The incumbent stablecoin issuers could solidify their lead by offering yield-bearing products. However, the U.S. regulator is not making this path easy and there’s also currently no catalyst incentivising incumbents to give up the spread that they’re earning on deposits to give back to end customers. Alternative providers are working on solutions that are regulator-friendly by design. If these challengers succeed, they could win significant market share and spark mass stablecoin adoption by offering what the incumbents cannot.

Stablecoins solve the problem that pure blockchain-based solutions have so far failed to do - provide a source of predictability in cash flows and value. Without this, economic activity is almost impossible. If Bitcoin and Ethereum are digital gold, stablecoins are digital cash. They provide crypto markets with the benefits of fiat, including access to the comparatively vast liquidity of global reserve currencies.

The primary benefit of fiat is its stability. Bringing...

Deeper Insights Ahead

The incumbent stablecoin issuers could solidify their lead by offering yield-bearing products. However, the U.S. regulator is not making this path easy and there’s also currently no catalyst incentivising incumbents to give up the spread that they’re earning on deposits to give back to end customers. Alternative providers are working on solutions that are regulator-friendly by design. If these challengers succeed, they could win significant market share and spark mass stablecoin adoption by offering what the incumbents cannot.

Stablecoins solve the problem that pure blockchain-based solutions have so far failed to do – provide a source of predictability in cash flows and value. Without this, economic activity is almost impossible. If Bitcoin and Ethereum are digital gold, stablecoins are digital cash. They provide crypto markets with the benefits of fiat, including access to the comparatively vast liquidity of global reserve currencies.

The primary benefit of fiat is its stability. Bringing that benefit on-chain through stablecoins allows the crypto ecosystem to tap into trillions of dollars in global liquidity. This also explains why DAI allows USDC as collateral as it’s much easier to mint DAI when you don’t have to worry about overcollateralized loan-to-value.

When considering retail adoption, stablecoins create a seamless transition. Denominating value in native currencies is an intuitive and almost necessary experience. Imagine asking a boomer to pay coffee denominated in 10k $SATS.

The numbers speak for themselves. At $128.8 billion in market capitalisation, stablecoins currently account for around 11% of the total crypto market. The number one stablecoin, Tether USD (USDT), has grown at an impressive CAGR of 25% over the past two years – despite the turbulence in the wider industry.

Mass adoption is the ultimate measure of success. Given that the total M3 supply of fiat currency worldwide is estimated at around $80 trillion, stablecoins have some way to go.

Put succinctly, the next milestone for stablecoin mass adoption is a regulator-approved form of yield.

The status quo

There are competing definitions and frameworks for categorising stablecoins.

The stablecoin market represents the full spectrum of regulatory subservience to dystopian anarchy, going from centralised and regulatory compliant to decentralised and fully permissionless. Let’s deal with the extremes first:

- Most centralised: Central Bank Digital Currencies (CBDCs). Examples: eYuan (China), Sand Dollar (Bahamas). 114 countries are exploring the idea, but few are implementing yet.

- Most decentralised: Undercollateralised Algorithmic. After many attempts, this category is still in search of a successful model. See this song for more details.

In the middle, you have:

- More centralised: Fully-reserved, fiat-backed providers. Examples USD Coin (USDC), Tether (USDT).

- More decentralised: Overcollateralised, crypto-backed providers. MakerDAO (DAI), Liquity (LUSD).

Deposit-backed stablecoins have emerged as the clear winner in the industry. Incumbents, Circle and Tether, have dominated the market, offering what individuals and institutions crave daily in crypto: predictability. An age-old value proposition stretching back to the emergence of the assembly line, has allowed Circle and Tether to pull ahead as a medium of on-chain payments and an intermediary form of market risk management. However, these tiny titans now face the classic innovator’s dilemma as new competitors hungry for market share nip at their heels and threaten their competitive moat.

