TLDR:

- Oil-Crypto Decoupling: Oil plunged 6% on Iran-Israel ceasefire while Bitcoin held $106,312 (+1.24%) and Ethereum gained to $2,447 (+1.87%), confirming crypto's independence from traditional energy correlations

- RWA Institutional Momentum: BlackRock BUIDL commanding $2.86B TVL (+51.81% 90d) signals traditional finance's aggressive on-chain migration, leading $11.39B RWA sector with established multi-chain infrastructure

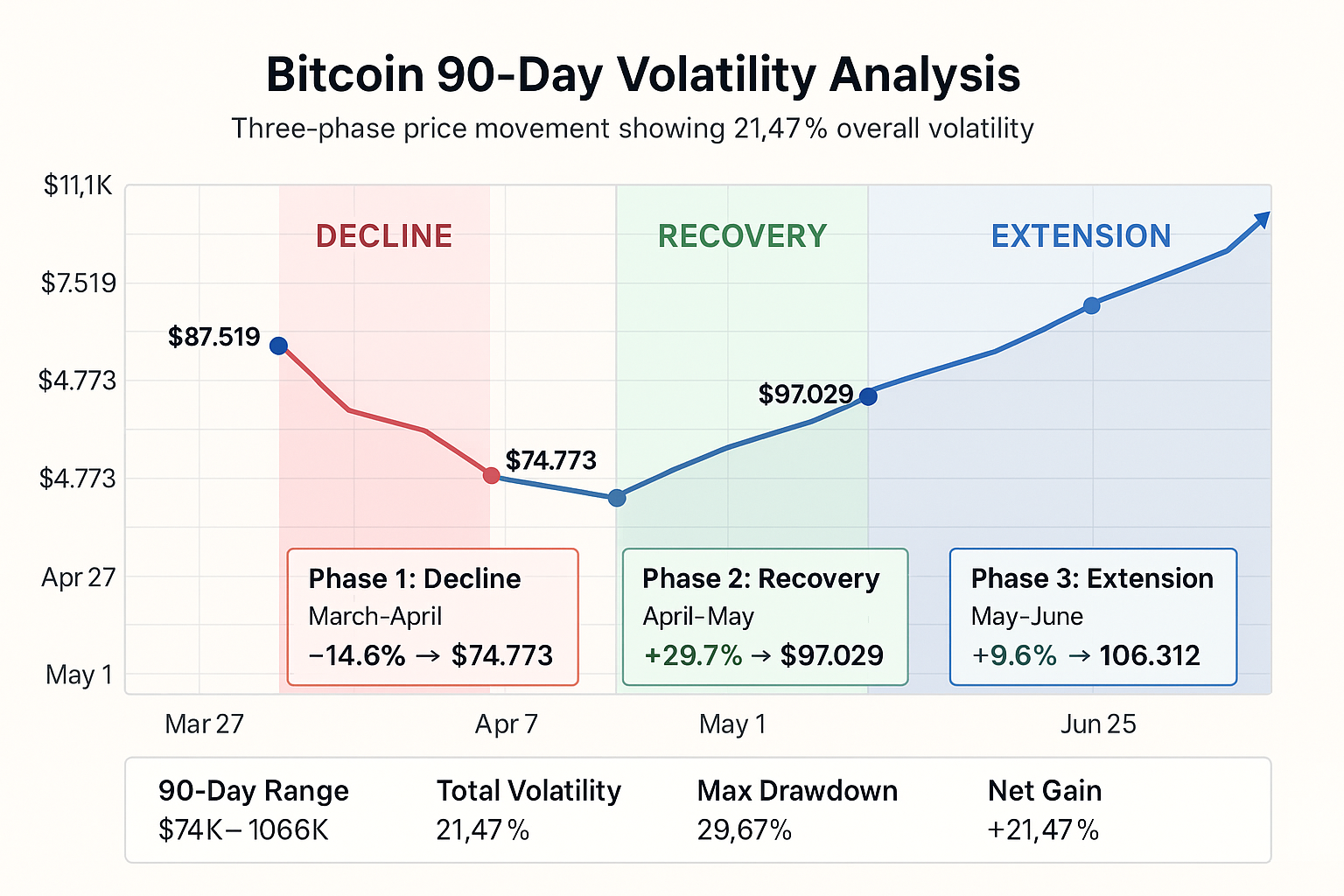

- Bitcoin Range Consolidation: 90-day volatility compresses to 21.47% with current $106,312 representing 9.57% breakout above $100K resistance, suggesting institutional accumulation above psychological levels

