This is a primer on marketplace design, market microstructures, and market-making from our combined 30+ years of experience in electronic trading at Tower, Citadel, Goldman Sachs and SGX. Whether you are a trader, a project launching a token, or an academic, we hope you find this four part series useful. If you’re a token team or exchange looking for end-to-end liquidity support, learn more about our crypto market making services.

Part I: Marketplace Design: General theories and background information

Part II: Crypto Marketplaces: A discussion of some of the unique features of crypto marketplaces and how they are distinctive from traditional financial exchanges

Part III: Market-Making on Crypto Marketplaces: What does market-making actually mean, and how does it work?

Part IV: How to Work with a Market-Maker: Choosing and working with the right partner

Table of Contents

Understanding Market-Making

What is a market-maker?

The definition of market-making is: quoting two-sided markets and providing liquidity to other market participants.

Quoting two-sided markets is simply saying “I am willing to buy at $X and sell at $Y”, and liquidity is what enables other market participants to buy or sell what they want, when they want. Market-makers are an important participant in all financial markets, including crypto, but they also exist in many other types of markets.

For example, secondhand-car dealers are a type of market-maker. They buy used cars from sellers at a lower price and sell them to buyers at a higher price. The difference between the two prices is the spread, or what the car dealer earns.

Market-makers exist because they perform an important function in markets. Buyers and sellers of second-hand cars could connect directly with each other, and sometimes they do, but often they prefer to go to a dealer instead. Why? Because they know the dealer will be able to transact a wide variety of inventory, immediately and easily, and at a reasonably fair price.

Fundamentally, market-makers make it easier for other people to transact what they want, when they want, and that ease of transaction is what we call liquidity.

Are you a maker or a taker?

In crypto markets, the term market-maker is commonly used to refer to a trading firm but to be technically accurate, the maker and the taker are determined on a transaction-by-transaction basis. Anyone can be either a maker or a taker. Most trading firms actually do both at different times, with different types of strategies.

