Digital asset trading refers to the buying, selling, and exchanging of blockchain-based assets such as cryptocurrencies, stablecoins, and tokenised assets across various online platforms. This includes both centralized exchanges (CEXs) and decentralized exchanges (DEXs), as well as over-the-counter (OTC) venues. Whether driven by speculation, utility, or infrastructure development, digital asset trading plays a foundational role in the broader crypto ecosystem.

Where Digital Assets Are Traded

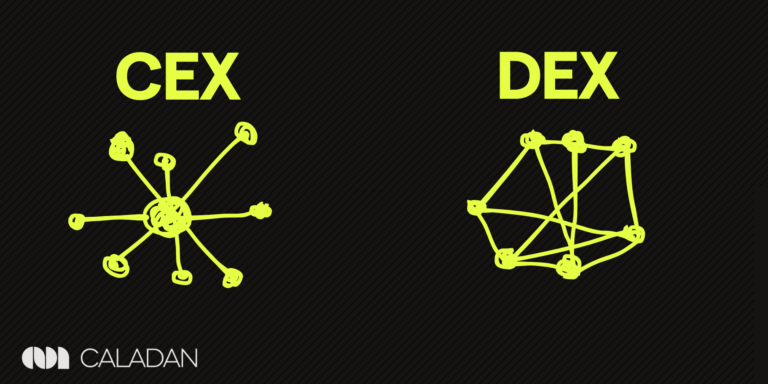

Digital assets are primarily traded on three types of platforms: centralized exchanges (CEXs), decentralized exchanges (DEXs), and OTC desks. Each type has distinct characteristics that influence how liquidity is accessed and managed.

Quick Comparison: CEX vs DEX vs OTC

| Feature | Centralized Exchanges (CEXs) | Decentralized Exchanges (DEXs) | Over-the-Counter (OTC) |

|---|---|---|---|

| Control | Centralized | Decentralized | Centralized (via broker/desk) |

| Access | Requires account, KYC | Open to all with wallets | Institutional/HNW focused |

| Liquidity | High (varies by exchange) | Variable (depends on pools) | High for large trades |

| Execution | Order book matching | Smart contract AMMs | Negotiated off-book trades |

| Transparency | Limited | Fully on-chain | Private |

| Best for | General users, large volumes | Permissionless, peer-to-peer trading | Large block trades |

Centralized Exchanges (CEXs)

Centralized exchanges are the most common type of cryptocurrency exchange, often hosting over 1,000+ employees across various departments such as AML, KYC, legal, customer service, operations, business development, trading, data, technology, marketing, and strategy. These exchanges offer a wide range of functions and services, making them a go-to for many token projects and traders.

However, the complexity of CEXs also means that listing a token involves navigating a highly structured process. From technical integration, which can involve connecting with 8-10 different APIs, to maintaining continuous communication with the exchange teams, the demands are high. Token market-makers play a crucial role in this environment, ensuring liquidity and smooth trading operations. Without an experienced market-maker, projects risk falling into delisting criteria, which can be catastrophic.

Decentralized Exchanges (DEXs)

On the other hand, decentralized exchanges (DEXs) offer a more open and flexible platform. Unlike CEXs, DEXs don’t require extensive functions or regulatory processes such as KYC or AML. Anyone, including crypto market-makers, can create a liquidity pool, making it easier for smaller projects to list their tokens.

However, the technical integration for algorithmic trading remains intense, much like on CEXs. Token market-makers need to ensure their algorithms are finely tuned to handle the unique aspects of DEX trading, such as real-time data and varying liquidity levels. The absence of formal listing requirements does not diminish the importance of market-makers; in fact, their role becomes even more critical in managing the volatility and maintaining order book depth.

Over-the-Counter (OTC)

OTC trading occurs off-exchange, typically between institutional parties. It is often used for large trades that might impact price if executed on open order books. OTC desks provide negotiated pricing and privacy, making them a key venue for high-net-worth individuals, funds, and projects looking to manage larger positions discreetly.