- Gaming Infrastructure Catalyst: Immutable zkEVM's $58.60M TVL (+53.32% 90d) driven by June 19 IMX staking migration and 83.3% Q1 contract deployment surge positioning for late 2025 chain unification

1. Markets Decouple: Oil Crashes, Crypto Stands Firm

Major Asset Performance

| Asset | Price | 24h | Market Cap | Volume | Trend |

Deeper Insights Ahead

TLDR:

- Oil-Crypto Decoupling: Oil plunged 6% on Iran-Israel ceasefire while Bitcoin held $106,312 (+1.24%) and Ethereum gained to $2,447 (+1.87%), confirming crypto’s independence from traditional energy correlations

- RWA Institutional Momentum: BlackRock BUIDL commanding $2.86B TVL (+51.81% 90d) signals traditional finance’s aggressive on-chain migration, leading $11.39B RWA sector with established multi-chain infrastructure

- Bitcoin Range Consolidation: 90-day volatility compresses to 21.47% with current $106,312 representing 9.57% breakout above $100K resistance, suggesting institutional accumulation above psychological levels

- Gaming Infrastructure Catalyst: Immutable zkEVM’s $58.60M TVL (+53.32% 90d) driven by June 19 IMX staking migration and 83.3% Q1 contract deployment surge positioning for late 2025 chain unification

1. Markets Decouple: Oil Crashes, Crypto Stands Firm

Major Asset Performance

| Asset | Price | 24h | Market Cap | Volume | Trend |

| Bitcoin | $106,312 | +1.24% | $2.11T | $30.6B | Range extension |

| Ethereum | $2,447 | +1.87% | $295.5B | $18.6B | Stable consolidation |

Geopolitical decoupling emerged as oil markets crashed 6% on Iran-Israel ceasefire news (Brent $67.14, WTI $64.37) while crypto maintained independence.

Wall Street rallied on hopes that Iran won’t disrupt crude flows, but Bitcoin’s +1.24% and Ethereum’s +1.87% gains demonstrated crypto’s evolution beyond traditional risk-asset correlations. Oil prices returned to pre-conflict levels seen before Israel’s June 13 attack on Iranian nuclear facilities, effectively eliminating the geopolitical risk premium built over two weeks.

The decoupling logic: Historically, Bitcoin traded as a risk-asset alongside oil during geopolitical stress. During the Russia-Ukraine war in 2022, Bitcoin dropped over 12% within a week of invasion and tracked equity markets closely.

However, 2025 data shows Bitcoin decoupling from traditional correlations. While S&P 500 slumped 10% since January, Bitcoin gained 15% year-to-date. This suggests investor-positioning of Bitcoin as distinct from energy-sensitive assets in extant times.

2. Traditional Finance Moves On-Chain: RWA Growth Analysis

Leading RWA Protocol Performance

| Protocol | TVL | Market Share | 7d | 30d | 90d | Asset Category |

| BlackRock BUIDL | $2.86B | 25.1% | -0.56% | -1.33% | +51.81% | Institutional Fund |

| Ethena USDtb | $1.46B | 12.8% | +0.15% | +1.29% | +2.00% | Treasury Stablecoin |

| Ondo Finance | $1.39B | 12.2% | +1.87% | +9.62% | +41.09% | Treasury Securities |

| Paxos Gold | $0.88B | 7.7% | +4.56% | +10.01% | +33.41% | Tokenized Gold |

| Tether Gold | $0.82B | 7.2% | -1.62% | -0.61% | +8.64% | Tokenized Gold |

Traditional Finance Integration: The RWA sector’s $11.39B total represents institutional validation of blockchain infrastructure for traditional asset management, with major fund managers (BlackRock, Franklin Templeton) leading deployment rather than crypto-native protocols driving adoption.