Ultimately, it all comes down to fiat

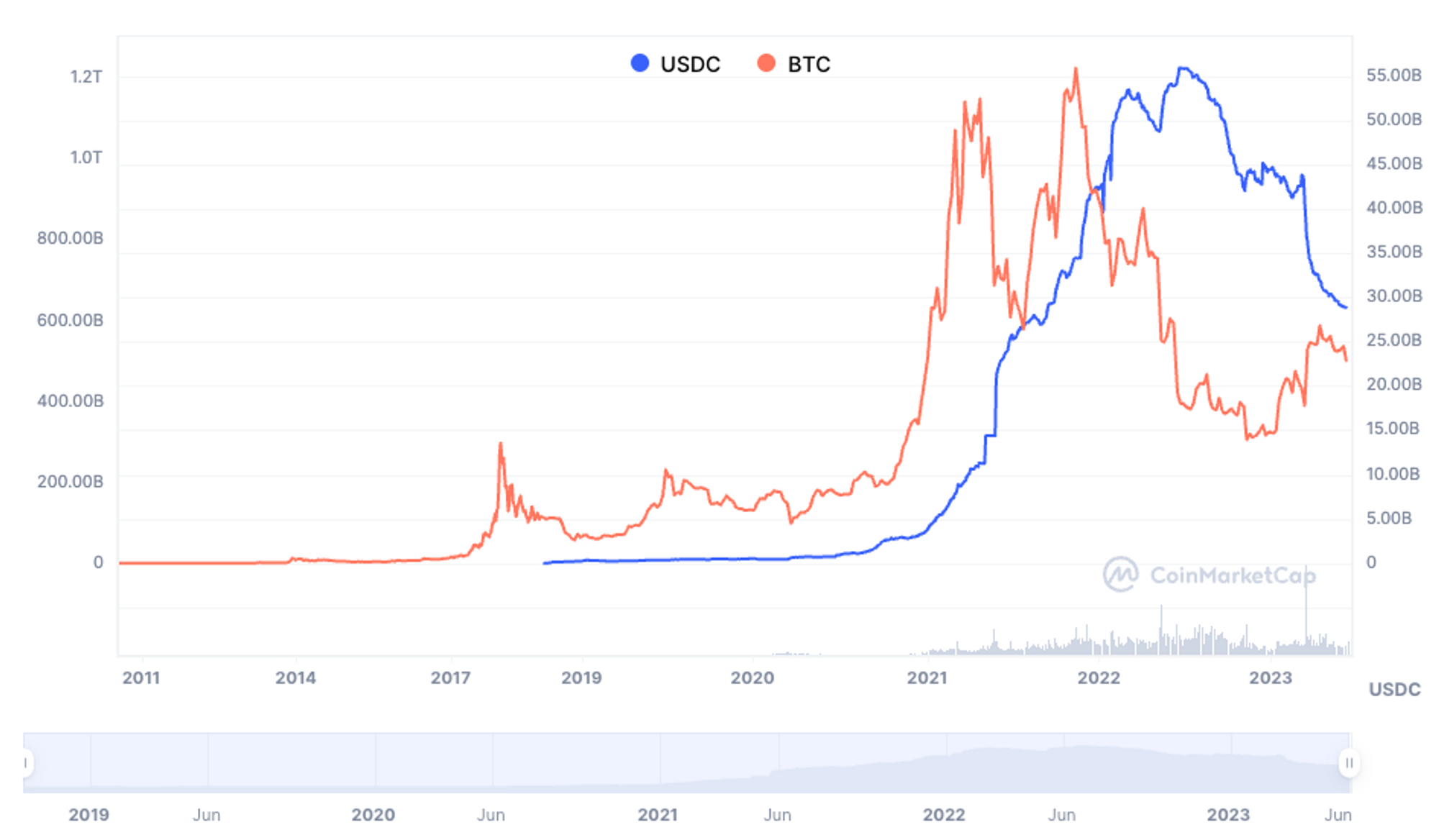

The stablecoin market is dominated by two coins – USDT and USDC – whose combined value of $112 bn accounts for almost 90% of total market capitalisation. Not only that, they represent the 3rd and 5th largest tokens respectively by market capitalisation in the crypto market as a whole.

