Decentralised Oracles

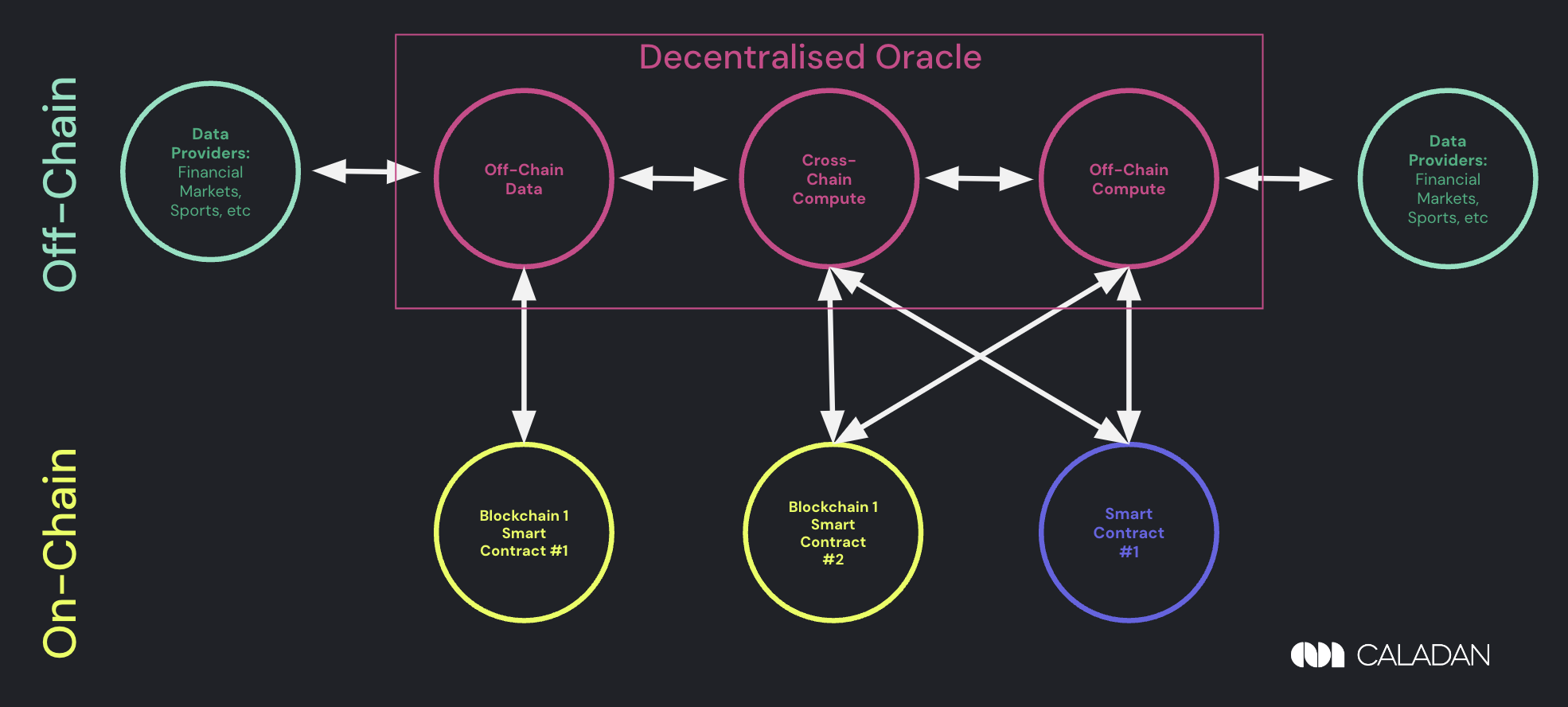

Oracles in crypto act as intermediaries between on-chain dApps and off-chain data sources, such as APIs, websites, and other external data feeds (sports scores, weather data, and financial market data). Since blockchains are isolated ecosystems, oracles enable dApps to access information from the real world, which is necessary for them to function effectively.

