The road to a live product, whether that means Mainnet or Listing, is long. Founders often have questions about which should come first, and whether or not the sequencing makes a difference.

Part I: Strategic Sequencing: The importance of sequencing and how your product goals will determine ordering of Mainnet, Listing, and other announcements

Part II: Listing and Launch: How exchanges choose projects, types of exchanges, and listing fees

Part III: Mainnet and Post-Launch: Mainnet and sustaining your project's momentum after launch

Table of Contents

Sequencing: Why You Need to Be Strategic About Release Cadence

The order to announce events and milestones is not a marketing decision, but a strategic one. It will affect the success of each of your releases, which in turn will lead to higher engagement, bigger partnerships, and stronger listings.

Sequenced correctly, you can leverage...

Deeper Insights Ahead

The road to a live product, whether that means Mainnet or Listing, is long. Founders often have questions about which should come first, and whether or not the sequencing makes a difference.

Part I: Strategic Sequencing: The importance of sequencing and how your product goals will determine ordering of Mainnet, Listing, and other announcements

Part II: Listing and Launch: How exchanges choose projects, types of exchanges, and listing fees

Part III: Mainnet and Post-Launch: Mainnet and sustaining your project’s momentum after launch

Table of Contents

Sequencing: Why You Need to Be Strategic About Release Cadence

The order to announce events and milestones is not a marketing decision, but a strategic one. It will affect the success of each of your releases, which in turn will lead to higher engagement, bigger partnerships, and stronger listings.

Sequenced correctly, you can leverage the momentum of previous announcements to amplify your message and product, and most of all, continue to stay relevant in the industry. The crypto industry is, at best, easily distracted, and at worst, disloyal. Therefore, you need to create consistent and immediately applicable messaging and releases to stay top-of-mind for your audience.

Building Momentum

Rather than thinking about your announcements as discrete events, consider them as a related wave that builds towards a climax. Usually that climax will be your listing for three major reasons:

- Ability to Trade: Your token generation event may have happened already, and your token might already be trading on a DEX, but it unlikely that retail consumers will be involved before the CEX listing. This ability will mean a lot for community engagement, and incentivises your audiences to act differently.

- Community Growth: This could also mean expanding into new markets based on your exchange listing selection, or it could simply mean being able to reach a retail audience you weren’t before. This will likely be one of the largest marketing events that you do.

- Increased Liquidity: Before the listing, your investors and founders will be the biggest holders of the tokens. After listing, retail and institutional investors will hold the most of your token. This increased liquidity may enable an exit event for investors or increase your own war chest. For traditional tech founders, they may need to raise a Series B after they get product market fit (which is basically what Mainnet tries to do), but for crypto founders, they can get more liquidity through that token listing instead.

That momentum needs to be continue to build after the launch, as apps build on your chain, you sign partnerships, and so forth with the goal of building your FDV as you go. After you list your token, your token price will almost always be how external parties view the worth of your project. FDV will always be what they measure against.

