TLDR:

- Crisis Impact: Israel-Iran conflict escalation drove oil prices up 7% to $74.23/barrel, triggering synchronized 4-7% declines across major cryptocurrencies as geopolitical risk-off sentiment dominated markets

- DeFi Resilience: Despite broader market stress, DeFi lending achieved record $55B TVL while liquid staking protocols maintained $41.45B combined TVL, demonstrating institutional confidence in decentralized infrastructure

- Altcoin Performance: AAVE (-2.38%) and Morpho Blue (+1.47%) significantly outperformed traditional markets and crypto assets, suggesting DeFi lending benefits from increased borrowing demand during volatile periods

- Infrastructure Divergence: Layer-2 bridges showed mixed performance with Veda (+10.08%) and Spark (+2.21%) gaining ground while Base Bridge declined 21.66%, reflecting varying institutional exposure to traditional finance volatility

- Market Evolution: Analysis indicates DeFi infrastructure has matured beyond experimental technology to become institutional financial infrastructure providing crisis-period utilities unavailable in traditional markets

1. Geopolitical Risk-Off...

Deeper Insights Ahead

TLDR:

- Crisis Impact: Israel-Iran conflict escalation drove oil prices up 7% to $74.23/barrel, triggering synchronized 4-7% declines across major cryptocurrencies as geopolitical risk-off sentiment dominated markets

- DeFi Resilience: Despite broader market stress, DeFi lending achieved record $55B TVL while liquid staking protocols maintained $41.45B combined TVL, demonstrating institutional confidence in decentralized infrastructure

- Altcoin Performance: AAVE (-2.38%) and Morpho Blue (+1.47%) significantly outperformed traditional markets and crypto assets, suggesting DeFi lending benefits from increased borrowing demand during volatile periods

- Infrastructure Divergence: Layer-2 bridges showed mixed performance with Veda (+10.08%) and Spark (+2.21%) gaining ground while Base Bridge declined 21.66%, reflecting varying institutional exposure to traditional finance volatility

- Market Evolution: Analysis indicates DeFi infrastructure has matured beyond experimental technology to become institutional financial infrastructure providing crisis-period utilities unavailable in traditional markets

