Key Takeaways

- The market is bifurcating into two asset classes: institutional-grade DCF assets with yield and infrastructure, and attention assets driven by retail mindshare and airdrop mechanics

- Capital is adopting a barbell approach, rotating into safe yield positions and selective high-conviction bets, while avoiding middle-risk exposure

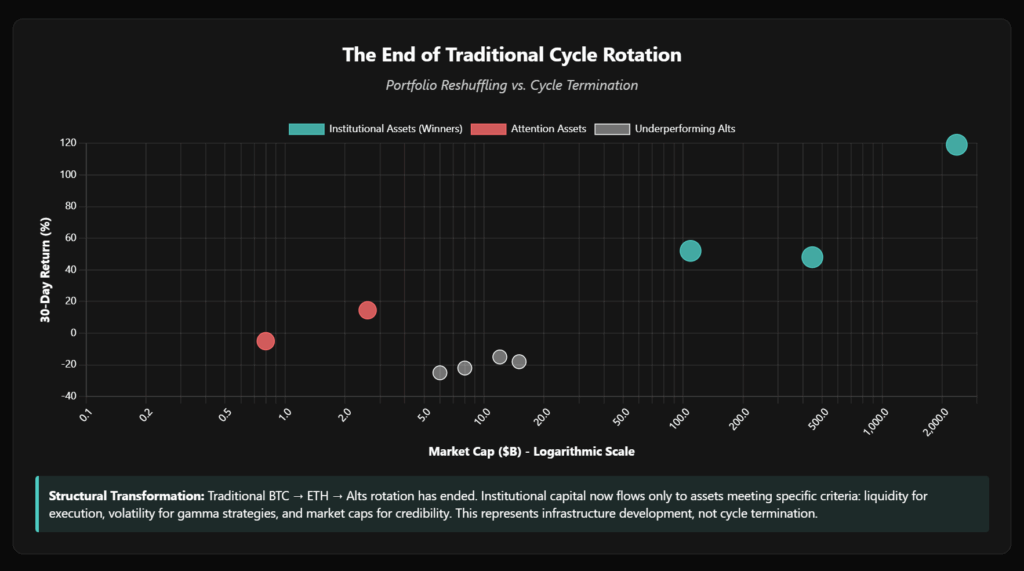

- Institutional flows seem to be consolidating in assets with depth, volatility, regulatory clarity, and balance sheet utility, breaking the traditional BTC → ETH → alts rotation

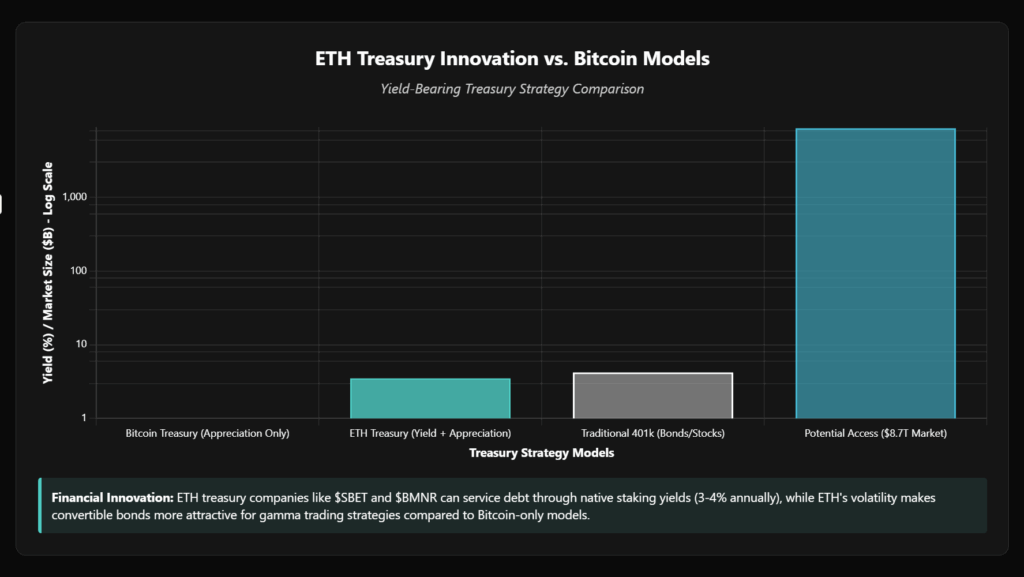

- ETH treasury companies are enabling firms to hold ETH as a productive asset, accelerating this crossover adoption through yield and structuring tools

- Perpetuals volume is concentrated on venues like Hyperliquid, likely signaling a market driven by sophisticated traders rather than broad retail flows

- Funding rates remain elevated but controlled, indicating strategic leverage use by professionals instead of euphoric excess ...