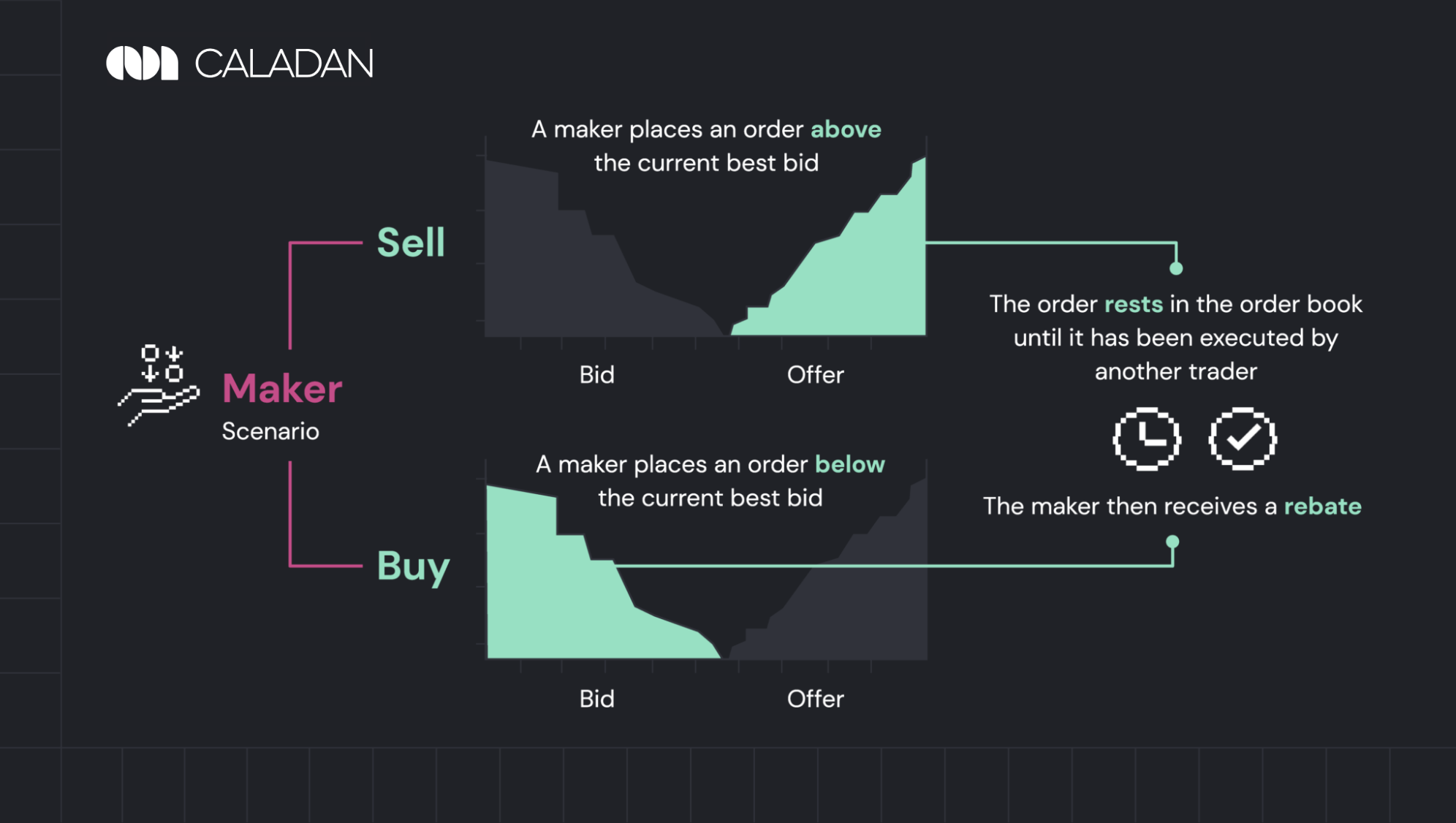

The maker in a transaction is the party who creates or “makes” liquidity on the market. On a central limit order book (CLOB) exchange, anyone can be a market-maker by submitting limit orders either above the current best bid or below the current best offer. For example, if the price of a token is $100 and you submit one order to buy at $99 and another order to sell at $101, congratulations! You are now a market-maker. These orders sit on the order book as resting liquidity that other traders can execute against.

In contrast, a taker is a participant who takes liquidity from the market by executing orders posted by market-makers. In our example above, if there is a buy order on the order books at $99 and you submit an order to sell at $98.99, then your order will execute against the market-maker’s resting liquidity and in this transaction you will be the taker.

In essence, market-makers create liquidity and market-takers consume it.

What effects do makers have on markets?

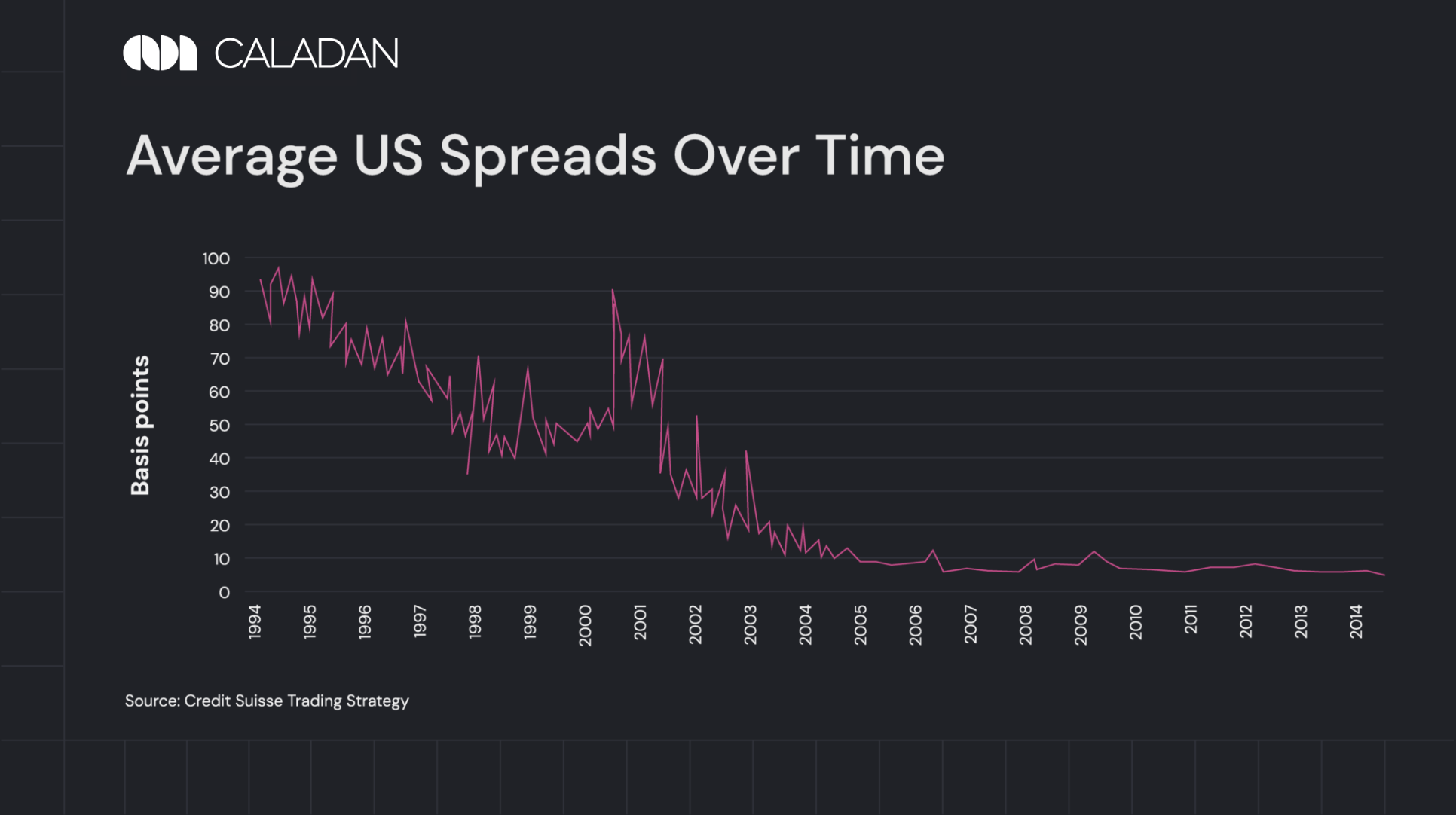

Electronic market-makers first emerged in the 1990’s. Over the next decade, U.S. equity spreads decreased 10x from ~1% to < 10 basis points (bps). Today, spreads in the U.S. equities markets are consistently below 1 bps. One way to understand the spread is as an invisible cost of transaction that buyers and sellers have to pay. Therefore, market-makers reduced the cost of transactions for everyone else in the market.