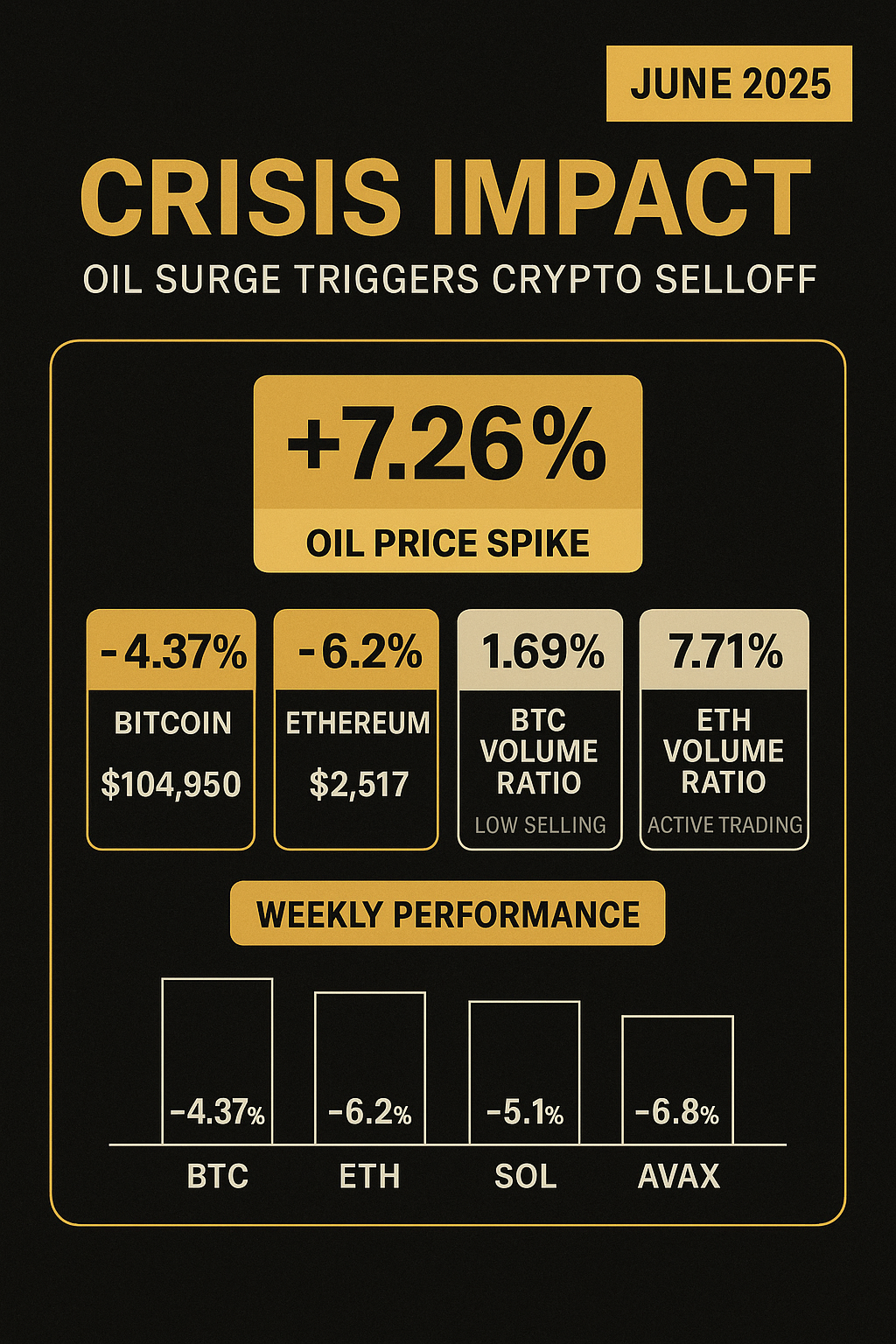

1. Geopolitical Risk-Off Sentiment Drives Cross-Asset Volatility

Crisis-Period Asset Performance Matrix

| Asset | Price | Market Cap | Volume 24h | Change 7d | Change 60d | Geopolitical Impact |