Deeper Insights Ahead

Key Takeaways

- The market is bifurcating into two asset classes: institutional-grade DCF assets with yield and infrastructure, and attention assets driven by retail mindshare and airdrop mechanics

- Capital is adopting a barbell approach, rotating into safe yield positions and selective high-conviction bets, while avoiding middle-risk exposure

- Institutional flows seem to be consolidating in assets with depth, volatility, regulatory clarity, and balance sheet utility, breaking the traditional BTC → ETH → alts rotation

- ETH treasury companies are enabling firms to hold ETH as a productive asset, accelerating this crossover adoption through yield and structuring tools

- Perpetuals volume is concentrated on venues like Hyperliquid, likely signaling a market driven by sophisticated traders rather than broad retail flows

- Funding rates remain elevated but controlled, indicating strategic leverage use by professionals instead of euphoric excess

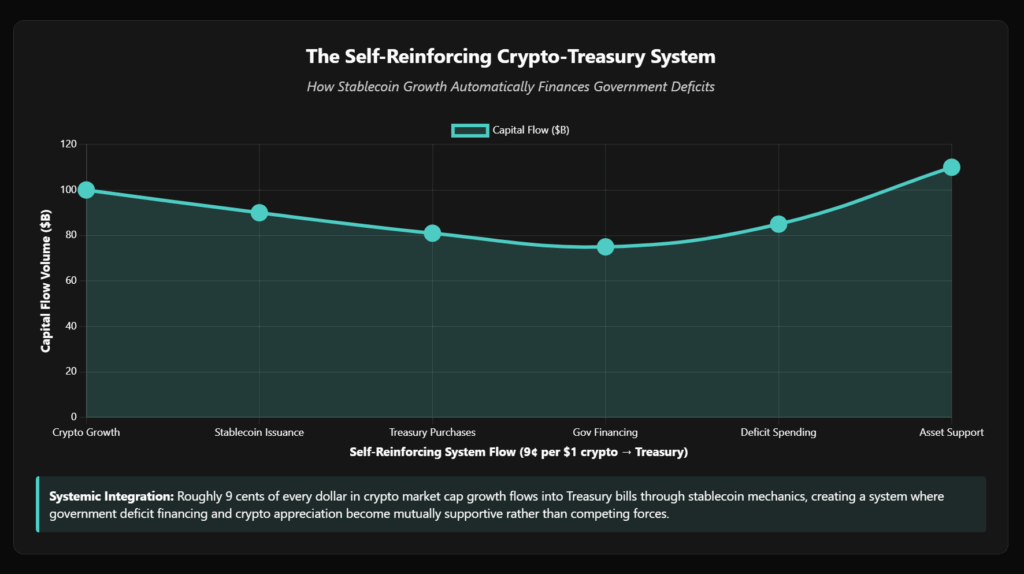

- Policy shifts are reinforcing this structure, with stablecoin growth feeding Treasury demand and retirement account access bringing new capital into crypto

We’re in the endgame.

Not the apocalyptic kind, but the methodical, high-stakes finale where the window for asymmetric opportunity is narrowing, shifting the question from “How high can we go?” to “How do you walk away a winner?”It’s 4 AM in Vegas, you’re up 500%, the drinks have stopped flowing, and dawn is approaching. Do you cash out your winnings or bet it all on one more hand?

We are not trying to call for the market top , but we are likely entering a phase that will require choices between preserving gains and pursuing additional upside.

A Tale of Two Asset Classes: Cash Flows vs Mindshare

During late-cycle phases as cycles mature, volatility patterns change and risk/reward calculations become asymmetrical, with potential upside often compressing while downside scenarios expand. The optimal response is a barbell strategy: preserve most capital in safe assets while concentrating remaining risk budget on highest-conviction opportunities with exceptional upside potential. This approach explicitly avoids the middle ground (moderate-risk investments that during late cycles offer neither the safety of cash positions nor the asymmetric upside of concentrated conviction plays).