Furthermore, the most successful example of a crypto-backed, decentralised coin – DAI – is now majority backed by USDC. This is why when SVB failed, USDC and DAI lost their peg briefly, owing to USDC’s reserve holdings in the doomed Silicon Valley lender. Credit contagion and co-mingling of assets is not limited to centralised banks.

It’s still “Up Only”

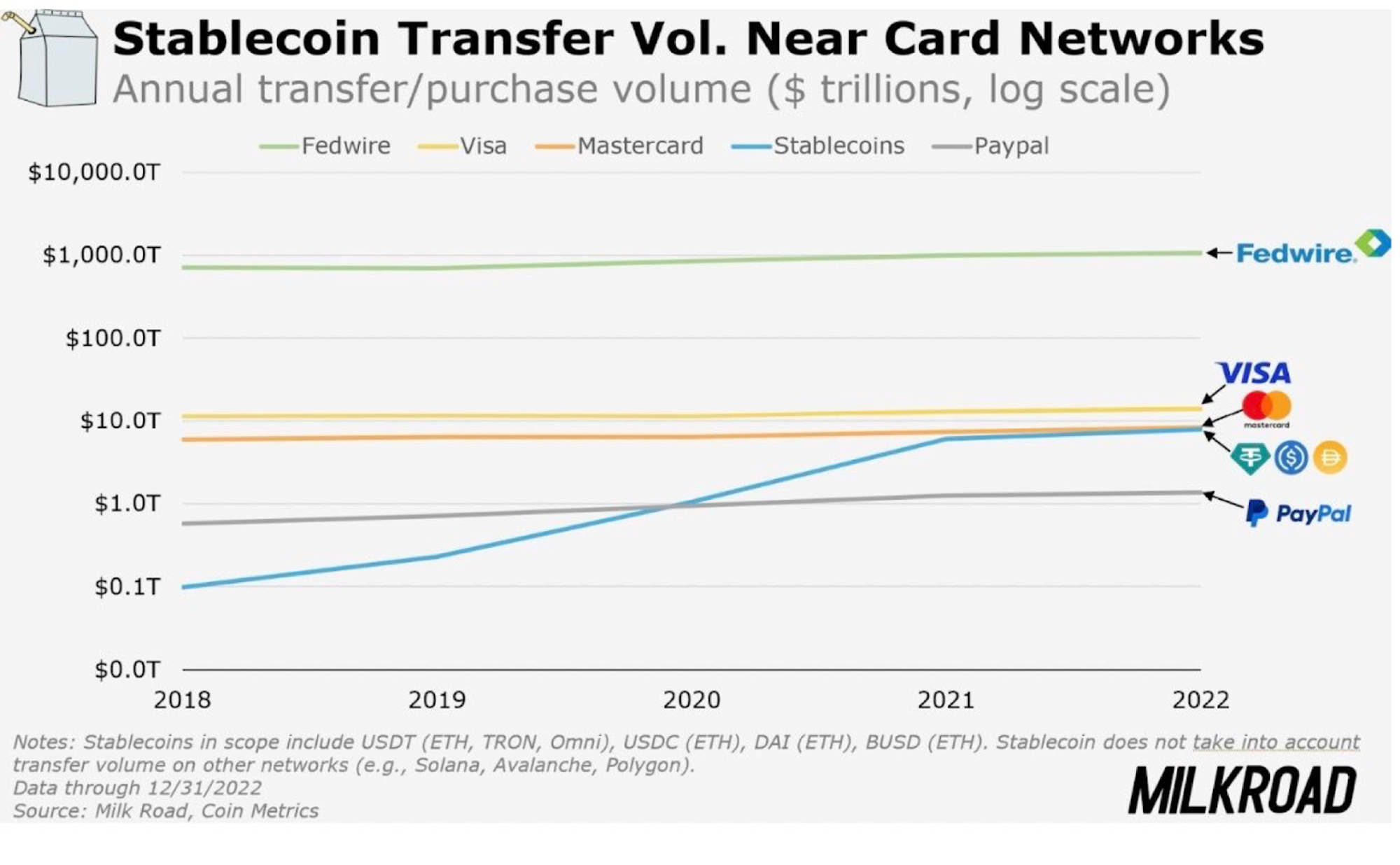

Despite a grisly 2022, stablecoin usage grew to nearly $8 trillion by the end of the year. To put that in context, total stablecoin transfer volume is now roughly equivalent to MasterCard, hot on the heels of Visa, and eyeing up the Federal Reserve’s Fedwire.

Source: Milk Road

How we got here

In the battle of stablecoins, the first hurdle is survival. Does the model work, or in other words, can a stablecoin deliver on its key premise – stability?

The centralised fiat-backed models of USDT and USDC have shown they can survive a savage bear market, whereas other models – TerraUSD most spectacularly, along with countless lesser-known stablecoins – have failed.

Failure to maintain a peg, typically during times of broader turmoil – is often due to a combination of intrinsic design flaws (e.g. bad game theory) and under-collateralisation, which culminate in a ‘death spiral’ once the peg slips and investors lose confidence. As seen with USDC and DAI, de-pegging is terminal if the underlying economics (full-reserve, over-collateralisation) are sound.

The second hurdle is adoption. Do people use it?

Evidently 1:1 backing by USD reserves is seen to be important. The obvious reason is that the US dollar is the global reserve currency and consumers are more likely to trust entities that hold it. Both retail and institutional investors have been badly burned in the exuberance of the latest bull market, and a flight to safety is only natural.

Of course, holding USDC – the “on-chain dollar” – is in many ways better than holding dollars off-chain. As already mentioned, it has the powers of a crypto token (fast and cheap to move, accessible anywhere), is the ‘common currency’ of the crypto-investing world and the denominator of the standard trading pair.

