cryptocurrency on a reputable and widely-used exchange can help you reach a larger and more diverse audience of potential investors and users. It can also lead to increased visibility, trading volume and protocol usage, which is often critical for the success of a new project.

High-liquidity exchanges facilitate easy buying and selling of your cryptocurrency. A more liquid market typically results in narrower bid-ask spreads and reduced price volatility, which can make your token more attractive to traders and investors.

Before balking at the listing fees, you need to consider these questions:

- How much you will make from your token sale?

- How will increased volumes impact your protocol?

- What is the brand value of working with a more prestigious exchange?

Reputable exchanges with a history of security and compliance give your project an aura of credibility and trustworthiness. Users, especially retail, are more likely to trust and invest in a token that is listed on a well-regarded exchange with a track record of protecting user funds and complying with regulatory standards.

However, getting listed is a complex and arduous process, including how you choose the exchange, how the exchanges assess tokens, and whether to go CEX or DEX first.

How to Pick an Exchange

The reputation of the exchange is more important parameter to evaluate. CMC has their own score to measure reputation, including volume. However, high volumes are important, but they need to be nontoxic. Other aspects of reputation are safety and security for users, and post-FTX exchanges have also been more transparent on proof of reserves. Other aspects to consider are:

- Geography: You can use similarweb.com to check where the majority of the traffic of that exchange comes from to see if it matches your current or desired audience. There are some exchanges that focus on specific geographies, which may or may not be relevant to your target audience.

- Compliance: International exchanges such as Binance, Kucoin, OKX may have fewer requirements, but the country-specific exchanges must abide by domestic asset regulations. For example, Hong Kong requires approved tokens on regulated exchanges to have at least a 12 month track record, while Japan has a very specific Green List System.

- Fiat Options: How can users on or offramp, and how seamless is the user experience for this?

- Types of Products Available: spot, margin, futures trading and staking/yield generation

- Customer Service:

- Responsiveness of the listing team and the platform’s customer service helpfulness for their users

- Speed of integration and listing for your token

- Professionalism and launch execution experience of the listing team

Listing and Other Fees

Listing fees are actually extremely variable, and many exchanges typically say that they actually charge listing fees, but other costs may involved. The listing fee also depends on the negotiating power of both the exchange and project, meaning the relative prestige of both. From an exchange’s point of view, projects are divided into several tiers based on assessable metrics. Top tier projects typically list at lower cost or free, while lower tier projects incur higher costs. For extremely hyped projects with strong social media and on-chain traction, exchanges may also do unsolicited listings, where they voluntarily buy your token to list for their users.

There are also different types of fees paid, usually broken down into:

Total fees =

exchange payment (listing and integration) fees +

marketing (twitter promotion and social media campaign) fees +

airdrop (listing event) fees + security deposit

Marketing fees start at $50K and can go up to $200K depending on the current reach of the project. Airdrop fees start at $50K, which go directly to an Airdrop campaign, while the security deposit starts at $200K and you should eventually get it back.

Not all exchanges have all these fees, but it’s important to know the total amount you may end up paying.

Exchange Payment Fees

- Small exchanges: $6K – $30K

- Medium-sized exchanges: $60K – $300K (There is a substantial jump in listing fees, but there is a huge volume difference)

- Top Exchanges: $1-2.5 million for a token listing

If there are two exchanges that want to list you, and you cannot afford the listing prices of both, it is acceptable to choose the better one based on the parameters listed above, and then come back to the second exchange you don’t list on later. It is unlikely that they won’t want you later.

How the Exchange Picks You

Even though we may act like you’re choosing the exchange, it is much more likely that that exchange is choosing you. The bigger the exchange, the less likely you are to get listed. But, what exactly are exchanges looking for?

Great question.

Unfortunately the only answer you will ever hear from them is some amorphous answer about traction, community, and tokenomics. Here’s some metrics that exchanges will consider in their assessment:

- Community Size and Activity: A large, active community that supports the project is a significant asset. Exchanges look at all aspects of community including but not limited to: number of followers, active participants in discord/telegram, whether engagement commensurates with followers, public opinion on social media. This reflects the potential for success and growth, as a vibrant community can drive adoption and engagement.