Oracles an be classified based on their network architecture into 1) centralised oracles and 2) decentralised oracles. Centralised oracles, which rely on a single trusted source for data feeds, are efficient in use but are under the risk of single point failures. The entire system of smart contracts will fail to execute required data or execute wrong outcomes due to problems in one component, like power failures, directory server crashes, or database corruption. Under such circumstances, decentralised oracles are becoming increasingly popular in the crypto industry, as they enable dApps to operate autonomously without relying on centralised intermediaries. The use of consensus mechanisms and multiple node operators makes them more tamper-proof and resistant to attacks, ensuring that the data they provide is reliable and accurate.

[Source]

Total Value Secured

One method of measuring Oracle growth and adoption, is through Total Value Secured (TVS), $26.8bn is secured by Oracles. While this is a broad measure of the the aggregate amount of TVL within all protocols and platforms that depend on the proper operation of an oracle network to protect their user funds, it is not a comprehensive measure. TVS is only a tangential metric that doesn’t necessarily measure adoption, and poorly models non-financial data aspects of the Oracle. There has been a significant decline in TVS since Q3 2022 because of the general decline in on-chain activity. However, this might actually mean that the oracle growth rate would accelerate at a faster pace than blockchain growth given that it is coming off a smaller base and the adoption of decentralised oracles should gain more traction with advancements in innovation.

The Opportunity

The market leader is ChainLink, which encompasses most use cases, has well-recognised clients, and a significantly larger market cap than others. Unfortunately, this means that the space is currently problematically centralised around Chainlink and needs to be disrupted. During the bull market, Chainlink alone secured more than $75 billion dollars. While Chainlink has remained vigilant against attacks, and has taken significant steps to innovate new products in this realm, the future of the decentralised oracles, still in fact needs to be decentralised. As DeFi grows, the definition of a contract expands, which includes both the on and off chain data systems. That also means what counts as points of failure are being expanded, which necessitates new innovations in the oracle space.

$867 MM have been stolen via oracle manipulation attacks since 2020, two of which have been Mango Markets for $112MM and BonqDAO for $120MM. Freeloading and mirroring (a type of Sybil attack) are other commons hacks that leverage the unique qualities of oracles. With each new Oracle innovation or chain upgrade, there will be new types of vulnerabilities that need to be proactively addressed.

Hopefully, data delivery is only the first phase in the potential of Oracles. There is also great potential around enabling novel solutions to significant on-chain challenges such as fair transaction ordering, intelligent automation, and access to randomness, making chains more secure and MEV-resistant. With fewer points of failure and more richness of data, Oracles become more decentralised and decentralisable, the platforms and systems they secure will also improve. With other innovations such as AI, with the data they bring in from the real, off-chain world, will also increase in volume and complexity due to base-layer throughput improvements and scalable compute chains.

Main Use Cases

NFTs

Decentralised oracles offer a verifiable randomness function (VRF) that can be utilised in assigning the rarity of NFTs during minting. For instance, Aavegotchi has implemented VRF to ensure the randomness of attributes of their NFT avatars.

DeFi

Oracles are employed in retrieving financial data such as asset prices for use in DeFi smart contracts. This data is critical in determining users’ borrowing capacity and collateralisation level. AAVE, a DeFi platform, leverages price feed oracles to acquire the prices of assets for its smart contracts.

Cross-chain services

Decentralised oracles offer a solution to the interoperability challenge across different blockchains. This enables the creation of cross-chain applications and services. With oracles, data can be transmitted easily between blockchains without requiring chain-specific integration.