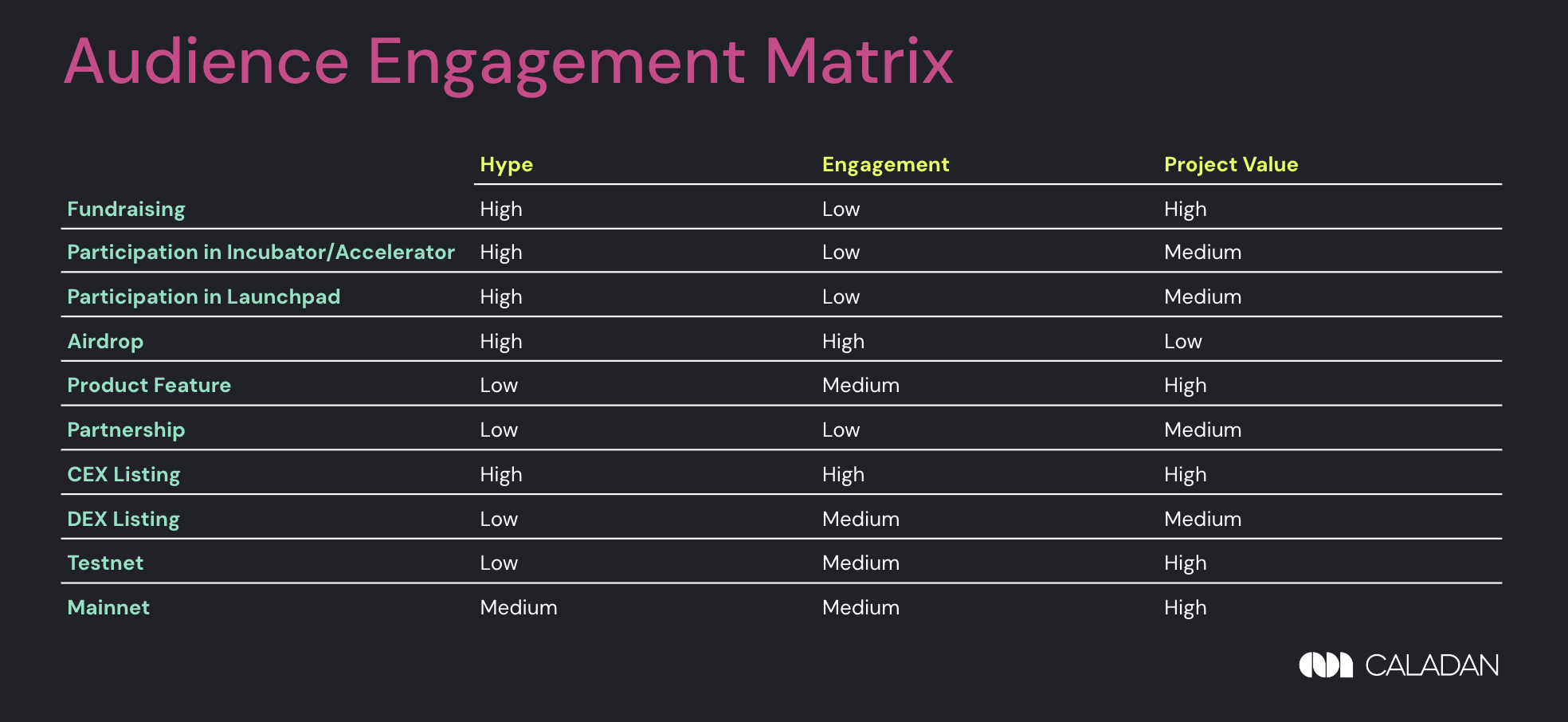

Therefore, every announcement you make, you should think about the impact on three dimensions:

- Hype: How likely are external parties, whether press, or your customers to get excited about you this, and how likely are they are going to talk about it? How does it affect the ecosystem at large, outside of your customers? Why should other people care?

- Engagement: Does this announcement involve the audience?

- Project Value: How does increased liquidity impact your product roadmap? Will this lead to more partnership, users, symmetrical markets? You can also account for token design and utility here.

For example, a fundraising announcement might be very big, in that press will cover it and that it means money for your project, but there’s no real way for the audience to engage with it, so they may forget it quickly.

If you release too many events at once that are very high in one dimension only, your audience might get burnt out. Therefore, it is actually wise to make smaller announcements in between bigger ones, to still stay relevant, without over-engaging your audience. Seek to build momentum for your listing by releasing news in incremental significance, managing your community’s expectations to keep interest and attention healthy.