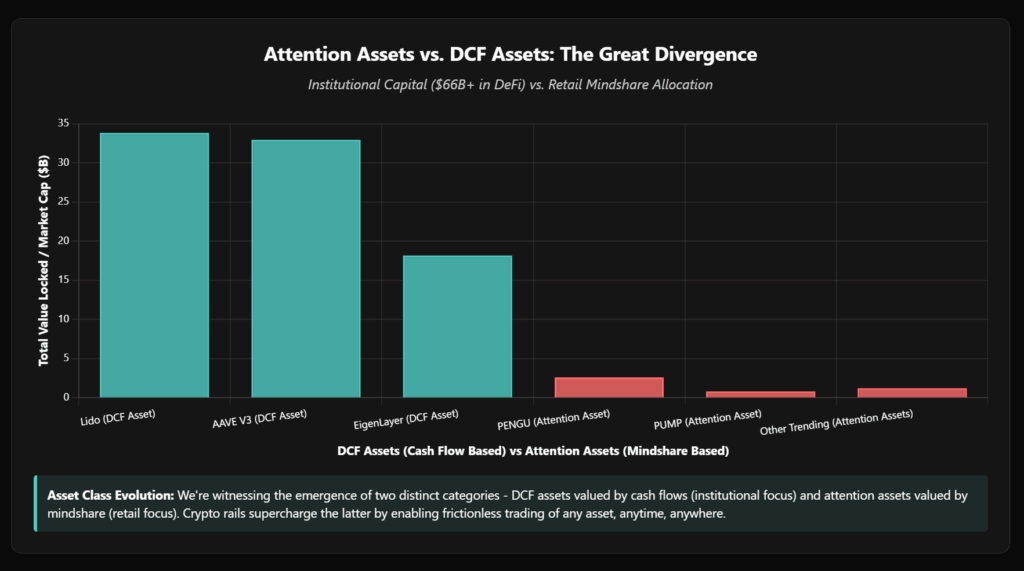

We’re witnessing the emergence of two distinct asset classes: Discounted Cash Flow (DCF) assets valued by cash flows and attention assets valued by mindshare, with crypto rails supercharging the latter by enabling anyone to trade any asset without gatekeepers.

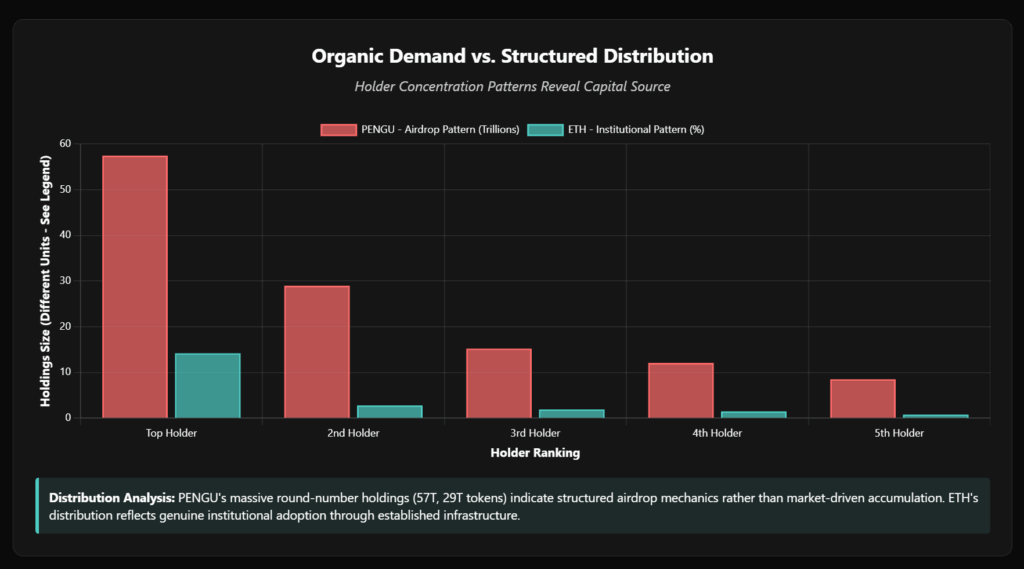

Institutional investors struggle without models for attention flows, making positions appear too much like gambling to their LPs, even as they miss 100x outcomes by focusing on benchmark tracking. For example: PENGU dominates search rankings at #1 (up 14.5% with a $2.6B market cap) while PUMP sits at #5, yet analysis reveals PENGU’s holder distribution shows extreme concentration in round-number allocations (57.45 trillion and 29 trillion tokens) with no cross-chain activity, indicating airdrop mechanics rather than institutional accumulation.