This is very important for exchanges, because it usually translates to more active trading, which means more fees for the exchange. - Founders’ Backgrounds: The identities, professional backgrounds, and reputations of the project’s founders are closely evaluated. Exchanges look for founders with established networks and solid credentials in their respective fields. Founders with a history of success and trustworthiness are often seen as a positive sign. This usually also translates from how much money the founder has been able to raise.

- Technology and Innovation: Projects that offer cutting-edge technology, innovative features, or a competitive edge tend to be more attractive for listing – especially if the project is unique and no similar verticals are currently listed on the exchange. This could also reflect how closely the token fits with the current popular narrative.

- Project Roadmap: Exchanges assess the project’s strategy, available resources, financial backing, and growth potential in the target market. Will the team be around for the long term to keep the project going for the foreseeable future, and can the team actually execute? Exchanges try to avoid potential rugpulls or short term project teams since their users will lose money and they will have to go through the extra work of delisting.

- Product Delivery Track Record: Exchanges look for evidence of successful product development and delivery by the project team. This demonstrates the team’s capability to execute on their plans and deliver tangible results. Security and audits is also part of this.

- Reputable Partnerships: Strategic partnerships with established companies or organisations enhance the project’s credibility and growth potential. Such partnerships often signify industry recognition, support and adds legitimacy, which can be a powerful endorsement.

- Token and Onchain Performance: The trading performance of a project’s token on DEXs or private markets is a key indicator of its popularity, demand, and potential value. Exchanges will also consider the number of onchain token holders, as it shows the distribution of your project and how many users have actually bought-in with their own money.

- Good Tokenomics: Equitable token distribution is crucial. It implies lower risks of price manipulation and a healthier ecosystem. Excellent tokenomics also help extend project longevity and sustainability as insiders’ selling pressure will be less impactful. Exchanges often look for projects that have a fair and transparent token distribution model.

- Compliance: Certain exchanges, like Coinbase, have to comply to very specific regulatory parameters because they sell to US citizens, and therefore the coins they list also have to be included.

By looking at our Quarterly Liquidity report, you will be able to see the metrics for protocols that have been listed by exchanges, and you can compare yourself to those. The most important parameter is certainly traction and community involvement.

The exchange should know that the team is in it for the long run, and that user volumes and interest will be sustained, rather than simply riding on the hype to use their users for exit liquidity.

CEX or DEX: Which comes first?

Even with the advent of DEXs, most protocols will still choose to list on a CEX first, simply because there is much more liquidity there. However, select tokens have been defi-first, which helped them gain momentum before getting listed on CEXs. It is also easier and cheaper to simply set up a liquidity pool on a DEX and seed liquidity compared to paying for a CEX listing.

You should consider the current stage of your project – early-stage projects should not be looking at CEX listings unless it is aligned with your protocol’s goals, while later-stage projects can consider large CEX debuts or concurrent CEX + DEX listings.

A DEX-first approach can also help improve decentralisation directly through onchain distribution and encourage usage of your protocol.

Some examples of projects that took the DEX-first approach are:

- Pendle: Since they were featured in Sushi’s incentive program, it made the most sense to set up the pool there. Pendle is a DeFi protocol themselves as well, so from a vision standpoint it made sense to be DEX-first. Furthermore, interest on DEX pools led to an organic listing on Binance. CEX listing was still a significant impact as it helped with brand recognition, and ultimately led to wider adoption across DeFi (protocol integrations) and CeFi (wallet and CEX integration of Pendle Earn).

- Compound: As a natively DeFi project, Compound’s DEX-first launch allowed the protocol to decentralise governance while rewarding users for participating in their ecosystem, making for a win-win situation that may not have been possible with a CEX-first approach.