Figure 1: Audience Engagement Matrix

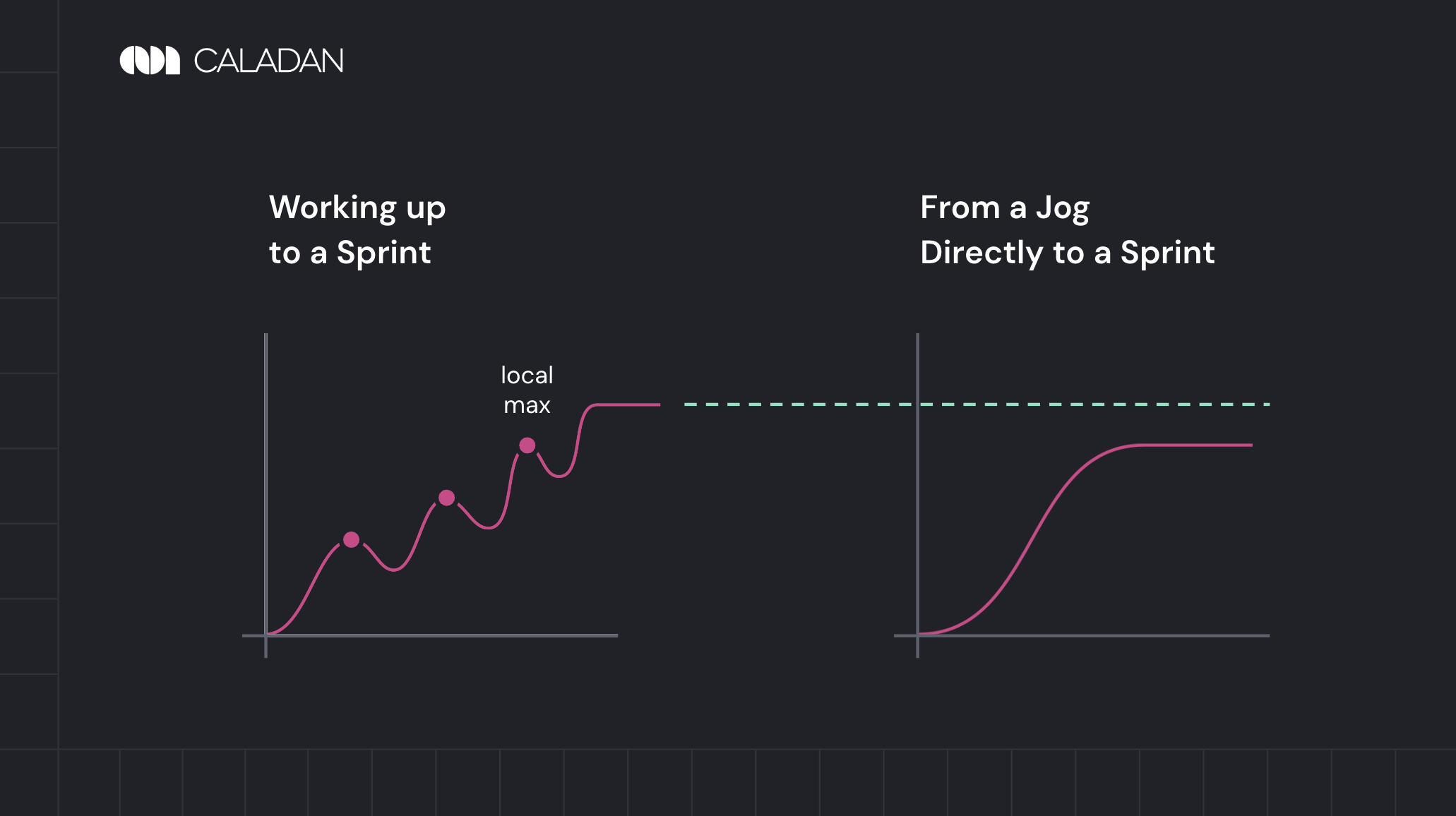

However, if you work up to that sprint, but have local max sprints, your final sprinting speed will actually be faster than if you had just started from a sprint.

Figure 2: Working up to a Sprint for your Project

Mainnet and Listing: Which comes first?

There is no correct answer which should come first, but it will depend on what your token does, where you are with product market fit, and adoption.

Listing Announcement

It is unlikely your listing announcement is your first announcement, but it will be one of your biggest. After you have solidified your initial listing exchange, that major exchange will make an announcement on the blog page and social media (Binance, Coinbase). Typically their followings, particularly in retail, are significantly larger than that of any one single token or coin. Therefore, this will be one of your biggest opportunity to reach a wide audience – take the chance to release other announcements that may build further interest, hype, or following. In particular, security or infrastructure tokens, as opposed to utility tokens, are not very applicable to retail investors until they are accessible on the retail market.

However, this is difficult because the bigger the exchange, the more you’re at their mercy of when they choose to launch the token. The bigger your token is, the more you may have the ability to negotiate timing, but it is likely that it is based on their schedule and the other tokens they are planning to list that quarter. You are absolutely not allowed to make announcements about listing before the exchange actually announces.

Mainnet before Listing

If you do not think that increased retail interest and greater liquidity will impact your chain, then you should do your Mainnet first. This would be applicable for more infrastructure or B2B type chains. For example, Optimism decided launched their Mainnet in December 2021, but their native token ($OP) only went live in May 2022. Rather than doing an Airdop, Optimism prefers to do retroactive airdrops for rewarding developers for good behaviour, as opposed to incentivising developers for specific behaviour.