90-Day Growth Analysis: BlackRock BUIDL’s trajectory shows institutional confidence in tokenized fund structures, growing from $1.89B to $2.86B despite recent consolidation (-0.56% weekly, -1.33% monthly). The 90-day growth significantly outpaces traditional fund inflows, indicating institutional preference for on-chain fund management infrastructure.

Asset Category Diversification: RWA protocols span Treasury bills (Ondo, Ethena), precious metals (Paxos Gold, Tether Gold), and institutional funds (BlackRock BUIDL, Franklin Templeton $720M). This diversification demonstrates institutional acceptance across multiple traditional asset classes rather than single-category experimentation.

Multi-Chain Distribution: BlackRock BUIDL operates across Ethereum, Aptos, Avalanche, Arbitrum, Optimism, and Polygon, indicating institutional preference for cross-chain accessibility rather than single-blockchain deployment. This infrastructure approach mirrors traditional fund distribution across multiple platforms.

3. Bitcoin Volatility Patterns: Range Consolidation Above $100K

Bitcoin’s 90-day realized volatility of 21.47% from March 27 ($87,519) shows three distinct phases:

Recent volatility patterns show 7-day range of 9.57% compared to 30-day range of 42.18%, indicating volatility compression in shorter timeframes. The 90-day high of $97,029 (May 1) to current $106,312 represents 9.57% appreciation, suggesting volatility normalization above previous resistance levels.

The 7-day volatility (9.57%) also represents significant compression from 30-day levels (42.18%), indicating potential range consolidation above $100K psychological level rather than continued high-volatility environment.

4. Gaming Chain Development: Immutable zkEVM Growth Drivers

Immutable zkEVM TVL Expansion Analysis (90-Day Growth Trajectory)

| Metric | Current Value | 7d Change | 30d Change | 90d Change | Performance Phase |

| Protocol TVL | $58.60M | +13.66% | +28.42% | +53.32% | Accelerating Growth |

| Market Position | #1 Gaming Chain | Gaming Category | Web3 Gaming | Layer-2 Gaming | Infrastructure Leader |

| Volatility Score | 21.36 | Moderate-High | Growth Driven | Expansion Phase | Development Activity |

| Peak TVL | $60.34M | June 21 | Recent High | 90d Maximum | Growth Ceiling Test |

Current TVL-Growth Catalysts: IMX staking launched on zkEVM June 19, marking the end of staking on Immutable X after 73 epochs. The new system requires staking plus NFT trading during 14-day cycles, with 20% of protocol fees allocated to stakers, thereby forcing capital migration to zkEVM infrastructure.

Developer Activity Explosion: The 83.3% surge in contract deployments signals expanding adoption and enhances the scalability of the Immutable network, validating its role as key infrastructure for Web3 gaming and NFT projects. Despite verified contract deployment declining 57.4% quarter-over-quarter, average daily contract deployers increased 1.5%, suggesting existing developers are increasing deployment activity through automation and experimentation.

Ecosystem Consolidation: The Immutable X merge into zkEVM (late 2025) creates a strong narrative of a unified “Immutable Chain” as a Web3 gaming hub. Chain unification also creates deeper in-game item liquidity and expanded DeFi tool access while maintaining Ethereum security through ZK-rollup architecture.

Gaming Asset Concentration: Guild of Guardians Heroes and Avatars NFTs accounted for 99.0% of total NFT sales volume in Q1 2025, with the Avatars collection experiencing a 40.4% increase despite an 8.5% drop in Heroes NFT sales. This concentration indicates strong gaming asset liquidity on zkEVM compared to broader NFT market fragmentation.