Why Digital Asset Trading is Important

Digital asset trading plays a pivotal role in the growth and utility of blockchain ecosystems. Here are the key reasons why it is essential:

1. Enables Efficient Exchange of Value

Users and institutions can easily trade cryptocurrencies, tokens, and other digital assets, fostering adoption and capital movement across networks.

2. Supports Liquidity and Price Stability

An active trading environment reduces volatility, minimizes slippage, and allows smooth entry and exit for market participants.

3. Drives Market Confidence

High liquidity and fair pricing mechanisms improve trust in digital assets, enhancing their utility across DeFi, payments, and applications.

4. Encourages Infrastructure Innovation

Digital asset trading accelerates the development of advanced systems, such as high-frequency trading engines, AMMs, and derivatives platforms.

5. Boosts Project Credibility and Ecosystem Growth

Healthy trading ecosystems make tokens more attractive to institutional investors and community members, improving token longevity and visibility.

Key Considerations for Token Market-Makers on Exchanges

Listing and Trading

For any token project, listing on an exchange is a significant milestone. The process typically involves several stages, including the submission of information, due diligence, legal work, and negotiation of deal terms. An existing relationship with the exchange’s listing teams can ease this process, but it’s the market-maker’s role to ensure that trading operations are ready for the go-live date.

Trading on an exchange, particularly for high-frequency trading (HFT), demands robust technical integration. The market-maker needs to manage multiple connections, such as real-time data feeds and symbol masters, to ensure seamless trading. The ability to quickly adapt to new listings and delistings is vital, especially on brand-new exchanges where API documentation may be lacking.

Delisting Risks and Prevention

Delisting is a nightmare scenario for any token project. This can occur due to insufficient liquidity, lack of communication with the project team, or suspicious activity that may suggest pump-and-dump schemes. Token market-makers play an essential role in mitigating these risks by maintaining liquidity, ensuring compliance with exchange requirements, and avoiding behaviors that could trigger delisting.

A good market-maker can keep a project out of the delisting zone by actively managing order books and engaging with the exchange. Understanding the exchange’s motivations—whether it’s revenue from trading fees, new user acquisition, or successful listings—allows the market-maker to align their strategies with the exchange’s goals, ensuring a mutually beneficial relationship.

The Role of Market Makers in Digital Asset Trading

Market makers are trading firms that provide consistent buy and sell orders on trading platforms to support liquidity. Their activity narrows bid-ask spreads, reduces slippage, and enables more stable price discovery.

Whether on CEXs or DEXs, market makers adapt their infrastructure and strategies to the platform’s specific requirements. On CEXs, this may involve direct API integrations, latency optimization, and KPI management with the exchange. On DEXs, this includes managing smart contract interactions, validator participation, and maintaining active liquidity pools.

By providing these services, market makers contribute to healthier markets that benefit both institutional participants and retail users.

The Importance of Relationships in the Exchange Ecosystem

Having a strong relationship with exchange teams, whether it’s through the VIP programs or direct connections with the operations and business development staff, can make or break a token’s success on an exchange. However, it’s essential to recognize that different departments within an exchange have their own goals and incentives. For example, while business development teams might be focused on fee generation, operations teams prioritize smooth listings.

Token market-makers need to navigate these relationships carefully, ensuring that they have the necessary access and support to maintain liquidity and trading activity. This is especially true in scenarios where there is a “Chinese wall” within the exchange, such as between Binance Research and Binance Labs, where having one relationship does not guarantee access to others.

Conclusion

Digital asset trading continues to evolve alongside the broader crypto ecosystem. New protocols, exchange formats, and trading technologies are expanding the possibilities for how assets are exchanged across blockchain networks.

Understanding the platforms, participants, and infrastructure behind digital asset trading is essential for anyone entering the space. As the industry matures, efficiency, security, and liquidity provision will remain central to how trading evolves—and how value is transferred across the digital economy.