The Current Landscape

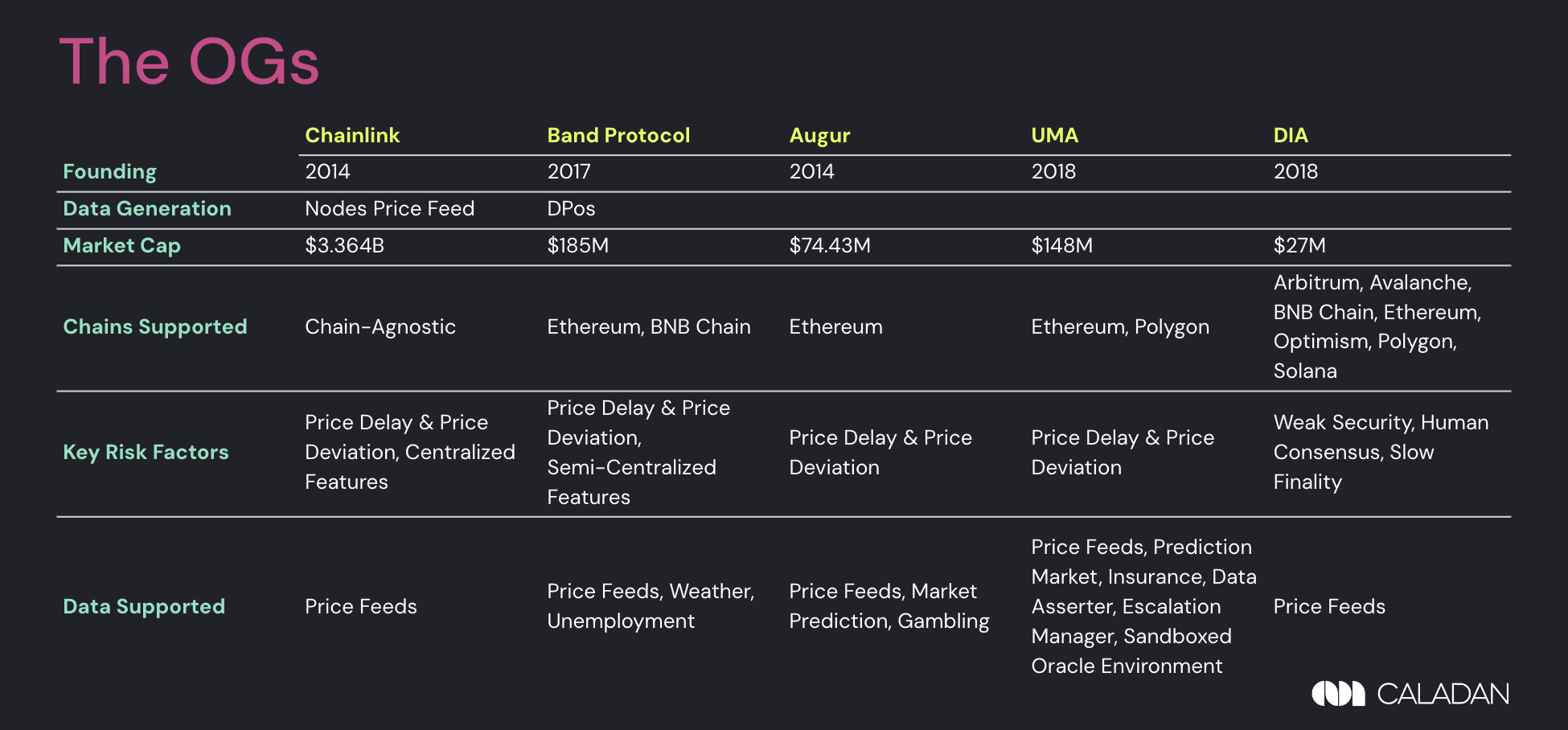

The OGs

This group consists of first movers that started in early stages of the competition. Their comprehensive services attracted large adoption and sustained their current market leader position. Despite innovator’s dilemma, many of them are still actively working with the communities to enhance accuracy, security, scalability and upgrade new services.

Chainlink (2014)

Chainlink is one of the most widely used blockchain oracles. It uses a decentralised network of nodes to fetch data from external sources and validate it before it is added to the blockchain. Chainlink’s main advantage is its security, as its decentralised architecture and large number of validators makes it difficult for attackers to manipulate the data. However, its consensus-based approach can also make it slower and more complex to use than other types of oracles.