By contrast, DCF assets like SOL (#3 trending, up 3.24% to $202) and ETH (#7 trending, with $53.6B in 24-hour volume despite the price decline) show entirely different holder patterns. The ETH holder structure demonstrates genuine institutional infrastructure, with the Ethereum 2.0 deposit contract holding 65.38 million ETH and major exchange wallets like Binance’s hot wallet controlling 1.29 million ETH while operating across 24+ chains.

This exemplifies the current market’s split personality: massive retail attention flowing toward structured distributions while real institutional money concentrates in DCF assets with proven infrastructure.

Late-Cycle Indicators: Why 4 AM Feels Different

Several converging signals suggest we’re approaching a cycle inflection point.

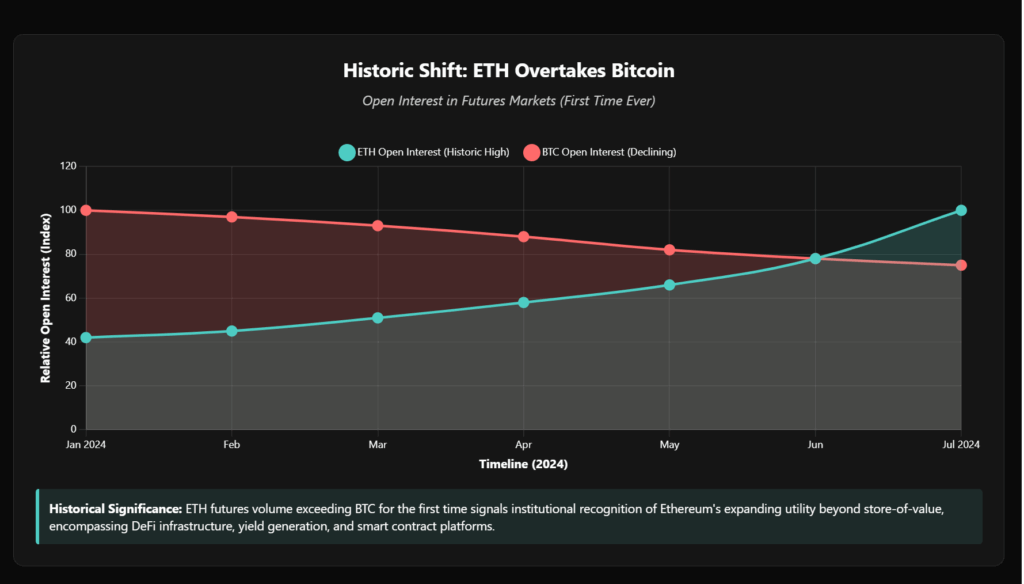

The Vegas parallel becomes clear in the numbers: ETH open interest flipping Bitcoin for the first time signals that traders are now betting more heavily on Ethereum’s volatility than Bitcoin’s, akin to casino-goers shifting from conservative blackjack to high-stakes poker. This shift indicates sophisticated players are positioning for larger moves, typically characteristic (but not necessarily fully indicative) of late-cycle behavior where volatility expectations increase.

Meanwhile, $25.54B in daily perpetuals volume, with 76% concentrated on a single platform (Hyperliquid), resembles the 4 AM casino floor where most tables are empty but the remaining players are betting bigger with more sophisticated strategies. This concentration suggests market participation has narrowed to professional players (instead of the broad-based retail euphoria of previous peaks), another hallmark of mature cycles.

We can see this as the difference between a packed casino at midnight versus the serious players still grinding at dawn.