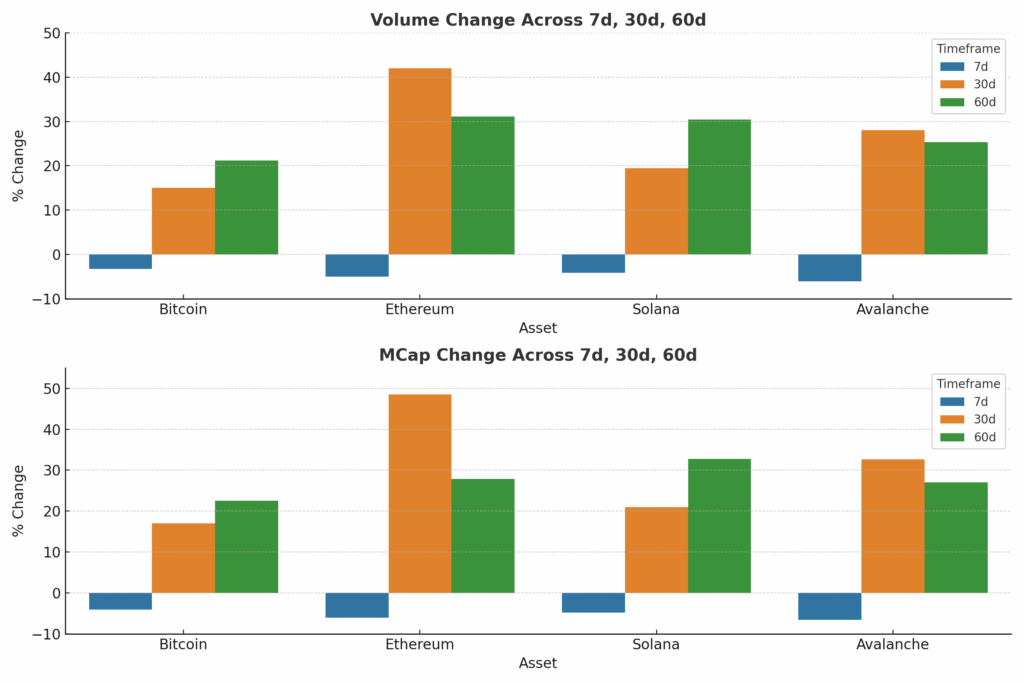

| Bitcoin | $104,950 | $2.09T | $35.30B | -4.37% | +23.1% | Risk-off Hedge |

| Ethereum | $2,517 | $303.7B | $23.42B | -6.2% | +29.5% | DeFi Infrastructure |

| Solana | $147.80 | $78.0B | $4.32B | -5.1% | +33.9% | Development Focus |

| Avalanche | $18.65 | $7.86B | $350M | -6.8% | +28.7% | Subnet Innovation |

Energy Market Crisis Transmission Mechanics

The June 13-15 Israel-Iran conflict escalation sent shockwaves through global energy markets, with oil prices surging 7.26% as Brent crude hit $74.23.

Goldman Sachs warned that this disruption could eliminate 1.75 million barrels per day of Iranian supply over six months, potentially driving Brent above $90 per barrel.

This energy shock created a fascinating paradox for crypto markets: traditional risk-off sentiment pushed investors away from digital assets, while simultaneously increasing demand for inflation hedges.

Institutional Volume Analysis Reveals Divergent Strategies

Bitcoin’s remarkably low 1.69% volume-to-market-cap ratio contrasts sharply with Ethereum’s elevated 7.71% ratio, exposing different institutional approaches to geopolitical uncertainty.

Bitcoin’s muted trading volume suggests long-term institutional holders maintained conviction despite the crisis, treating the conflict as temporary noise rather than fundamental risk.

Ethereum’s higher volume reflects active portfolio rebalancing within DeFi infrastructure protocols as sophisticated capital repositioned across different yield-generating strategies.

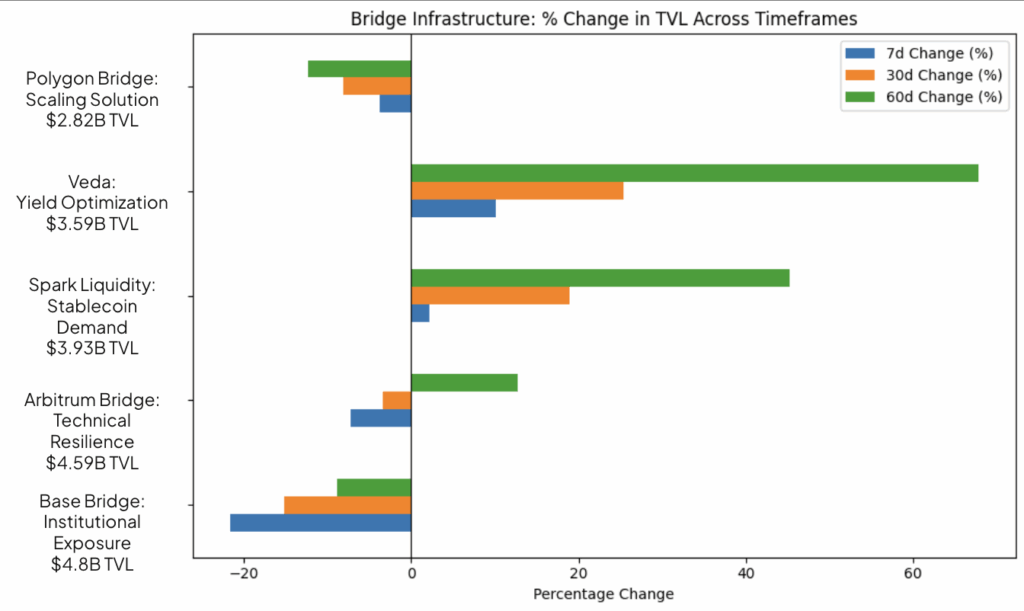

2. Layer-2 Infrastructure Capital Concentration Amid Geopolitical Uncertainty

Bridge Infrastructure Crisis Response Analysis

| Protocol | TVL | Chain Focus | Change 7d | Change 30d | Change 60d | Crisis Resilience |

