The rise of meme coins in the cryptocurrency space has sparked significant debate. It blends the worlds of humour, internet culture, and cryptocurrency trends, serving as a unique trendsetter in the sector. The coins have called into question the judgement of retail investors and the true value of the entire crypto industry. They have also highlighted the power of community and branding in driving market trends.

While most cryptocurrencies were designed with specific use cases or technological advancements in mind, coins like Dogecoin and Shiba Inu have managed to carve out a niche. Born from memes and viral internet content, these coins have quickly gained significant popularity. Their value has been driven more by the influence of online culture than by traditional market fundamentals.

Despite their playful and whimsical origins, these coins are not exempt from the challenges faced by other cryptocurrencies. These include market volatility and liquidity issues. Due to the lack of underlying fundamentals, these coins become even more susceptible to price swings and instability. As these digital assets continue to capture the imagination of investors and traders alike, it’s crucial to ensure the cryptocurrency market stability at all times.

This article will dive into the origins of meme coins and examine their impact on the broader cryptocurrency outlook. At the same time, we will also uncover the role of crypto market makers in maintaining the balance in an often unpredictable space.

The Meteoric Rise of Meme Coins

What are Meme Coins?

Traditional cryptocurrencies such as Bitcoin or Ethereum are built on specific technological advancements or practical use cases. On the flip side, meme coins are often a community-driven category of cryptocurrency. Primarily gaining traction through community engagement, humour, and online trends, these coins often draw inspiration from internet culture, memes, jokes, and viral phenomena.

While they may hold market value, many of them lack a clear or practical utility. This makes their appeal more about entertainment and the culture surrounding them, rather than about solving real-world problems.

Meme Coins and Blockchain Technology

Like other cryptocurrencies, meme coins are based on blockchain technology. What sets these coins apart is their branding which fosters a strong sense of community among their holders. Communities around these coins often unite to boost demand and organise online campaigns, further solidifying the coins’ place in pop culture.

Often based on popular characters, animals, or internet trends, these coins are typically created by a small group of developers or communities. Once created, these coins can be directly listed on decentralised exchanges (DEXs). Everyone is able to trade these coins on these platforms without the need for a central authority. The transactions are often driven by enthusiasm, speculation, and social media hype. As their popularity grows, these coins begin to attract the attention of a broader audience, including more serious investors and traders.

Over time, many meme coins begin to transition to major centralised exchanges (CEXs), such as Binance, Coinbase, and Kraken. This broadens their reach and propels them into the mainstream cryptocurrency market. Despite their origins in humour and internet culture, these coins have become a formidable force. Notably, some even reached multi-billion-dollar market caps.

Dogecoin (DOGE)

Created in 2013, Dogecoin holds the title of being the first and most well-known meme coin. It was inspired by the “Doge” meme, which features a Shiba Inu dog with humorous captions in broken English. While initially created as a joke, Dogecoin quickly gained attention due to its fun, light-hearted nature. The Dogecoin community has used the coin to fund various initiatives, including raising money for clean water projects and sponsoring sports teams.

Shiba Inu (SHIB)

Launched in 2020, Shiba Inu was created as a direct competitor to Dogecoin. It sought to capitalise on the same viral appeal and animal-themed branding that made Dogecoin so popular. Often referred to as the “Dogecoin killer,” Shiba Inu’s rise to fame was hyped by social media buzz and community-driven hype. The Shiba Inu token features a Shiba Inu dog, much like Dogecoin, but with a more pronounced focus on building a broader ecosystem.

Pepe Coin (PEPE)

Pepe Coin is inspired by the “Pepe the Frog” meme, a character that has become an iconic figure in internet culture. Known for its widespread use across social media platforms, Pepe the Frog became synonymous with various online subcultures. Pepe Coin experiences short-term price spikes from trending memes, influencer endorsements, or viral moments on platforms like Twitter and Reddit.

