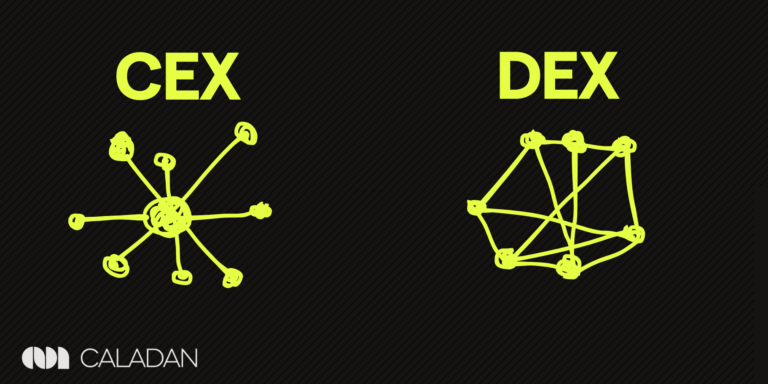

In the rapidly evolving world of cryptocurrency, understanding the different types of exchanges is crucial for anyone looking to navigate this landscape effectively. Whether you’re launching a token or trading actively, the choice between centralized exchanges (CEXs) and decentralized exchanges (DEXs) can significantly impact your strategy. For token market-makers, this distinction is particularly important, as the nature of the exchange dictates the operational requirements and the integration process.

Centralized Exchanges (CEXs)

Centralized exchanges are the most common type of cryptocurrency exchange, often hosting over 1,000+ employees across various departments such as AML, KYC, legal, customer service, operations, business development, trading, data, technology, marketing, and strategy. These exchanges offer a wide range of functions and services, making them a go-to for many token projects and traders.

However, the complexity of CEXs also means that listing a token involves navigating a highly structured process. From technical integration, which can involve connecting with 8-10 different APIs, to maintaining continuous communication with the exchange teams, the demands are high. Token market-makers play a crucial role in this environment, ensuring liquidity and smooth trading operations. Without an experienced market-maker, projects risk falling into delisting criteria, which can be catastrophic.

Decentralized Exchanges (DEXs)

On the other hand, decentralized exchanges (DEXs) offer a more open and flexible platform. Unlike CEXs, DEXs don’t require extensive functions or regulatory processes such as KYC or AML. Anyone, including crypto market-makers, can create a liquidity pool, making it easier for smaller projects to list their tokens.

However, the technical integration for algorithmic trading remains intense, much like on CEXs. Token market-makers need to ensure their algorithms are finely tuned to handle the unique aspects of DEX trading, such as real-time data and varying liquidity levels. The absence of formal listing requirements does not diminish the importance of market-makers; in fact, their role becomes even more critical in managing the volatility and maintaining order book depth.

Key Considerations for Token Market-Makers on Exchanges

Listing and Trading

For any token project, listing on an exchange is a significant milestone. The process typically involves several stages, including the submission of information, due diligence, legal work, and negotiation of deal terms. An existing relationship with the exchange’s listing teams can ease this process, but it’s the market-maker’s role to ensure that trading operations are ready for the go-live date.

Trading on an exchange, particularly for high-frequency trading (HFT), demands robust technical integration. The market-maker needs to manage multiple connections, such as real-time data feeds and symbol masters, to ensure seamless trading. The ability to quickly adapt to new listings and delistings is vital, especially on brand-new exchanges where API documentation may be lacking.

Delisting Risks and Prevention

Delisting is a nightmare scenario for any token project. This can occur due to insufficient liquidity, lack of communication with the project team, or suspicious activity that may suggest pump-and-dump schemes. Token market-makers play an essential role in mitigating these risks by maintaining liquidity, ensuring compliance with exchange requirements, and avoiding behaviors that could trigger delisting.

A good market-maker can keep a project out of the delisting zone by actively managing order books and engaging with the exchange. Understanding the exchange’s motivations—whether it’s revenue from trading fees, new user acquisition, or successful listings—allows the market-maker to align their strategies with the exchange’s goals, ensuring a mutually beneficial relationship.

The Importance of Relationships in the Exchange Ecosystem

Having a strong relationship with exchange teams, whether it’s through the VIP programs or direct connections with the operations and business development staff, can make or break a token’s success on an exchange. However, it’s essential to recognize that different departments within an exchange have their own goals and incentives. For example, while business development teams might be focused on fee generation, operations teams prioritize smooth listings.

Token market-makers need to navigate these relationships carefully, ensuring that they have the necessary access and support to maintain liquidity and trading activity. This is especially true in scenarios where there is a “Chinese wall” within the exchange, such as between Binance Research and Binance Labs, where having one relationship does not guarantee access to others.

Conclusion

Navigating the complex world of cryptocurrency exchanges requires a deep understanding of both the technical and relational aspects of the ecosystem. For token market-makers, the choice between a CEX and a DEX, the intricacies of listing and trading, and the ability to prevent delisting are all critical factors that influence success. By aligning their strategies with the motivations of the exchanges and maintaining robust technical integrations, market-makers can ensure that their token projects not only survive but thrive in this competitive environment.