However, US dollar reserves are not a differentiating factor, as many other stablecoin issuers can point to a 1:1 reserve ratio. The people who have trouble maintaining the peg are those who are under-collateralised. If an issuer has a 1:1 ratio they should be fine from a depositor perspective, as no matter how many people redeem, a token still equals a dollar. The exceptions would be lack of transparency (e.g. Tether – which is still okay) or regulatory shutdown (which would affect all issuers).

It’s true that network effects – as liquidity, trust, and exchange support will all be self-reinforcing – tend to produce power-law distributions of market share. But while network effects may have propelled Tether and USDC to the top of the tree for now, the prospect of a digital dollar, tokenised deposits, and hungry competitors (more on this group shortly) should drive both the incumbents to strive toward the next milestone.

What next?

To maintain its primacy, there are a number of directions the current incumbents could go – ease of use, greater transparency, greater decentralisation, and even submitting to stricter regulation.

The number one factor is the ability to offer investors a comparable yield to regular fiat holdings.

The capacity to earn a fixed rate of interest on a USD-dollar balance is a concept every consumer is familiar with, and the ‘risk-free rate’ (e.g. via T-bills) is embedded within the asset allocation strategies of most institutional investors.

A successful yield-based offering could begin a positive feedback loop that not only reinforces the dominance of the issuer, but bolsters the legitimacy of crypto in the eyes of the wider, as-yet-unconverted public. As we know, the crypto industry is more associated with speculation than investing in popular media. A boring, yield-bearing product would do a great deal to turn the ‘casino’ into something closer to a main street bank alternative.

Alternatives sources of yield

While it’s possible to earn a yield on stablecoins today, many of the routes to yield are effectively out of reach for the vast majority of the investing public – that is to say, those investors who would not identify as “crypto-native” or “down the rabbit hole”, even though they may be interested in crypto and willing to test the waters.