The state of the market and your fundraise also affects this deeply. Optimism’s biggest competitor Arbitrum, soft launched May 2021, did Mainnet Launch in August 2021, but did not list their token until March 2023, almost two years after their Mainnet. They wanted to focus much more on developers and creating utility with their chain, and didn’t see as much of a need to have the token public.

Listing before Mainnet

If greater retail interest will be attractive to more developers for Mainnet, then listing should come first. This was applicable to chains such as Sui, which are built for gaming and entertainment, two very consumer focused industries.

It is advised to space Listing and Mainnet at least 2-3 weeks apart. This is also a question of internal bandwidth as both Listing and Mainnet require a lot of work from teams, so the spacing may be a challenge. You do not want to space more than 5 weeks, because you may not be able to capitalise on all the attention you got from your listing. If your Mainnet is completely inapplicable to consumers, then this may not be relevant otherwise.

The danger here is also that if your listing does not go as well as you would like, including those of unforeseen external reasons like a FTX or the USDC depeg, it could negatively affect your Mainnet later on.

Listing and Mainnet Simultaneously

For the biggest L1’s, they have preferred to do Mainnet at the same time as listing, because this will create the most hype and attention. However, this is the most difficult to do, and should only be attempted you have both the capital and resources to do this well.

Out of the top 48 tokens (BTC and ETH not counted) on CoinMarketCap, 75% chose to do Mainnet before Token Listing, but the majority of those were during the bull market. Only 8 chose to do listing after Mainnet. Even fewer chose to do list and Mainnet at the same time. Three of those were Filecoin, Algorand, and The Graph, which all raised significant resources during the bull market and launched in late 2019 into 2020. The other two had their own circumstances:

- $OKB: Because this is OKX’s native token, and their first listing was of course on OKX, they had a lot of control in timelines and execution.

- $APT: Even though Aptos listed on FTX, Coinbase, and Binance, the token price plunged right after launch, mostly about controversial tokennomics and technical shortcomings. The price continued to fall because of the FTX controversy, which happened shortly after. Based on unexpected market events, their launching sequence would not have made a different either way.

Other projects may choose to mint their tokens significantly earlier, either for legal reasons, or because they want to have a private sale. There are often various token requirements and technical deployment considerations for the private sale. The private sale allows investors and key stakeholders with ability to significantly contribute to the success of the project to obtain an early stake at lower prices. This allows the team to build up a cash reserve to bankroll the project, while also aligning stakeholders’ incentives for the longer term success of the token.

Always remember to create a contingency timeline for delays, whether internal or external. Is there a replacement announcement you make in stead? Can you hold external parties at bay? Will there be leakage if a deadline is delayed?

Other Announcements

| Announcement | Best Outlet | Description | Examples |

| Fundraising | Press | Relatively straightforward to get covered, if your round is significant/big enough. Work with your investors to amplify this message. | Kaito Funding PR Article Kaito Funding PR Tweet |

| New Product Features | Owned Channels (Twitter, Substack, etc) | Unlikely to be covered by press, unless it is something truly revolutionary. Important to consider the specific audiences that this is relevant to. | Uniswap Wallet UniswapX dYdX iOS dYdX iOS Swap GMX – Chainlink |

| Partnerships | Twitter Spaces, Press | Leverage the partner to increase the announcement. | SynFutures x Parsiq Twitter Spaces |

| Testnet/ Mainnet Launch | Twitter, Blog Posts | Get users excited about the testnet or mainnet launch to maintain adoption and traction. | Scroll Testnet Launch SynFutures V3 Testnet |

| New Chain Integration | Twitter, Blog posts | Use the L1/L2 to amplify your message as much as possible, be as specific as possible in emphasising how your unique product features fits with that chain. | Notifi x Sui Integration |

Conclusion

In your project’s journey towards token listing, the sequencing of events should be planned carefully as a strategic move that can greatly impact the success of your project. The order in which you release announcements, milestones and listings creates momentum, builds engagement, and increases your project’s perceived value.

By carefully planning and sequencing each step, you can capture the market narrative and leverage the momentum of your target audience to establish strong mindshare in your audience. Each milestone announcement should be structured working up to a sprint, building the wave that leads up to your project listing and a healthy, engaged community around your project.

This will rally your users around your project and become committed advocates, incentivised to help contribute to your success.

Figure 1: Audience Engagement Matrix

Figure 1: Audience Engagement Matrix