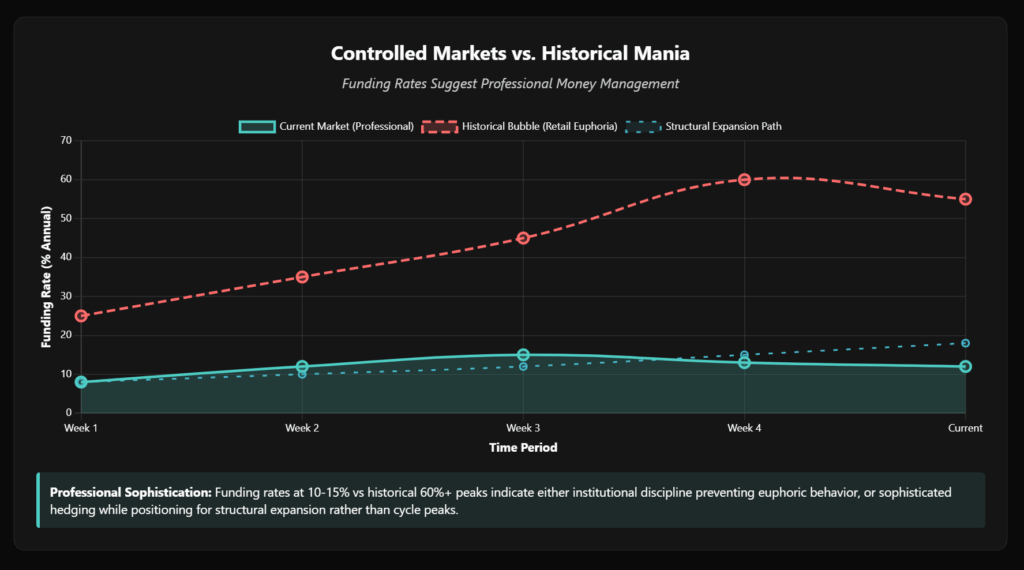

The funding rate environment further confirms late-cycle dynamics. Currently, the casino’s “house edge” indicators aren’t flashing red like previous manias.

Funding rates, essentially the cost of leverage, remain controlled at 10-15% versus the 40-60% panic levels that marked previous bubble peaks, but this controlled leverage actually indicates professional positioning rather than retail euphoria, exactly what we’d expect as cycles mature and amateur participants get shaken out.

More tellingly, while retail attention chases trending tokens, institutional money quietly concentrates in the casino’s most established “banks”: $33.81B locked in Lido’s staking (up 24% weekly), $32.93B in AAVE’s lending protocols, and $18.15B in EigenLayer’s restaking. This flight to quality within crypto represents classic late-cycle behavior where smart money consolidates in blue-chip positions while retail chases speculative plays.

This suggests professional money may understand something retail doesn’t, either positioning defensively or recognizing structural shifts that aren’t immediately obvious.

ETH Treasury Companies: The Bridge Between Asset Classes

The emergence of ETH treasury companies like Sharplink Gaming ($SBET) and BitMine ($BMNR) represents a critical evolution in how traditional finance accesses crypto exposure, directly impacting the attention vs DCF asset divide.

Unlike Bitcoin treasury plays that rely purely on appreciation, ETH treasuries can service debt through protocol-level yields, with ETH’s native yield generation through staking and restaking (currently around 3-4% annually) making it function more like a DCF asset while maintaining attention-driven upside potential.

This dual nature explains why ETH has become the bridge asset between institutional and retail capital flows. ETH’s higher volatility makes convertible bonds more attractive to hedge funds executing gamma trading strategies, while its yield-generating capabilities provide the fundamental backing that institutional investors require for position sizing.

This creates a feedback loop where ETH treasury adoption drives institutional legitimacy, which in turn attracts more attention-based capital.

Current order book dynamics support this institutional positioning, as ETHUSDT on Binance shows historically high asks-to-bids ratios indicating spot selling pressure around the $3,800 level, while perpetuals maintain depth and price stability, suggesting sophisticated players are redistributing spot holdings while maintaining derivatives exposure, similar to BTC’s behavior during its approach to $110,000.

The next few weeks will likely determine which interpretation proves correct, as late July decisions around Federal Open Market Committee (FOMC) meetings, Treasury issuance policies, and tariff implementations will establish market direction for the remainder of the year. Two distinct paths emerge: if August brings sustained upward momentum, we likely see releveraging into year-end as the wealth effect kicks in, alternatively, a slow drip lower into September options expiration followed by recovery to current levels represents the more cautious scenario.