Most retail clients would find even the centralised options (Binance Earn, ByBit) or mature DeFi alternatives (Aave, Curve) alienating and difficult to use. The relatively low yields of 1-2% on these platforms are unappealing, even if one overlooks the general cloud of uncertainty hovering over such institutions in the post-FTX/Celsius/BlockFi era.

Neither retail nor institutional investors would be well advised to risk their hard-earned USD in the higher-yield, more DeFi-heavy options (available on platforms such as Beefy and DeFi Llama). As noted, this side of crypto is likely to be a detractor, not a promoter, of widespread adoption.

So what’s stopping the incumbents?

We have not yet mentioned a crucial and – certainly now – highly relevant criterion for a successful stablecoin, besides stability and adoption. Namely, acceptance by the regulator.

Dominating the market through offering yield should be an open goal for the likes of Coinbase (part of the consortium that issues USD Coin) who have blazed a trail in retail and institution-friendly products and UX, and weathered the crypto winter to boot.

Both the incumbent issuers can afford to offer yield as they are making money hand over fist currently, by investing the vast funds they must hold as reserves. According to the latest audit, Tether holds only 0.69% as ‘pure’ (i.e. non-interest-bearing) cash – with 76% in Treasury bills and a substantial amount of Bitcoin. The company recently declared profits of $1.48 billion.

And it’s not as though the incumbents haven’t tried to give investors something back.

Coinbase announced the launch of its savings product (Coinbase Lend) offering 4% APY on USDC deposits way back in June 2021. The product was so-called because Coinbase was not paying interest per se, but simply acting as a connector between the depositor (or lender) and a ‘verified’ borrower.

The SEC intervened, however, and classified the product as a security, essentially forcing the company to withdraw the new product just months after it was announced. The immediate failure of one of the largest movers in the space – with a war chest to put in the necessary lobbying hours – is not encouraging to others considering the risk.

If Coinbase were to proceed with a yield-bearing product today – especially in the present circumstances – there is a good chance that it would once again be shut down. The SEC has separately taken aim at Kraken and Binance (now twice this year) for activities relating to ‘unregistered securities’ and is clearly – now more than ever – in no mood for compromise.

Alternatively, the company could opt to restructure itself as a bank: obtaining a banking charter, adhering to stringent capital and liquidity requirements, beefing up its regulatory compliance functions, and installing comprehensive risk management frameworks – and all of that assuming it gets approval from regulators (e.g. FDIC). Needless to say, this would also circumscribe the potential for future innovations at the exchange.

For all their competitive advantage, this is a difficult position to be in. And the clock is ticking.

The middle way

While the incumbents ponder their next move, another solution may be emerging to resolve the current stalemate with the regulators.

Amid the yield farms and beleaguered crypto exchanges, a crop of new, innovative stablecoin issuers are appearing. With firms like Ondo Finance at the head, they are laser-focused on offering yield to end consumer deposits, that could either create a model for the incumbents to copy or (just possibly) supplant them as the new behemoths. Some examples we’ve seen are:

- Public Key Financial: targeting the US with a unique regulatory compliant framework

- Fluent Finance: Attacking the global markets through partnerships, working with banking partners for deposits and then issuing stablecoins based on the deposits

- Mountain protocol: Tackling non-US markets and creative distribution channels prioritising ones with the highest flywheel effect

- Usual: Issuing stablecoins backed by money market fund deposits, which is different from fractional reserve deposits but functions similarly and may carry analogous risk.

Essentially, they are trying to create a middle ground between a crypto exchange and a bank. The general principles appear to be:

- Institutional-grade everything: no shortcuts on security, or FTX-style spreadsheet-based transaction records.

- Credentialed teams From high-profile, respected institutions (e.g. Goldman). People the regulator could look up in the phone book.

- Regulator-friendly: Being proactive and charming when engaging with regulators and keeping the books open from day one.