- Shiba Inu, Pepe, Dogecoin: Entirely a memecoin and fuelled by organic community interest, so they were DEX first. Memecoin exchange listings can be challenging without DEX volumes and metrics. Unless your memecoin project has strong credibility, traction or an established product, it may be challenging to meet the CEX listing criteria for a CEX-first launch.

One or Many: How many CEX’s for initial listing?

If you have decided to go for a CEX listing first, you should always try to get listed on the biggest CEX possible. There are cases where a really strong community or strong trading history can cause a bigger CEX to take interest in after you list on a smaller exchange, but this is extremely rare. If a bigger CEX is willing to take you but the listing cost is significantly higher, it may be better to make that upfront investment and go with them, rather than to go with a cheaper, smaller exchange. The more reputable exchange with high trading volume is likely to have better price discovery and may fetch a more competitive price in the market.

Unless you are absolutely sure about your volumes, you should list on one exchange first to concentrate your liquidity. This is especially true for the bear market, where trading volumes are generally low. The same applies for multiple trading pairs, which will dilute your depth. It is better to start with a couple of core pairs, and then add as your price stabilises. During the bull market, listing on multiple exchanges at once has the upside of helping with marketing and hype – if you have multiple partners talking about you, it will create a lot more buzz.

From our research, there is always a significant discrepancy between volumes on the first and second exchanges, so listing on multiple exchanges will not necessarily help your volumes in general.

