Executive Summary

The Web3 ecosystem faces a critical information problem. Current sentiment analysis relies predominantly on social media tracking, yet evidence shows massive divergence between what people say online and their actual on-chain behavior.

This report proposes that behavioral data offers superior signal quality for understanding genuine market dynamics and identifies emerging infrastructure that could fundamentally reshape how the industry measures adoption and value.

The Sentiment Measurement Problem

Web3 has become an ecosystem of noise masquerading as signal. With over 10,000 active applications scattered across dozens of blockchains, market participants desperately seek reliable indicators of genuine traction. The industry’s response has birthed Information Finance (InfoFi), attempting to create order from chaos through data aggregation and analysis.

Today’s dominant approach tracks social sentiment. Leading platforms scan Crypto Twitter for mentions, measure engagement rates, and rank projects by mindshare. These tools excel at capturing conversation volume but miss a fundamental truth: talk is cheap, especially in crypto.

More troublingly, the current landscape enables what might be called “manufactured sentiment.”

When projects can effectively purchase mindshare through influencer partnerships, paid promotional campaigns, and coordinated social media efforts, the resulting metrics cease to reflect genuine market sentiment and instead become artifacts of marketing budgets.

This pay-to-play dynamic transforms sentiment tracking from market intelligence into a bidding war where treasury size, not product quality, determines visibility.

Consider the perverse incentives this creates. A well-funded project can dominate social metrics through aggressive spending on Twitter campaigns, Discord community managers, and Telegram group promotions. Meanwhile, a superior protocol with limited marketing resources remains invisible despite genuine utility and organic user adoption. When sentiment becomes something that can be bought rather than earned, its value as a market signal collapses.

Even legitimate marketing efforts distort true market signals. When projects incentivize social engagement through point systems, token rewards, or airdrop allocations tied to Twitter activity, they create artificial conversation that obscures organic interest. Users post not because they believe in a project but because they’re incentivized to say something positive. The resulting social metrics become meaningless, reflecting not what users think or feel, but what they’re incentivized to express.

This measurement failure creates cascading problems throughout the ecosystem. Investors allocate capital based on Twitter buzz rather than usage metrics. Projects waste treasuries on influencer marketing that generates impressions but not users. New participants cannot distinguish genuine opportunities from orchestrated hype campaigns. The result is systematic mispricing of assets and misallocation of resources.

The Behavioral Data Thesis

We propose a straightforward thesis: on-chain actions reveal truth that social posts obscure. Every transaction requires economic commitment through gas fees and capital deployment. This cost creates natural resistance against manipulation that free social posts lack.

The information density of behavioral data dwarfs social metrics. A single on-chain interaction reveals wallet history, asset preferences, protocol experience, risk tolerance, and time commitment. Aggregated across millions of users, these patterns expose genuine market dynamics invisible to social tracking.

Consider what comprehensive behavioral analysis could reveal. Not just whether users try a protocol, but how deeply they engage.

Not just first-time users, but retention patterns over weeks and months. Not just isolated actions, but complete user journeys across protocols and chains. This depth transforms sentiment analysis from gauging temporary attention to understanding sustained adoption.

The Current Landscape’s Limitations

Existing discovery mechanisms in Web3 mirror the pre-Google internet: fragmented, manual, and inefficient. Users navigate through dubious Telegram groups, conflicting influencer recommendations, and short-term airdrop campaigns. The chaos creates vulnerability to rug pulls, manipulation, and simple confusion.

Previous attempts at bringing order have produced mixed results. Point-based reward systems did increase participation but created new problems. Users optimized for earning rather than learning. Platforms became flooded with mechanical, low-quality engagement. The original purpose of discovery became secondary to reward extraction.

Even well-intentioned educational efforts fail at scale. Expecting users to read extensive documentation or watch tutorial videos creates insurmountable friction. The complexity of DeFi, bridging, staking, and governance requires hands-on experience, not passive consumption. Yet without guidance, users remain paralyzed by complexity.

Layer3: Behavioral Infrastructure at Scale

One platform has quietly built the most comprehensive behavioral dataset in Web3. Layer3 has processed over 167 million on-chain actions across 45+ blockchains, creating unprecedented visibility into genuine user behavior.

The platform’s approach revolutionizes user engagement through structured quests that transform complex protocols into sequential, manageable tasks. Rather than telling users to “explore DeFi,” Layer3 breaks down the experience: bridge assets to Base, swap on Uniswap, provide liquidity, stake LP tokens. Each step generates verified on-chain data while teaching through action.

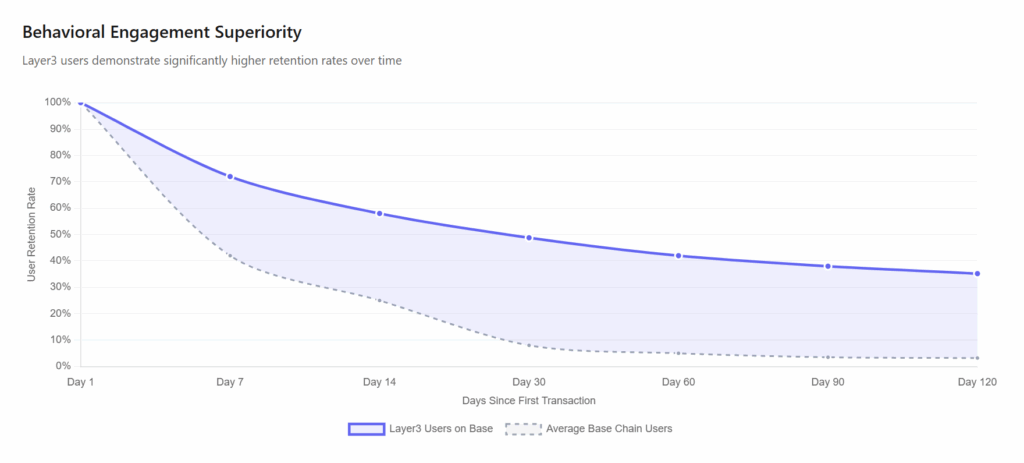

This methodology has produced extraordinary results. Layer3 users on Base demonstrate 6.1x higher 30-day retention and 11.3x higher 120-day retention compared to average on-chain users. The platform’s most active cohort averages 115 consecutive days of engagement with 1,525 transactions per user.