- TradFi-friendly: Being “bank and broker ready”, to use the words of one challenger.

- High-quality investments: Rather than funneling customer funds into the cheapest option, seeking out higher-tier teams in the investment world.

- Jurisdiction Specific: Either choose to focus on the US and headquarter there, or base abroad and work with both US and non-US clients.

To summarise, the aim of the next-generation, yield-offering product that wins over the hearts of regulators and investors could look different from previous crypto products both technically and culturally.

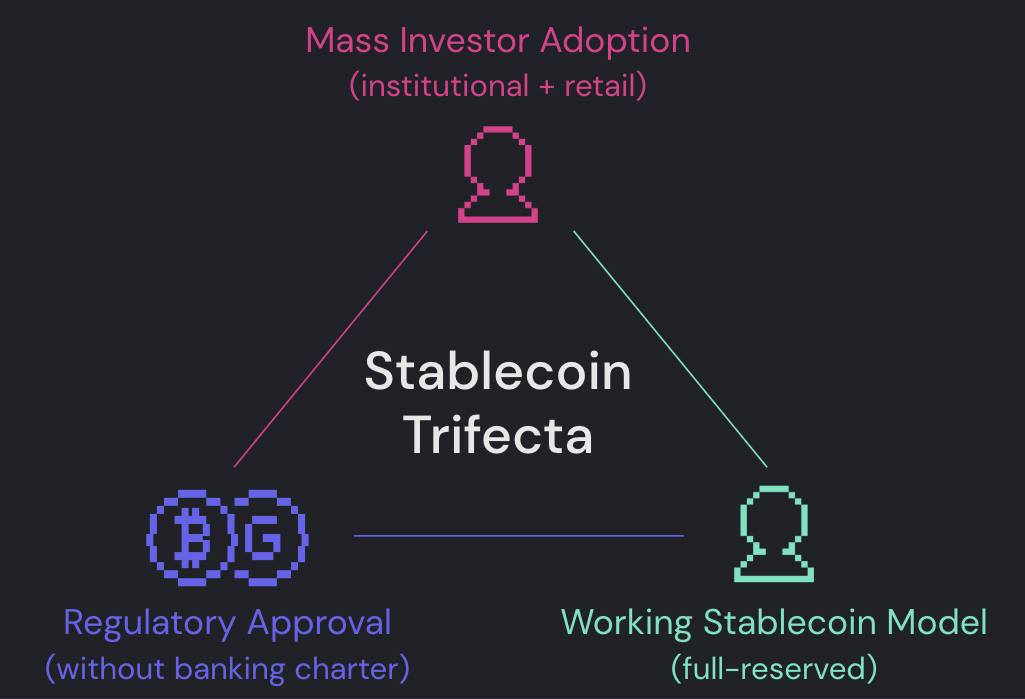

If the innovators can manage this, they could well leapfrog the incumbents by achieving the elusive trifecta of a working stablecoin model (full-reserved), mass investor adoption (retail + institutional), and regulatory approval (without a banking charter).

It’s both possible and logical that nimble startups would develop the winning formula to resolve the regulatory log jam.

The focus should – however – remain on adoption above compliance – focusing on the consumer and not the regulator. Why? The latter serves the former, and the former ultimately drives adoption.

In other words, the regulator doesn’t know what the answer is until someone figures it out, and the consumer will decide who has figured it out. If the stablecoin in question can get adoption fast enough and create a war chest, they can retroactively litigate.

Small organisations can make life easier for themselves by targeting specific jurisdictions rather than crypto as a whole, as we know some countries (e.g. Portugal) and states (e.g. Wyoming) are friendlier than others.

Whoever is going to figure out the answer – whether it is the incumbents, the innovators, or even a bank, needs to do it fast – before power-law dynamics elevate the winner to new and potentially unreachable heights.

The incumbents in particular should remember that competitive advantage does not have a lifetime guarantee.