Launchpads

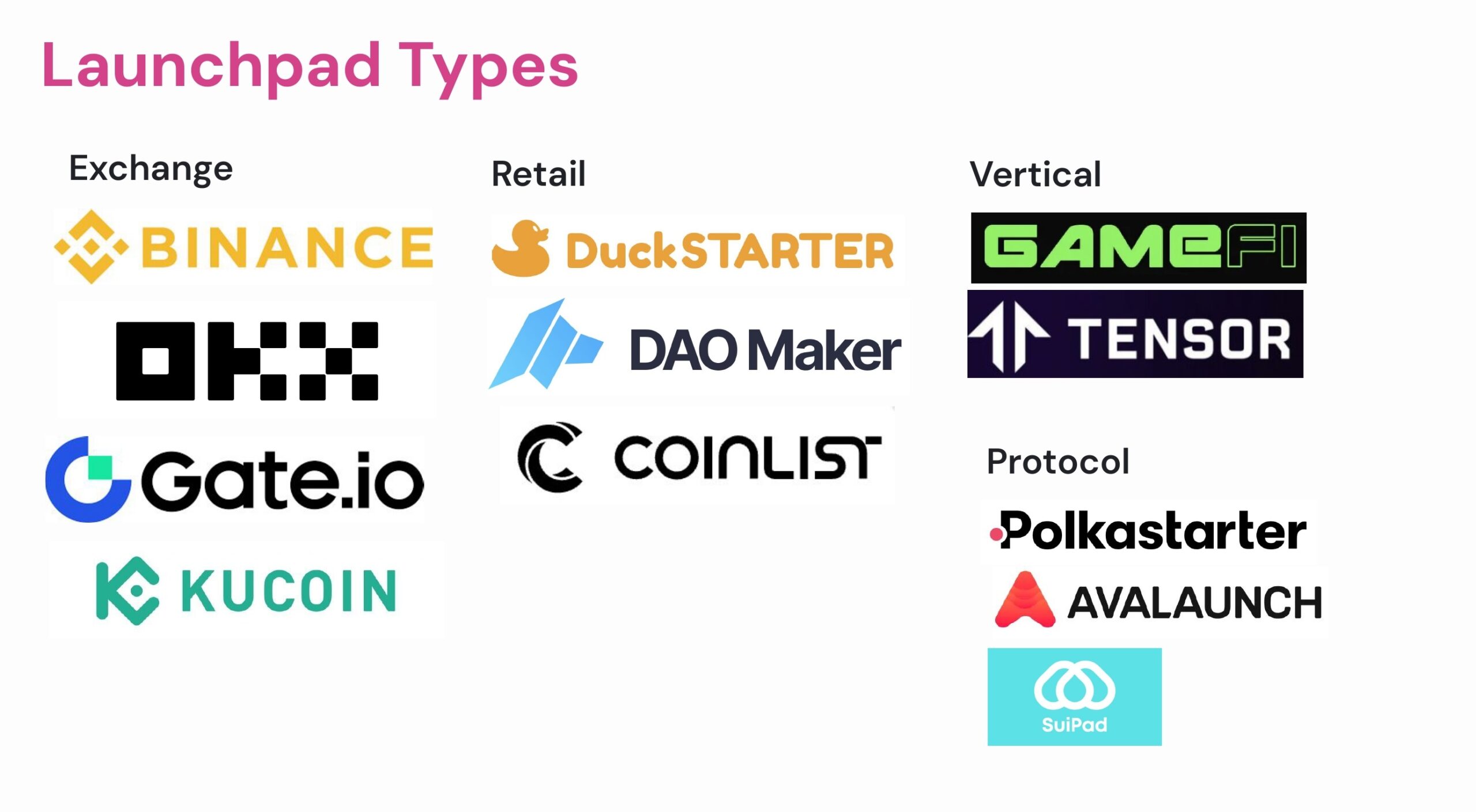

Launchpads come in different forms and functions:

- Exchange Launchpads: Most of the major exchanges (including Binance, OKX, Gate.io, Kucoin) all have their own Launchpads as their flagship listing event, with the benefit of getting much stronger exposure and in-app promotions for your listing.

- Protocol Specific: Polkastarter for Polkadot, Avalaunch for Avalanche. A bit more narrow, but usually there’s one large launchpad per ecosystem, so it’s easier to get the audience attention and cultivate goodwill.

- For Retail Investors: DuckStarter, Seedify, DAO Maker, Coinlist

- Vertical Specific: Gamefi.org for games, Tensor and Magic Eden for NFTs

Ultimately, there is no definitive evidence that joining a launchpad will affect your token price. Launchpads might actually help you more with the qualitative aspects of your token launch, like building community, business development and exposure that might affect your token price, but attribution is difficult.

There is some research that indicates listing on Binance increases the initial listing price, but this may not translated to sustained trading prices.

Consult Widely

Talk to other projects who have gone through the process, both successfully and unsuccessfully, during bear and bull markets. Different projects can have different experiences with the same exchange or the same market maker, so it’s best to find projects that are realistically closest to your situation. There is often more than meets the eye when it comes to a TGE and price variations.

Outside of other founders who have gone through the same process, there are many other resources that will be familiar with the token listing process, such as accelerators, advisory companies, launchpads (as mentioned above) and market-makers.

Reputable market-makers have gone through many token launches, and many of them have relationships with exchanges and can help you get listed. They may also be able to help you answer other questions about specific exchanges and aspects about liquidity.

Conclusion

The significance of where a token gets listed cannot be overstated. The choice of exchange can have a profound impact on a project’s performance, visibility, and overall success. The benefits extend beyond mere exposure; high-liquidity exchanges contribute to easier buying and selling of the cryptocurrency, narrowing bid-ask spreads, and reducing price volatility. While the allure of prestigious exchanges is undeniable, it’s crucial to carefully consider the associated fees, examining not just the exchange payment fees but also marketing fees, airdrop fees, and security deposits.

Additionally, the process of getting listed is nuanced, and it often involves exchanges selecting projects rather than the other way around. The parameters considered by exchanges reflect a desire for projects with substantial traction, community involvement, and the potential for sustained growth. As projects navigate the listing process, understanding these dynamics and aligning with the right exchange is crucial for long-term success in the ever-evolving cryptocurrency landscape.

Ultimately, thorough research, strategic decision-making, and a comprehensive understanding of the project’s goals are essential for navigating the complex terrain of token listings and exchanges.

For more information, check our article about working with market-makers. Feel free to reach out via our socials or email – we’re happy to help.