Band Protocol (2017)

Band Protocol is a cross-chain data oracle platform that aggregates and connects real-world data and APIs to smart contracts. Band Protocol’s flexible oracle design allows developers to use any data including real-world events, sports, weather, random numbers, and more. Developers can create custom-made oracles using WebAssembly to connect smart contracts with traditional web APIs within minutes.

Augur (2014)

Augur is a blockchain-based prediction market that allows users to bet on the outcome of real-world events. Its main advantage is accuracy, as it relies on a consensus-based approach to determine the outcome of events. However, Augur is primarily designed for prediction markets and may not be suitable for other types of applications.

UMA (2018)

UMA offers smart contract templates to users for the creation of financial smart contracts and synthetic assets. Synthetic financial contracts are tokenised representations of real-world assets, such as derivatives. Synthetic financial contracts track the performance and pricing of derivatives through smart contracts. As a result, investors could find exposure in markets with higher barriers to entry.

DIA (2018)

DIA (Decentralised Information Asset) is a cross-chain, end-to-end, open-source data and oracle platform for Web3. The platform allows developers to source and verify data from traditional and digital financial applications. The feeds provide information such as asset prices, Metaverse data, lending rates and more.

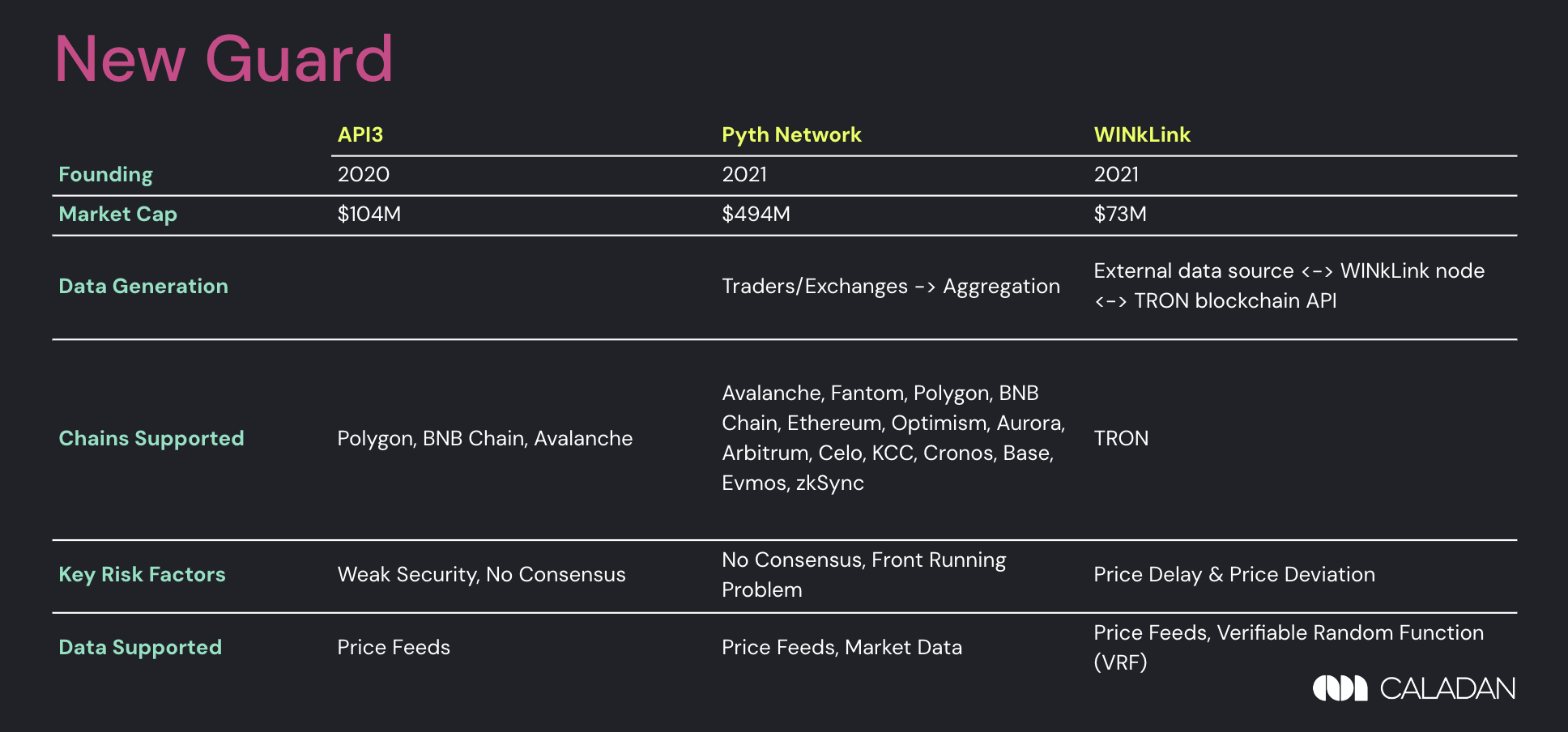

New Guard

This group have emerged as a dominant force in a related market compared to the original oracles (OGs). Their competitive edge lies in offering a wider range of services, and targeting specific client ecosystems, such as TRON blockchain, that occupy considerable market cap and require more customisable services.

API3 (2020)

API3 is a first-party oracle solution. The platform allows developers to use APIs connect their dApps to real world data streams. API3 can also be used by API owners — their proprietary Airnode technology can turn regular APIs into those that can be easily integrated into web3.

Governed by API3 DAO, all of API3’s coding data is available to devs in an open-source format all while maintaining a high level of operational transparency.

Pyth Network (2021)

Pyth Network is an oracle that publishes financial market data to multiple blockchains. Various exchanges and market making firms contribute to their available market data. The oracle continuously aggregates publishes prices to provide accurate price feeds for a number of different asset types such as US equities, commodities, and cryptocurrencies.

WINkLink (2021)

WINkLink is the first comprehensive decentralised oracle service to bring reliable real-world data onto the TRON blockchain. As the first-ever TRON oracle service, the project is looking to capture an emerging market of dApps throughout the TRON ecosystem.