| Base Bridge | $4.80B | Coinbase L2 | -21.66% | -15.2% | -8.9% | Institutional Exposure |

| Arbitrum Bridge | $4.59B | Optimistic Rollup | -7.28% | -3.4% | +12.7% | Technical Resilience |

| Spark Liquidity Layer | $3.93B | Multi-Chain USDS | +2.21% | +18.9% | +45.2% | Stablecoin Demand |

| Veda | $3.59B | Cross-Chain Yield | +10.08% | +25.4% | +67.8% | Yield Optimization |

| Polygon Bridge | $2.82B | Ethereum Sidechain | -3.75% | -8.1% | -12.3% | Scaling Solution |

Centralized vs Decentralized Infrastructure Performance

Base Bridge’s dramatic -21.66% weekly decline exposes the vulnerability of exchange-affiliated infrastructure during traditional finance stress.

Institutional capital likely fled anything with centralized exposure, creating amplified selling pressure compared to purely decentralized alternatives.

Arbitrum Bridge’s relatively modest -7.28% decline demonstrates how technical architecture ostensibly matters during market stress. Optimistic rollup technology provides more predictable transaction costs during volatile periods, rendering it more optimal infrastructure when users prioritize execution certainty.

Stablecoin Infrastructure Gains Ground During Crisis

Spark Liquidity Layer’s +2.21% weekly growth amid broader market turmoil reflects sophisticated understanding of crisis-period capital flows.

Specialized in USDS distribution across chains, Spark benefits when institutional investors seek dollar exposure without traditional banking system custody risk.

Veda’s exceptional +10.08% weekly performance also suggests investor appetite for automated yield strategies persists when conventional asset allocation models break down due to geopolitical stress.