The economic validation is equally compelling. Layer3 generates over $16.5 million in annualized revenue, split between protocols paying for user acquisition (40%) and users paying for credential generation (60%). This balanced model demonstrates clear product-market fit across both supply and demand.

The CUBE Credential System: Making Behavior Persistent

Layer3’s innovation extends beyond simple tracking to creating permanent behavioral records through its CUBE system. These NFT-based credentials capture granular metadata about every user action: wallet address, chain, application, timestamp, and completion details. With over 60 million CUBEs issued, this represents one of the largest on-chain datasets ever created.

Crucially, this data remains open and permissionless. Any protocol can query CUBE data to verify user behavior without partnerships or permissions. This creates powerful network effects where credentials from one protocol become valuable across the entire ecosystem.

The practical applications are transformative. Ondo Finance used Layer3 to drive $1.04 million in TVL for its RWA-backed stablecoin, with 92% remaining after campaign completion. Jito attracted 5,400 new users to its liquid staking protocol, with 70% of staked assets remaining after one month. EigenLayer educated thousands on complex restaking mechanics through hands-on quests rather than documentation.

Signal: Redefining Attention Metrics

Layer3’s Signal product represents the practical implementation of behavioral sentiment analysis. Rather than counting social mentions, Signal calculates an “Attention Index” measuring the efficiency of converting content into participation.

The metric compares unique participants completing on-chain actions against content volume produced. High scores indicate efficient user acquisition with minimal noise. Low scores reveal heavy marketing with poor conversion. This fundamentally reframes success metrics from volume to efficiency.

Early Signal data already identifies emerging projects capturing genuine momentum before price movements reflect adoption. Exchanges use these heatmaps for listing decisions. Investment funds identify opportunities invisible to social sentiment. Projects benchmark their user acquisition efficiency against competitors.

Market Validation Through Performance

The behavioral approach’s superiority appears in concrete outcomes. Layer3 users claimed 20.4% of Arbitrum’s airdrop and 29.7% of zkSync’s distribution, proving they represent the most active ecosystem participants. On Optimism, Layer3 was identified as the most-used application by “high trust” users filtered against bots and farmers.

Major institutions validate this approach through partnership. Robinhood selected Layer3 as its exclusive Web3 education partner, using behavioral quests to teach millions about tokenized assets and RWAs. This positions Layer3 as critical infrastructure bridging traditional finance and Web3.

The platform’s efficiency is remarkable. With just 16 employees, Layer3 maintains one of the highest revenue-per-employee ratios in crypto. Monthly traffic reaches 1.9 million visitors with 15-minute average sessions, indicating deep engagement rather than superficial browsing.

The Network Effect Flywheel

Layer3’s model creates powerful, self-reinforcing dynamics.

Protocols compete for user attention by purchasing and burning L3 tokens, creating deflationary pressure. Users earn rewards for genuine participation, building credentials that unlock future opportunities. As more protocols join, more value flows to users. As more users participate, the platform becomes more attractive to protocols.

This resembles the aggregation dynamics that built Google and Amazon. The key difference: Layer3’s open credential system ensures value accrues to the ecosystem, not just the platform. Projects benefit from accessible behavioral data. Users own their reputation as portable assets. The entire ecosystem gains from reduced information asymmetry.

Implications for Web3’s Evolution

The shift from social to behavioral sentiment has profound implications. Markets would price assets based on usage rather than hype. Projects would optimize products for retention rather than Twitter mentions. Users would be rewarded for genuine participation rather than social signaling.

The infrastructure requirements are substantial but achievable. Cross-chain data aggregation, identity systems, and interpretation frameworks must mature. Privacy considerations need addressing while maintaining transparency. Standards for behavioral credentials require industry coordination.

Yet the direction seems clear. As Greenfield Capital observed in their investment thesis, platforms aggregating behavioral data represent the next generation of crypto infrastructure, comparable to how search engines organized the early internet. The question is not whether this transition will occur, but how quickly markets will recognize the superiority of behavioral signals.

Moving Forward

The information asymmetry plaguing Web3 cannot be solved by better social media tracking. The solution requires fundamental infrastructure that captures, interprets, and distributes behavioral data at scale. Layer3 has demonstrated both the feasibility and value of this approach through verifiable metrics: hundreds of millions of tracked actions, tens of millions in revenue, and measurably superior user outcomes.

The market’s current valuation of behavioral analytics infrastructure appears disconnected from its strategic importance. As Web3 matures beyond speculation toward genuine utility, the ability to distinguish real adoption from manufactured hype becomes essential. Platforms that provide this distinction position themselves as critical infrastructure for the ecosystem’s next phase.

For market participants seeking alpha, the message is clear: ignore what people say and watch what they do. The infrastructure enabling this behavioral analysis represents not just a better measurement tool, but a fundamental evolution in how Web3 creates and captures value.

Those who recognize this shift early may find themselves positioned ahead of a major revaluation as markets discover that in Web3, as in life, actions truly speak louder than words.