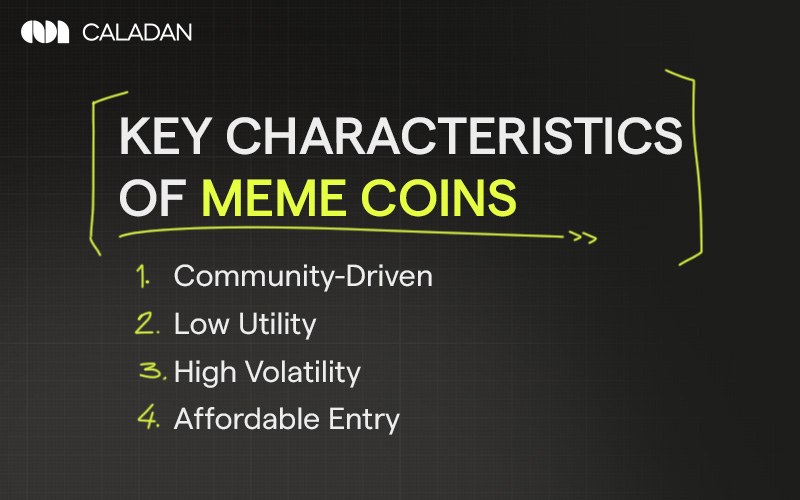

Key Characteristics of Meme Coins

As meme coins have evolved from niche tokens to mainstream contenders in the cryptocurrency market, they have several characteristics that distinguish them from traditional cryptocurrencies. Understanding these traits helps explain why these coins have captured the imagination of investors and the wider public.

Community-Driven

Meme coins thrive due to their large, passionate online communities, highlighting the role of enthusiastic followers in boosting their value. Unlike traditional cryptocurrencies, these coins are largely influenced by the popularity and engagement of their communities. The strength of these communities can fuel viral trends and encourage social media campaigns. Most importantly, they nurture a sense of belonging among holders.

Low Utility

Most of these coins are not designed to solve real-world problems or provide innovative solutions. Instead, they function as collectables, cultural tokens, or assets for short-term speculation. Investors are often attracted by the coins’ entertainment value, the potential for quick profits, or simply as a way to participate in a trend. This limited utility makes them more vulnerable to market fluctuations driven by sentiment rather than substance.

High Volatility

Meme coins are notorious for their volatility. Their value tends to fluctuate wildly in response to a single tweet from a celebrity, influencer, or high-profile figure. This makes these coins highly speculative, with their prices often affected by hype, social media buzz, and public sentiment.

The market volatility in these cryptocurrencies may present opportunities for short-term gains. Nonetheless, it also exposes investors to significant risks. The lack of a solid foundation or inherent value means that these coins may experience rapid price declines just as quickly as they rise. In other words, they can be a risky investment for those looking for stability.

Affordable Entry

An appealing aspect of meme coins is their affordability. With low per-token prices, they offer an accessible entry point for new investors. As such, individuals are able to participate in the cryptocurrency market with relatively small investments. This affordability has contributed to the widespread popularity of these coins. However, this low price point is prone to volatility, as small market movements might pose a disproportionate impact on the value of these coins.

Factors Contributing to the Popularity of Meme Coins

Now that we have explored the key characteristics, it’s important to understand the factors that have contributed to the growing popularity of these coins.

The Role of Social Media in Meme Culture

Social media has played a part in amplifying the popularity. Memes are quick, shareable pieces of content that often go viral. That is how they became a central aspect of internet culture.

Meme coins combine this viral nature with blockchain technology, offering users a fun and engaging way to interact with cryptocurrency. Platforms like X, Reddit, and TikTok have been instrumental in circulating these coins. They have often triggered price surges based on viral moments or online trends. This connection between internet culture and cryptocurrency has made these coins more accessible and appealing to a wider audience.

Community-Driven Development

Community involvement is at the core of these coins, driving their development and success. Both developers and users contribute to the coin’s development, marketing, and promotion. They establish a vibrant ecosystem where the success of the coin is directly tied to the level of community engagement. The constant interaction within these communities, whether through social media campaigns, charitable efforts, or simply sharing memes, helps to keep the momentum going.

Financialisation and Speculation

As the cryptocurrency market has become more financialised, meme coins have garnered the attention of speculators seeking high-risk, high-reward opportunities. Their volatility —where prices can surge or plummet within a short period—makes them an attractive option for “venturesome” traders.

The Need for Market-Makers in Meme Coin Ecosystems

Why Meme Coins Need Market-Makers

Meme coins, much like a highly anticipated new restaurant, can attract massive attention. Nonetheless, they may struggle to meet demand without the right infrastructure. In the case of a restaurant, a lack of tables and staff would lead to frustration and missed opportunities.

Similarly, their liquidity shortage potentially hinders their ability to capitalise on their hype. As a result, the potential for price appreciation and token growth is lost. This is where crypto market making firms come in. Market-makers play a crucial role in crypto markets, managing demand surges and price slippage to maintain growth potential.