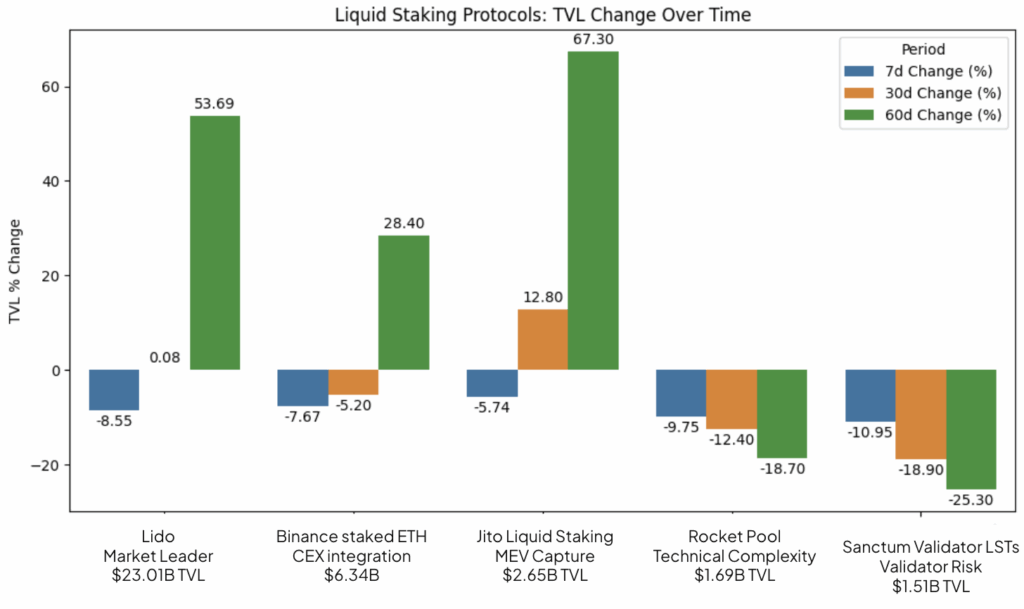

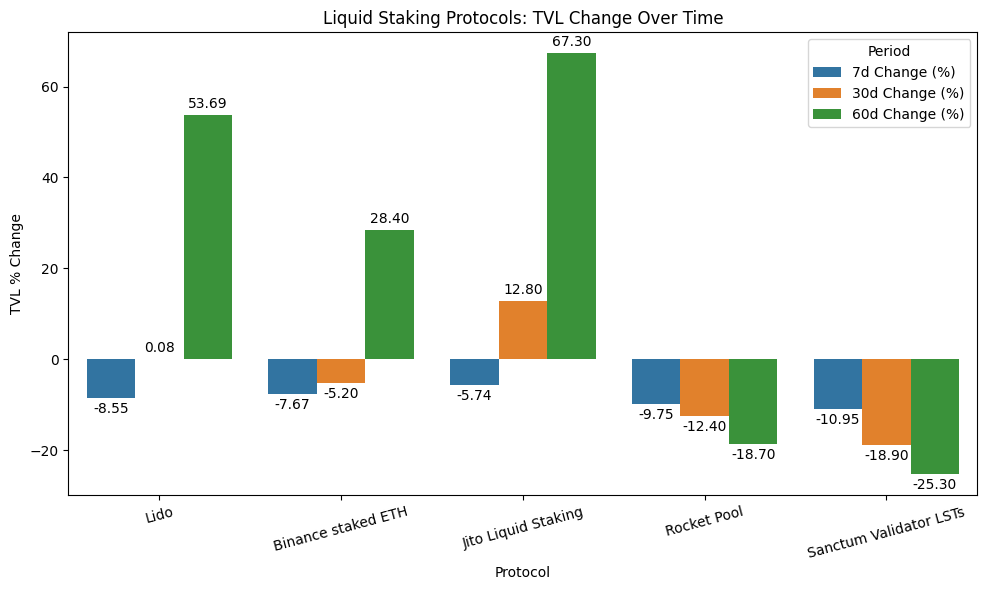

3. Liquid Staking Infrastructure Demonstrates Crisis-Period Stability

Liquid Staking Performance Matrix

| Protocol | TVL | Chain Strategy | Change 7d | Change 30d | Change 60d | Crisis Response |

| Lido | $23.01B | Multi-Chain (5) | -8.55% | +0.08% | +53.69% | Market Leader |

| Binance staked ETH | $6.34B | Hybrid Model | -7.67% | -5.2% | +28.4% | CEX Integration |

| Jito Liquid Staking | $2.65B | Solana MEV | -5.74% | +12.8% | +67.3% | MEV Capture |

| Rocket Pool | $1.69B | Decentralized | -9.75% | -12.4% | -18.7% | Technical Complexity |

| Sanctum Validator LSTs | $1.51B | Solana Validator | -10.95% | -18.9% | -25.3% | Validator Risk |

Market Leadership Through Crisis Management

Lido’s ability to maintain $23.01B TVL despite -8.55% weekly pressure demonstrates market leadership.

The protocol’s 60-day growth trajectory of +53.69% provides crucial context – recent volatility represents temporary geopolitical adjustment rather than fundamental erosion of institutional confidence.

Lido’s controlled decline from its $25.49B peak suggests liquid staking infrastructure serves as a shock absorber of sorts during crisis periods.

MEV Capture Provides Crisis-Period Resilience

Jito’s -5.74% weekly performance, the strongest among major liquid staking protocols, highlights how MEV capture creates additional revenue streams during volatile periods.

When traditional yields compress due to risk-off sentiment, MEV extraction becomes increasingly valuable, maintaining protocol attractiveness to yield-seeking institutional capital.