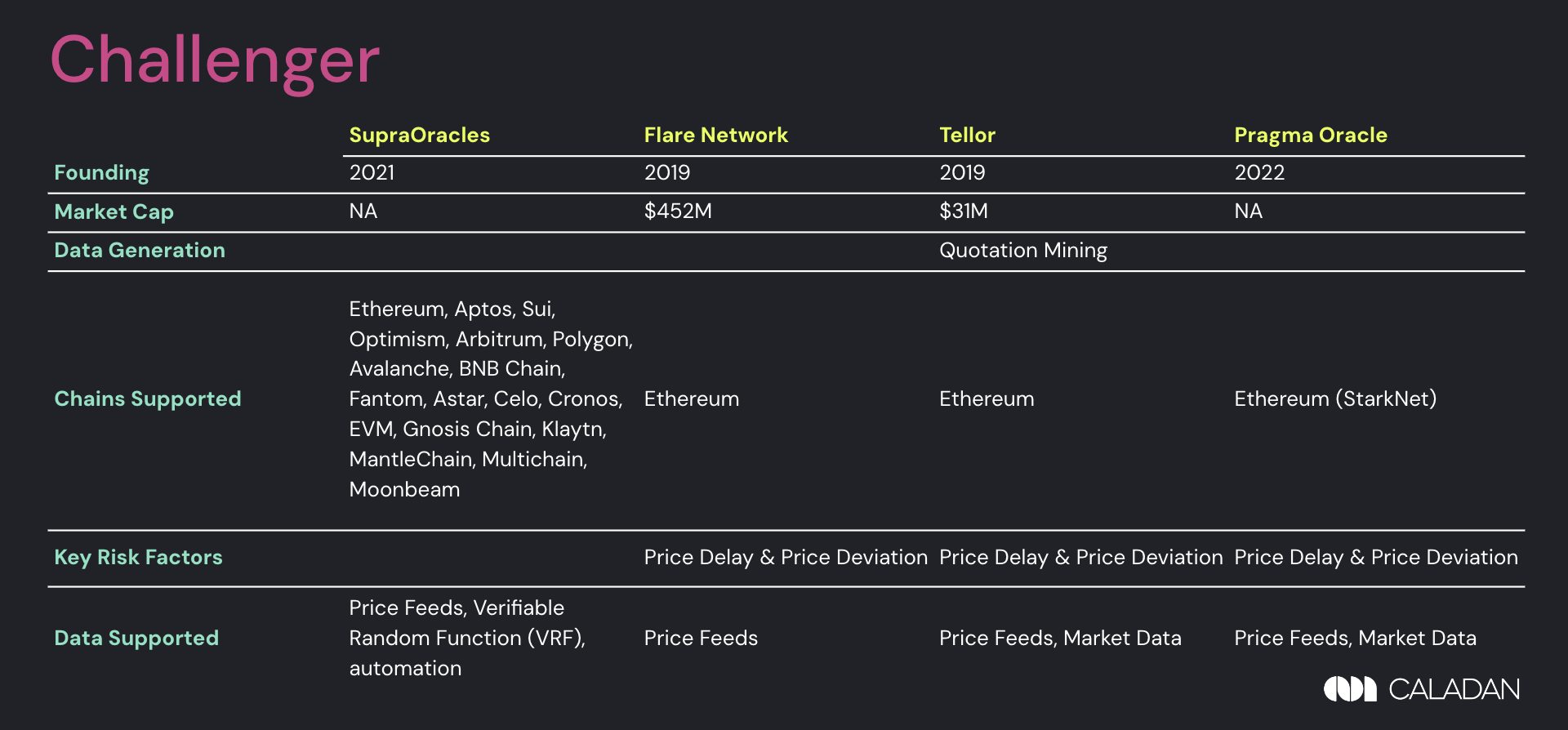

Challenger

This group competes with the New Guard by providing similar or better service offerings with advanced mechanism design that enhances speed, security, and decentralisation.

SupraOracles (2021)

SupraOracles’ Tribes and Clans model, along with parallel processing, makes it truly decentralised and helps offer 3-5 seconds of full finality to further prevent price delay and price deviation problems.

Flare Network (2019)

The Flare Time Series Oracle (FTSO) is a highly decentralised data feed oracle that supports the provision of reliable price data, with almost 100 independent data providers incentivised to provide reliable data every 3 minutes. The FTSO will also deliver other off-chain data available for use in on-chain dApps, including time series data such as weather or grain and commodity prices for insurance purposes.

Tellor (2019)

Tellor blockchain oracle utilises a reporting client as the core element in its functions. The reporting client serves a system with a network of reporters. The reporters work on searching, querying, verifying and validating data. Tellor oracle protocol features two distinct types of data feeds Spot Price and Custom Price. Spot Price offers market data sourced from existing APIs, while Custom Price helps in data modification according to client requirements.

Pragma Oracle (2022)

Pragma Oracle is a decentralised, transparent and composable oracle network that leverages zero knowledge cryptography on StarkNet. The network is powered by data partners that include Jane Street, Gemini, CMT and more.