Volatility in Meme Coin Markets

Meme coins are notorious for their high volatility, with prices often swinging dramatically in short periods. For example, Dogecoin has once experienced sharp price surges followed by equally rapid declines. Given the rapid fluctuations that trigger a sense of instability, the unpredictable nature of these coins often deters potential investors. Without mechanisms to manage these price movements, these coins risk losing investor confidence and missing out on long-term growth.

The Dangers of Lack of Liquidity

Meme coins are well-known for their extreme volatility, with prices frequently fluctuating over short periods. When these coins lack liquidity, investors face wide price spreads, slippage, and an increased risk of market manipulation. This may create an environment where buying or selling becomes inefficient and costly.

Market-makers step in to fill this gap by providing liquidity. By ensuring smoother price movement and reducing the chances of price swings, crypto market making services provide a more stable environment for both buyers and sellers. This encourages consistent participation and helps the market grow sustainably.

Sustaining Interest and Investment in Meme Coins

Market-makers are crucial for maintaining investor confidence. To achieve this goal, they help stabilise the market and make them more appealing to long-term investors. This is especially important as these coins transition from being speculative assets to more viable trading assets.

With steady liquidity, market-makers move these cryptocurrencies beyond short-term speculation, supporting their community-driven growth. The key is to sustain their development and approach a larger and more dedicated investor base.

The Future of Meme Coins and Market-Makers

As meme coins continue to evolve, the role of market-makers will become increasingly prominent. The ongoing development of these coins, alongside their growing relationship with market-makers, will define the next phase of this dynamic segment.

Integration and Growth

No longer just novelties, these coins are becoming dynamic players in the crypto space. With new ones regularly emerging, many with unique features and use cases, their appeal is broadening. These coins are finding their place more seamlessly within crypto exchanges, paving the way for greater mainstream acceptance. As they grow, these coins will likely see further integration into existing crypto infrastructures. In other words, they are more accessible and appealing to a wider audience, while also contributing to the overall evolution of the cryptocurrency market.

The Evolving Role of Market-Makers

Crypto market making services are becoming an increasingly integral part of the meme coin ecosystem, supporting new projects and lending professionalism to the market. As the demand for these coins continues to rise, market-makers are stepping in to provide the liquidity and stability necessary for their continued success. Their involvement is helping to transform meme coins from speculative assets into more sustainable and reliable investments.

A key difference between the coins and more traditional tokens lies in the way they engage market makers. For standard cryptocurrencies, market makers are usually employed by the token’s foundation, which funds their activities and ensures liquidity. In contrast, the coins often operate without a formal foundation or structured team.

Instead, individual contributors or key opinion leaders (KOLs) from the community actively seek out market makers to help drive liquidity and trading volume. These individuals or groups typically fund market makers through a community pool of tokens, relying on collective support rather than a corporate-backed structure.

In the future, market-makers may gain greater recognition in the DeFi (Decentralised Finance) space. Their contributions will promote the overall stability and liquidity of decentralised markets. As the meme coin market matures, market-makers will continue to keep these coins viable, attractive, and resilient in an ever-changing financial sector.

Frequently Asked Questions

What happens if meme coins don’t have market makers?

Without market makers, meme coin markets can experience extreme volatility, large spreads, and slippage. This lack of stability can discourage investment and potentially lead to market manipulation, harming the reputation and value of the meme coin.

Are market-makers only important for popular meme coins like Dogecoin?

No, market-makers are essential for any meme coin. While large meme coins like Dogecoin benefit from market-makers, newer or smaller ones also require liquidity and stability to avoid excessive volatility and to grow their investor base.

Is there a future for meme coins with market-makers involved?

Yes. As the meme coin market matures and gains credibility, market makers play a pivotal role in improving liquidity and reducing volatility. This ultimately leads to a more professional and regulated ecosystem for meme coins.

Conclusion

While meme coins originate from internet culture and memes, they need robust financial structures to thrive in the evolving cryptocurrency market. To sustain growth and attract a broader investor base, these coins must transform beyond their speculative nature. In this transition, market-making services are the catalysts.

Caladan specialises in expert crypto market-making services. Having traded over 1,000 tokens and billions in daily volume, we offer our clients access to low-latency infrastructure, finely tuned algorithms, and extensive connectivity across both centralised and decentralised exchanges.

Contact us now to schedule a consultation.