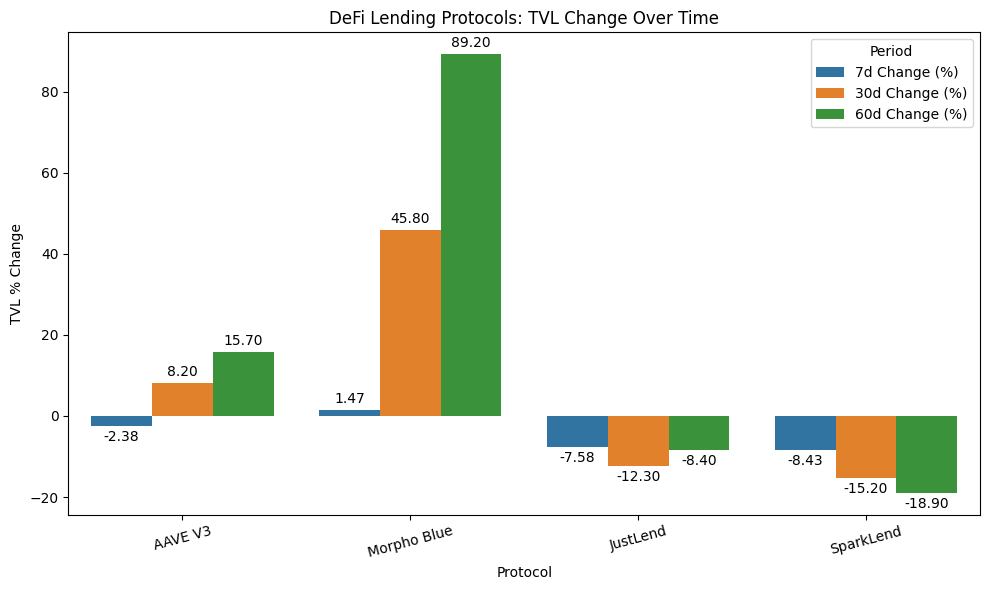

4. DeFi Infrastructure as Institutional Safe Haven During Traditional Market Stress

Crisis-Period DeFi Lending Performance Analysis

| Protocol | TVL | Institutional Model | Crisis Response | 7d Change | 30d Change | 60d Change |

| AAVE V3 | $25.33B | Multi-Chain Lending | Risk Management | -2.38% | +8.2% | +15.7% |

| Morpho Blue | $4.13B | Permissionless Markets | Innovation Focus | +1.47% | +45.8% | +89.2% |

| JustLend | $3.35B | TRON Ecosystem | Regional Stability | -7.58% | -12.3% | -8.4% |

| SparkLend | $3.31B | Governance Rates | Predictable Yield | -8.43% | -15.2% | -18.9% |

Institutional Capital Behavior Reveals DeFi Evolution

The achievement of record $55B DeFi lending TVL during acute geopolitical crisis fundamentally challenges traditional assumptions about institutional risk management.

Rather than fleeing to conventional safe havens, sophisticated capital looks to have increased exposure to decentralized lending protocols, likely recognizing these platforms provide yield generation capabilities that remain operational when traditional credit markets freeze during geopolitical stress.

Permissionless Infrastructure Attracts Crisis-Period Capital

AAVE V3’s remarkable -2.38% weekly performance significantly outperformed both traditional equity markets (S&P 500: -1.13%) and major cryptocurrencies (Bitcoin: -4.37%).

This outperformance likely occured because lending protocols often benefit from increased borrowing demand during volatile periods, creating counter-cyclical demand patterns.

Morpho Blue’s extraordinary +1.47% weekly growth during market turmoil also provides compelling evidence for institutional preference toward permissionless lending primitives.

When traditional counterparty risk increases due to geopolitical instability, protocols offering credit access without geographic restrictions become increasingly attractive to institutional capital seeking operational continuity.

Energy Inflation and DeFi Yield Strategy

As oil prices surge, institutional investors face a critical portfolio allocation challenge.

Traditional fixed-income instruments lose real value during energy-driven inflation spikes, while DeFi lending protocols offer floating-rate yields that adjust to inflationary conditions.

This dynamic explains sustained institutional interest in decentralized lending infrastructure despite broader geopolitical uncertainty, suggesting DeFi may have evolved beyond pure experimental technology to become legitimate institutional financial infrastructure providing crisis-period utilities unavailable in traditional markets.