However, underlying structural forces suggest this represents portfolio reshuffling rather than cycle termination, as the government is fundamentally changing how it creates economic stimulus by guaranteeing above-market procurement contracts for critical industries, channeling credit directly to productive industries while guaranteeing profitability, creating genuine economic growth that ultimately drives both employment and asset prices higher.

Yet even understanding these structural shifts doesn’t guarantee successful navigation, as psychological factors often override rational analysis during periods of heightened volatility.

The Broken House Rules: How ETFs and Treasury Companies Rewrote Capital Flow Dynamics

Traditional crypto operated on predictable patterns where BTC led, then ETH, then SOL and majors, finally alts got their turn, but this cycle has disrupted those established flows with many alts remaining 15%+ below Q1 highs despite BTC approaching $119,000.

The explanation centers on how institutional innovations have fundamentally altered capital allocation. Price-insensitive institutional capital via ETFs and treasury companies now requires specific conditions: high volume for liquidity, sufficient volatility for directional opportunities, and substantial market caps for credibility, which creates a new hierarchy where only assets meeting institutional criteria (BTC with $2.37T market cap, ETH at $446B, SOL at $109B) attract meaningful flows while traditional “alt season” beneficiaries remain starved of capital.

ETH treasury companies best illustrate how these new requirements break traditional patterns. Their ability to service debt through protocol-level yields while offering superior convertible bond terms creates sustained institutional demand that operates independently of rotation cycles.

This dual appeal allows ETH to attract institutional capital simultaneously with retail attention, breaking the old sequential flow model where institutional and retail money moved in predictable waves.

The political dimension reinforces these structural changes, as emerging policy frameworks suggest systematic crypto adoption through 401(k) plans now allowed to invest in crypto assets (representing $8.7 trillion in potential inflows), proposed capital gains tax elimination, and stablecoin mechanics that automatically channel roughly 9 cents of every dollar in crypto market cap growth into Treasury bill purchases, creating a self-reinforcing system where government deficit financing and crypto appreciation become mutually supportive rather than competing forces.

This creates a new paradigm where the attention vs DCF asset distinction becomes the primary investment framework.

Institutional investors must now develop models for attention flows rather than relying on traditional valuation frameworks, making positions appear too much like gambling to their LPs even as they miss potential 100x outcomes by focusing on benchmark tracking, while crypto rails enable network effects for assets that capture mindshare independently of traditional cash flow metrics.

The winners will be assets that can bridge both categories (generating institutional-grade cash flows while capturing retail attention), exactly what ETH treasury companies enable.

Actionable Framework: Double Down or Cash Out

All analysis, behavioral patterns, and market data point toward a critical decision point, though optimal response depends heavily on individual circumstances and risk tolerance.

Cash Out Most Chips

Consider systematic profit-taking and reduced exposure while building cash positions. Whether upside from current levels represents fundamental value or momentum-driven reflexivity remains unclear, making bankroll management principles increasingly relevant.

Double Down With Intent

For remaining risk capital, focus on high-conviction opportunities where potential upside significantly exceeds downside, backed by structural advantages. DCF assets with demonstrable institutional adoption, supply mechanics creating scarcity, accelerating network effects, or regulatory clarity. Position sizing becomes critical: losses shouldn’t impact core holdings, but significant wins should move the portfolio meaningfully.

Avoid the Middle Tables

Moderate-risk diversified positioning may prove suboptimal in binary outcome scenarios. Choose between conviction and cash rather than hedging across multiple uncertain outcomes.

Set House Rules to Prevent Re-Entry

Establish clear parameters for when cashed-out capital can re-enter markets. Given potential for sustained releveraging or meaningful drawdowns through September, predetermined criteria prevents emotional decision-making.

Prepare for Regime Changes

Historical correlations may not hold. Traditional valuation frameworks may prove inadequate for assets deriving value from network effects and liquidity rather than fundamental metrics, while government credit guarantees create systematic upward pressure on risk assets, particularly as stablecoin growth automatically channels crypto gains into Treasury bill purchases financing the deficits driving expansion.

The Bottom Line

The chips are on the table, dawn is approaching, and the house edge is catching up. Your move.