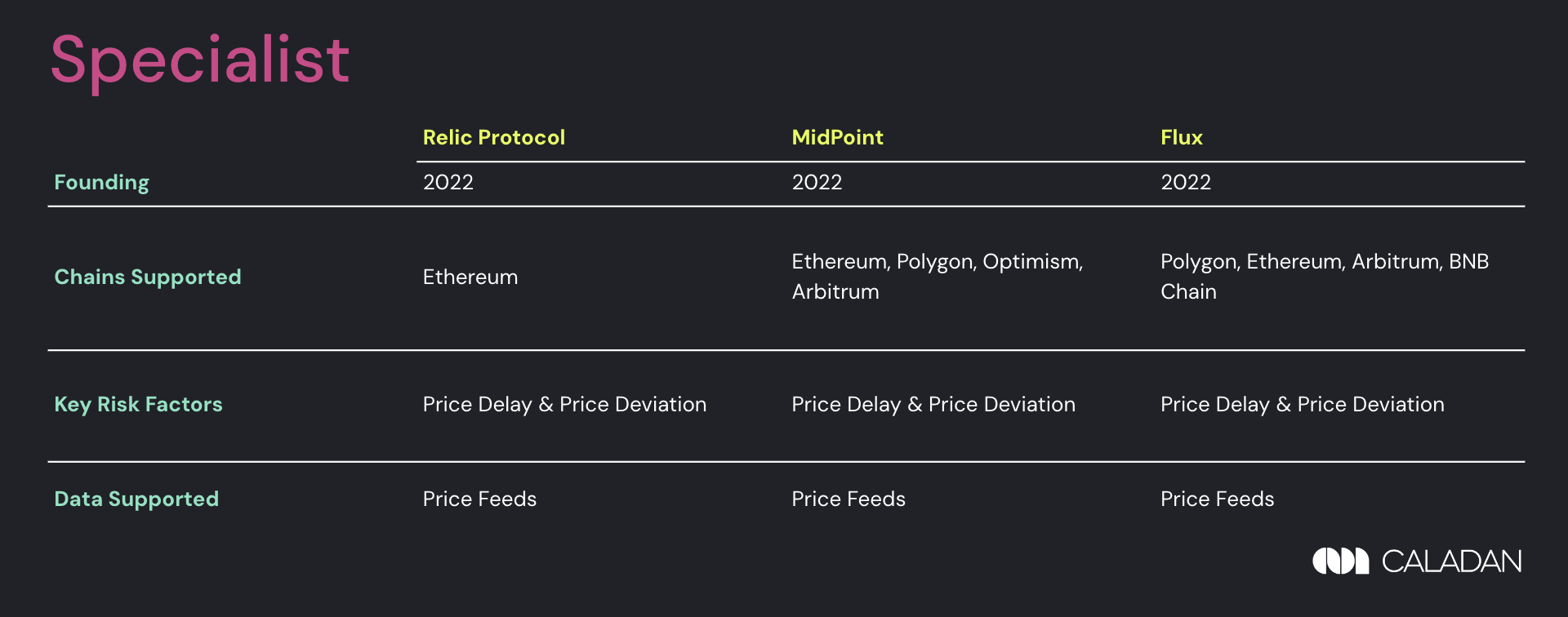

Specialist

Users seeking in-depth knowledge in a particular area, such as Ethereum historical data, may opt to engage the services of a specialised oracle in addition to or instead of a generalist oracle.

Relic Protocol (2022)

Relic Protocol is the world’s first solution that provides a secure and trustless way for contracts to access any Ethereum historical data without relying on third-party authorities in a decentralised manner using cryptography such as zk-SNARKs.

Relic Protocol’s on-chain state verification is heavily optimised, resulting in minimal gas usage for apps built on Relic Protocol. Developers can easily build efficient history-powered dApps using Relic Protocol’s Solidity and Typescript SDKs.

MidPoint (2022)

Midpoint is a platform for Ethereum developers that provides many different kinds of off-chain infrastructure with one simple API. With a single API call, developers set up “midpoints” – specifying a set of off-chain actions to be triggered from on-chain events. Midpoints can be oracles that query APIs based on requests from chain, data bridges to pass arbitrary messages between chains, data feeds to stream off-chain data back on-chain, and much more. The Midpoint dashboard provides a visual interface to help with creating these workflows.

Flux (2022)

Flux’s First Party Oracle (FPO) is an oracle that allows users to publish data directly onto the chain using their proprietary open-source Provider Node. This makes published data as reliable as its sources, as Flux cannot edit or manipulate published data in any way. Developers can connect their protocols and contracts directly to the data feed contracts to aid in their building.