Market-makers also increase depth, or the size of the orders that you can transact. This willingness to provide liquidity allows traders to trade more efficiently, as they can buy or sell at the quoted price without having to wait for a counterparty to take the other side of their trade.

By having more liquidity and tightened spreads, dramatic price swings should be mitigated, making the token more attractive for a larger audience. Price manipulation becomes more difficult and less likely, as higher liquidity means it takes more capital to move prices. Having a good market maker and an effective crypto market making strategy also significantly reduces slippage, and can help accommodate large transactions or block trades when necessary.

Additionally, market-makers can help to stabilise the market during periods of volatility by providing liquidity and acting as a buffer against extreme price swings. Overall, the presence of market-makers in the cryptocurrency market is essential for maintaining a healthy and efficient trading environment.

Market-making variations: same same but different

Depending on the type of exchange or marketplace, the mechanics of how exactly to provide liquidity can look quite different. However, the overall goal of the crypto market making strategy and market-making activity always remain the same: make it easier for other people to transact what they want, when they want.

CLOB exchanges:

- These are order-driven markets, where everyone’s orders are visible. In theory anyone can be a market-maker for any token or derivative on a CLOB exchange; there’s no approval process. But there is a very steep technological barrier to entry. If you are not able to place, cancel, or modify your orders quickly enough to adjust with the ever-changing market, you will very quickly lose a lot of money. Crypto market-making is very much a technology business.

OTC and RFQ:

- Over the counter (OTC) desks are quote-driven markets – you request a quote for buying/selling a certain amount of a certain token, and they respond with a quote. Unlike on a CLOB exchange, your orders remain private, which can be beneficial if you are looking to either buy or sell large quantities without moving the market too much. One key benefit of trading by RFQ is that there’s no slippage.

- A market-maker can give quotes for OTC either over the phone or by messaging app (in which case it’s called “voice OTC” or “high-touch OTC”) or it can be done via an API (in which case it’s called “electronic OTC” or “RFQ”). Both centralised and decentralised RFQ platforms exist.

AMM DEXs:

On decentralised exchanges like Uniswap, there are no private market-makers. The market-making function is done in an entirely automated function with smart contracts, which is why these DEXs are called AMMs or automated market-makers.

NFTs:

Is it possible to market-make for NFTs? Absolutely, just as it’s possible to market-make for cars or wheat or gold or a wide variety of other things. As with market-making for tokens, the goal remains the same: to decrease the spread, increase liquidity, enable more efficient price discovery.

Market-making technology

Here’s a high-level, simplified overview of a market maker’s technology stack:

As discussed above, makers need to quote two-sided markets with both bids and asks. But the market’s midpoint (the price between the bid and ask) is constantly shifting, and crypto markets are 24/7. Therefore, market-makers need a technology stack that is both extremely fast and extremely reliable.

Connecting to Exchanges

Market-makers connect to exchanges via either a websocket or FIX API, which allows them to ingest real-time market data. This real-time data is then normalised to account for the differences in data structure between different exchanges, and is used in two ways: it’s fed into live trading algorithms, and it’s also stored in a database of accumulated historic market data.

Pricing and Order Management

The historic market data is used in the exchange simulator, which is a development and research tool that market-makers build for themselves. The simulator allows market-makers to test different algorithms and fine-tune strategies without putting any real money at risk. It’s analogous to testnet for blockchain protocols, or to the flight simulators that pilots use to practice flying.

Pricing algorithms that have passed testing in the exchange simulator are deployed in live trading. The real-time market data is continuously fed into these algorithms, which then make instantaneous decisions about how much to bid/ask and at what prices. These decisions are in turn handed off to the order management system (OMS), which transforms these bids and asks into the particular format that is needed for this particular exchange, and then sends it out to the exchange via a trading API.

Key System Metrics

Market-makers use the term latency to describe the speed with which they can process data and send out orders, throughput to describe the number of orders that they can send, and uptime to describe how reliable their systems are. All of these performance metrics are very important to market-makers, who will typically process thousands of transactions per second.

To give you an idea of the speed that is required – at AlphaLab Capital, our end-to-end latency is less than 2 milliseconds, which is industry-leading for crypto but would actually be considered very slow in traditional finance.

For projects ready to scale liquidity with an experienced trading partner, explore Caladan’s crypto market making solutions across 70+ centralized and decentralized exchanges.